Insurtech

What are InsurTechs?

InsurTechs are digital challengers and enablers, whose primary objective is transforming segments of the insurance value chain by leveraging the latest technologies, adopting new business models, and having customers at the forefront of their strategic and operational thinking.

Value pools: key areas of focus for InsurTechs

Successful InsurTechs work fast, efficiently, and productively to create a superior customer experience that benefit all parties. We help clients adapt and respond to latest trends so that you can comfortably and intelligently refine your strategies, adopt new business models, and reinvent operations.

Four proven ways EXL can add value to your business now:

Drive profitability through actionable data and insights

Product and pricing capabilities

| Pricing model development | Product delivery | Actuarial support | Data management and reporting |

|

|

|

|

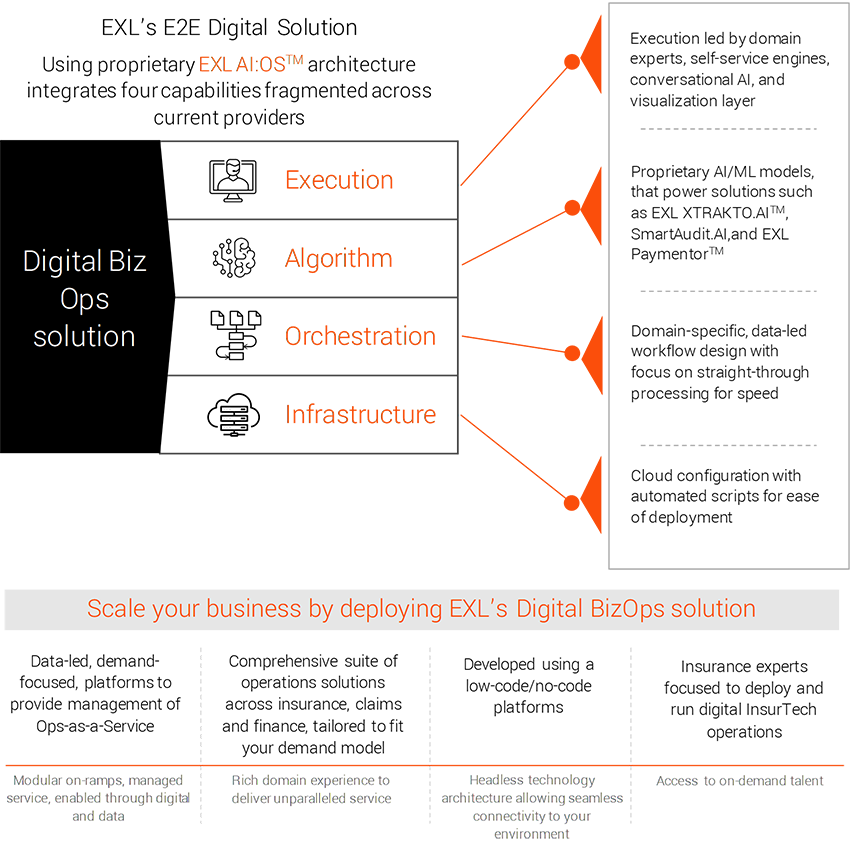

Build scalable operations enabled by digital and analytic

EXL’s Digital Biz Ops applies the right blend of human capital and technology to help you tap the full value of digital and data at scale, create distinct market advantages and maximize total shareholder return.

Focus on your core as we tackle the rest

EXL provides services across the entire P&C insurance and F&A value chain, bringing efficiency and focus to your core operations.

P&C Insurance

| Product design | Agency and distribution management | New business and underwriting | Policy administration | Claims management |

|

|

|

|

|

F&A

| Operational finance | Business finance | Specialized finance | Policy and process | Information systems |

|

|

|

|

|

Augment your talent pool with on-demand domain specialist

Our go-to talent pool and partner ecosystem adapt to your way of doing business, helping you achieve the outcomes prescribed for your P&C and F&A operations.

