ISG recognizes EXL as a leader in insurance services for the third consecutive year

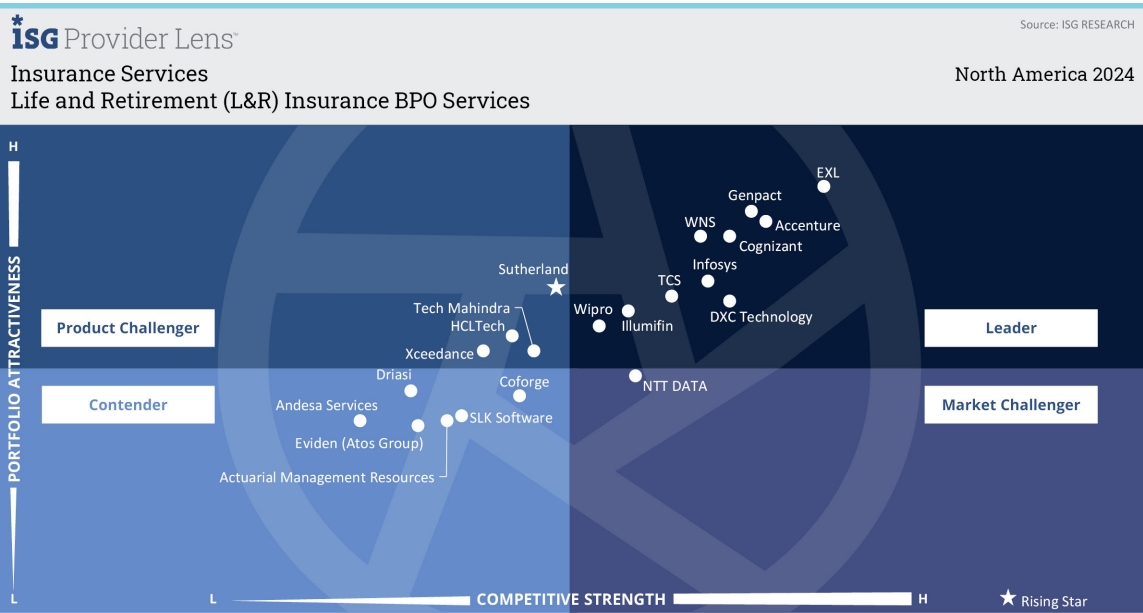

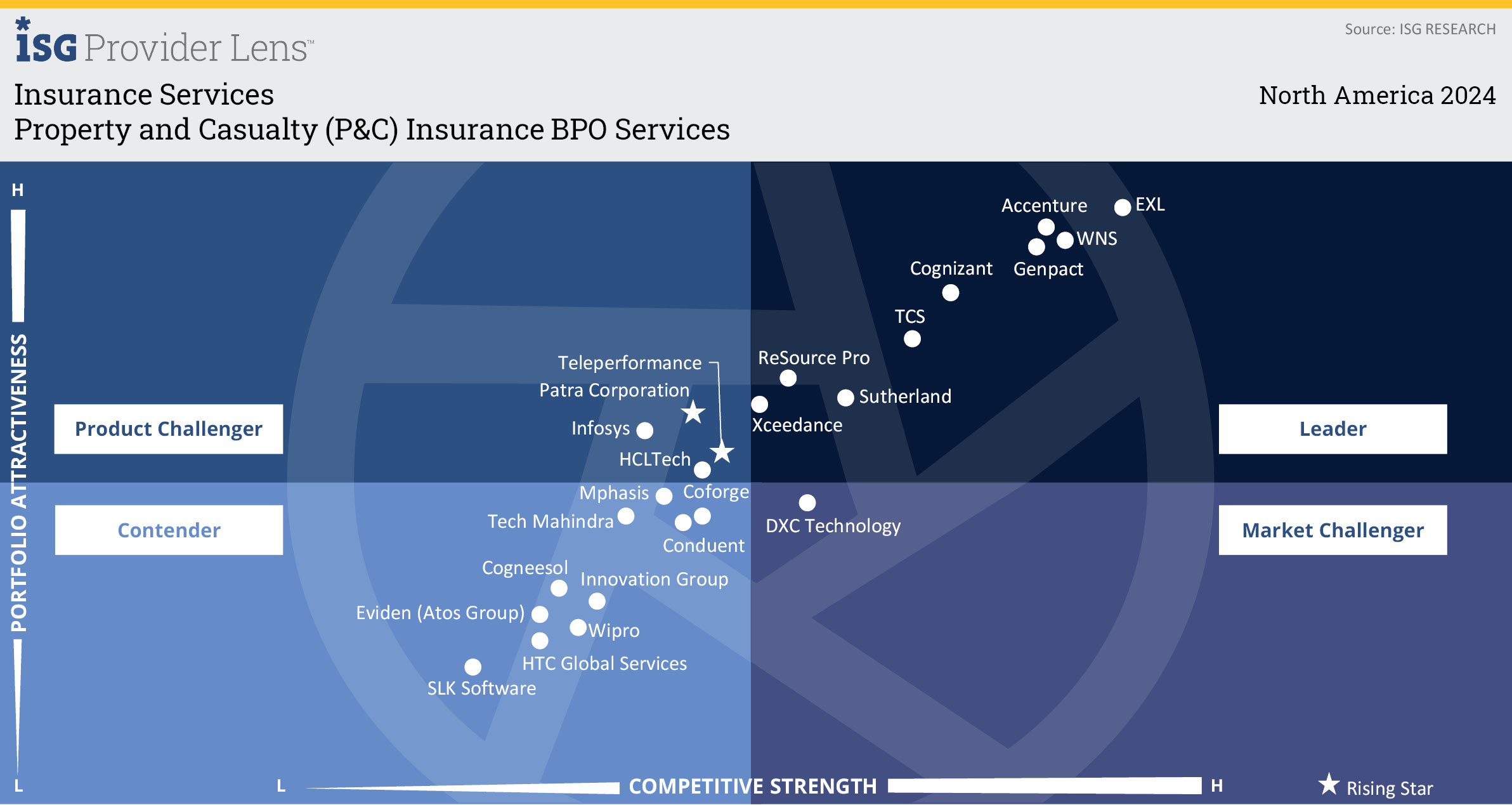

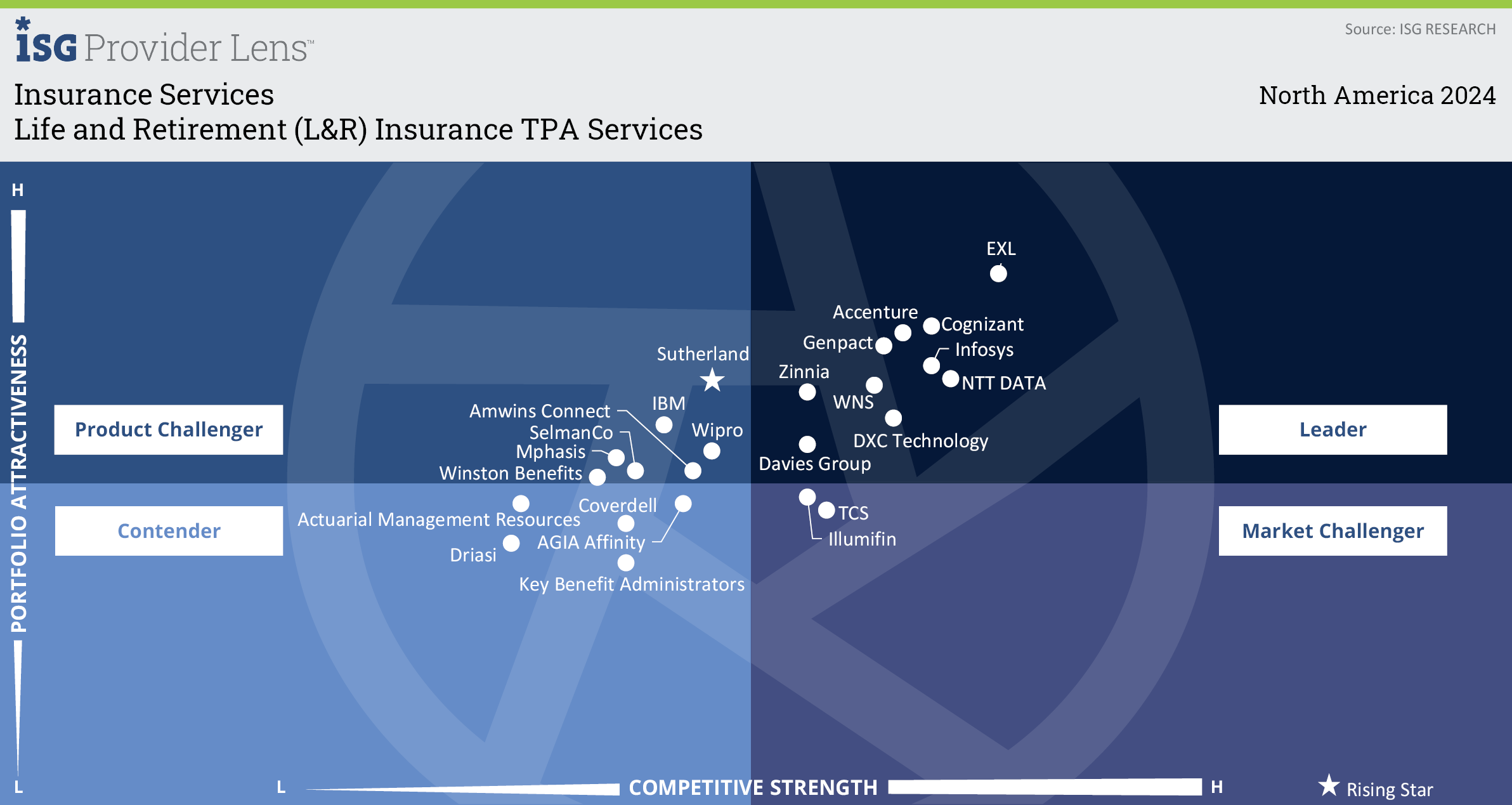

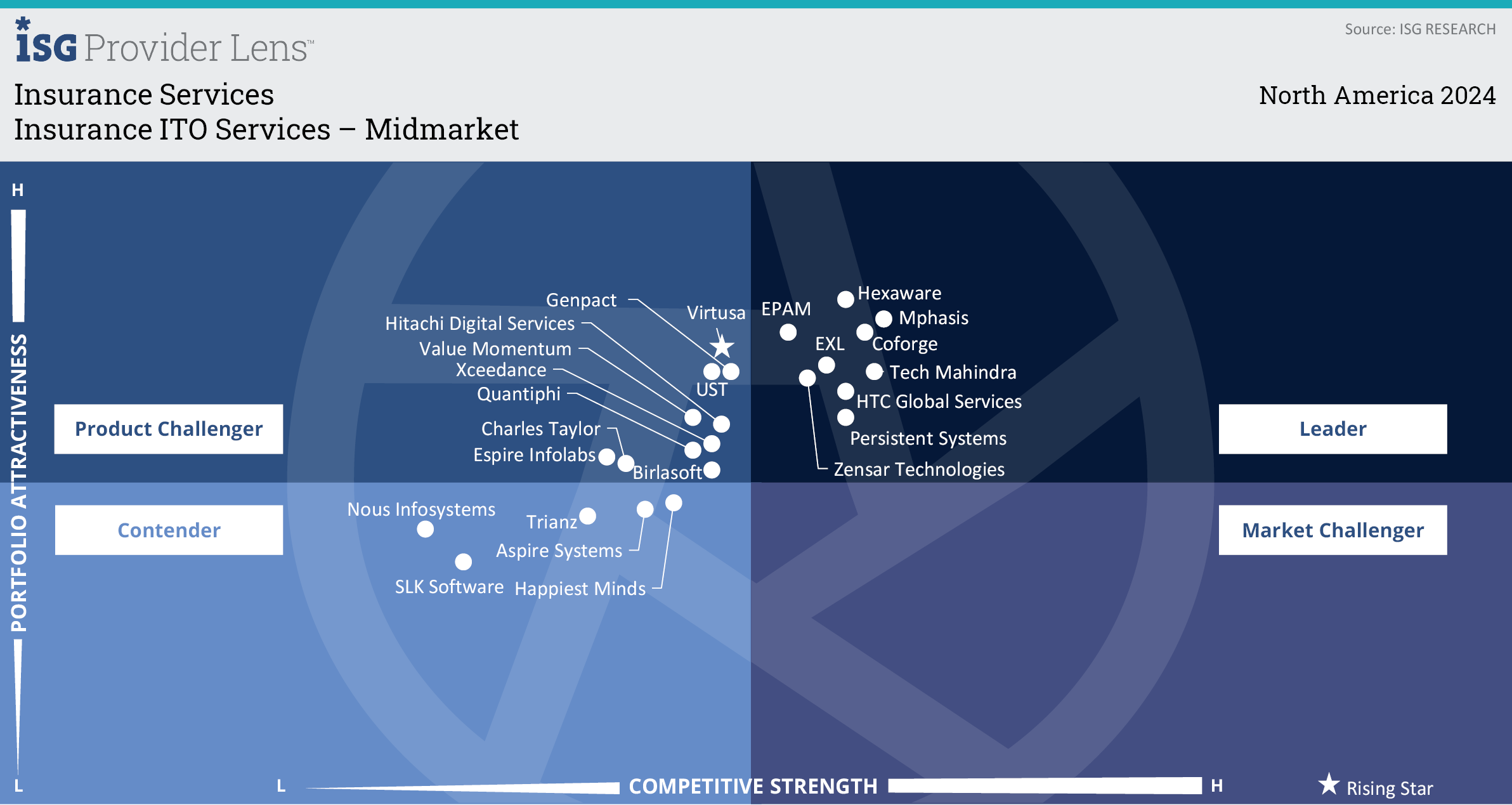

For the third year in a row, EXL has been recognized as a leader in the ISG Insurance Services 2024 report across key categories in North America:

- Life & Retirement (L&R) Insurance BPO Services

- Insurance ITO Services – Midmarket

