Intelligent operations drive smarter group insurance results

Smart moves are powered by advanced Artificial Intelligence and Machine Learning analytics solutions.

End-to-end operations management capabilities provide benefits such as:

- Amplify the broker experience

- Enhance your data strategy

- Readily adapt to changing market and regulatory conditions

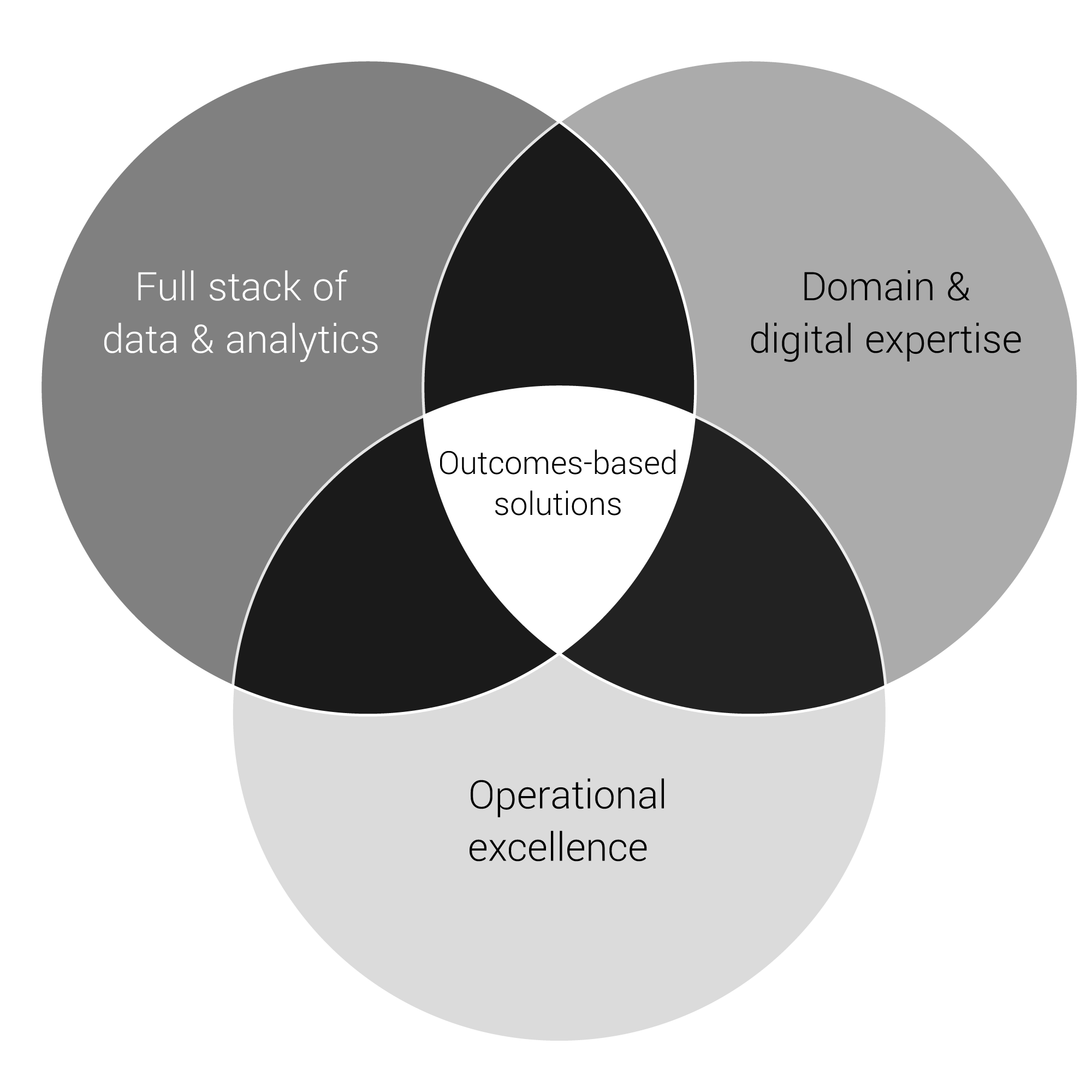

Bring together the power of analytics, digital, and rich domain experience to provide outcome-based solutions.

The EXL group insurance difference

Accelerate claims processing, billing and medical underwriting processes

Tap a digital command center/nerve hub to stay ahead of changing requirements

Leverage flexible engagement models from a trusted partner

What we do

EXL provides an integrated solution that spans group and voluntary markets across disability, life, and supplemental products.

Data driven sales and distribution

- Member cross/upsell

- ER prospecting

Accelerated quoting and proposals

- Automated RFP registration

- Proposal documentation

Digital onboarding, enrollment, and medical underwriting

- Census ingestion, enrichment and validation

- NLP/AI-led medical impairment assessment

AI and analytics powered billing solution

- Smart intake

- Matching & reconciliation solution

- Payment leakage solution

Front office digital transformation

- Intelligent virtual assistant driven self-service

- Omni-channel platform

AI-powered claims experience

- Auto adjudication of fast and routine STD, leave and VB claims

- STD/LTD claims duration forecasting

Third party administration

- Client-centric business model for increased self-service

- Embedded analytics and advanced digital technologies

Group life insurance solutions

EXL Digital Endorsement Portal

Cutting-edge extraction and automation across the endorsement process

Insurance Analytics Leadership Exchange

Insurance analytics experience and thought collective

Featured insights

Case study

Quote and proposal transformation

Case study

Quote and proposal transformation

EXL’s client, a large US-based group and voluntary benefits (VB) carrier, detected inefficiencies in its quote and proposal process and requested an “outside-in” process assessment to determine opportunities to improve. Specifically, they wanted to create a differentiated experience and reduce operating expenses associated with assembling quotes for RFPs, while also enhancing customer experience with an eye on improving its win percentage.

View

Case study

EXL’s client, a large US-based group and voluntary benefits (VB) carrier, detected inefficiencies in its quote and proposal process and requested an “outside-in” process assessment to determine opportunities to improve. Specifically, they wanted to create a differentiated experience and reduce operating expenses associated with assembling quotes for RFPs, while also enhancing customer experience with an eye on improving its win percentage.

White paper

Imagination & Insight

White paper

Imagination & Insight

We have identified eight trends that we believe business in general should use as guides for their strategic development. In this first issue, we will address the two first EXL levers for growth: resilience and diversity.

View

White paper

We have identified eight trends that we believe business in general should use as guides for their strategic development. In this first issue, we will address the two first EXL levers for growth: resilience and diversity.

EXL in the news