P&C Insurance

- AI/ML

- Automation

- Cloud

- Data and analytics

- Customer experience – Omni-channel,

unified desktop, conversational AI

F&A

- Cloud architect/ engineer

- Automations/ robotics experts

- Accounting platforms

- Data scientist and data engineers/developers

- Web/ workflow developers

- Intelligent extraction and ML

- Data visualization

- Design thinking/ process mining

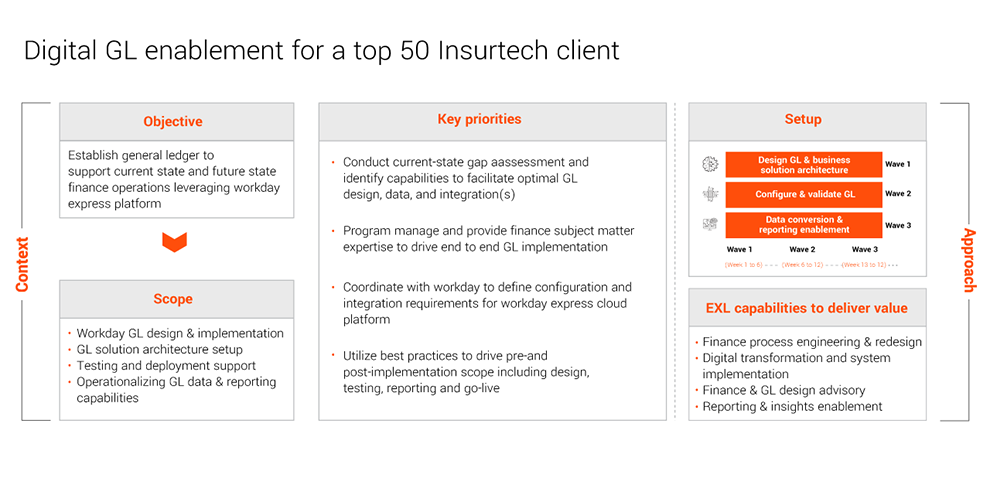

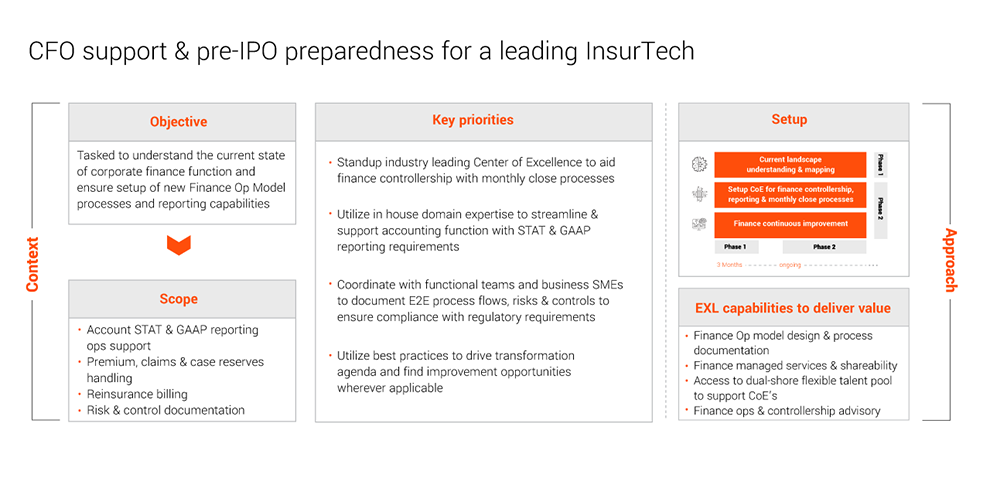

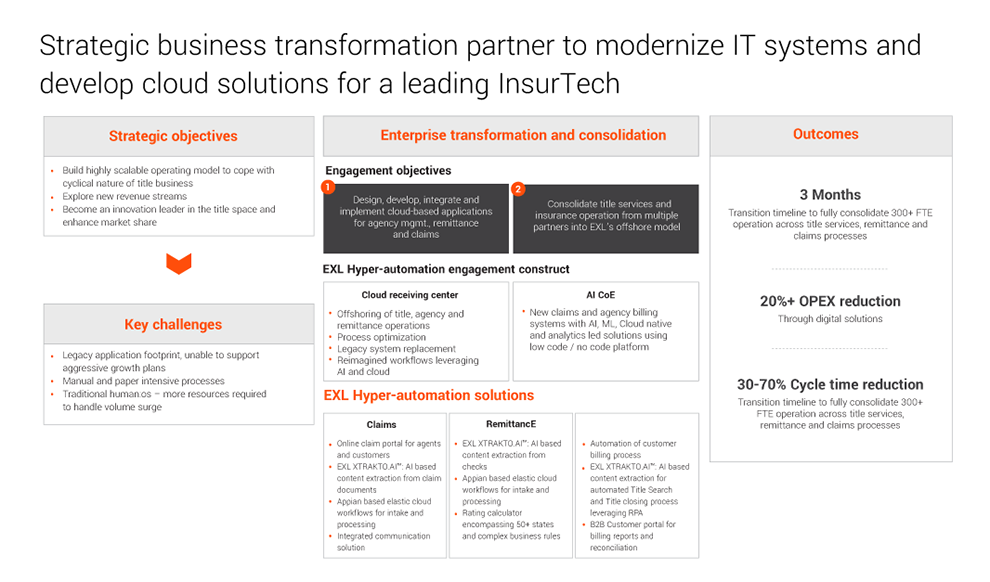

Most innovative InsurTech use cases

To embark on the next phase of the transformation journey, InsurTechs need partners that can help rapidly adopt digital ready, low-code no-code platforms and data and AI-enabled operations that support and boost the growth roadmap. EXL is well poised to be that strategic long-term partner.