- L&R Insurance TPA Services

- Property & Casualty (P&C) Insurance BPO Services

"EXL harnesses extensive subject expertise, proprietary solutions, digital proficiency, and predictive analytics capabilities across the L&R insurance value chain. This empowers L&R insurers to optimize outcomes and enhance CSAT." – Ashish Jhajharia, Lead Analyst, ISG

Key Strengths Cited in the Report include:

Life & Retirement Insurance BPO Services

- AI-Driven Business Progress: The company collaborates closely with life insurance carriers to facilitate a shift to a human-in-the Loop AI-led model. EXL assists carriers in digital transformation, offering cloud-first industry solutions with genAI capabilities.

- Unmatched Data & AI Expertise: Seamlessly combining domain knowledge with analytics and AI to tackle complex challenges.

- Comprehensive Group & Voluntary Solutions: From actuarial services to claims, EXL delivers tailored GenAI-powered offerings.

Property & Casualty Insurance BPO Services

- Deep Industry Expertise: A global team of 15,000+ professionals delivering tailored operational efficiencies.

- Innovative Digital Tools: Proprietary solutions like EXL XTRAKTO.AI™ and EXL EXELIA.AI™ for seamless operations.

- Advanced Analytics: 3,500+ analytics experts delivering insights for underwriting, claims, and fraud prevention.

Life & Retirement Insurance TPA Services

- Modern Digital Ecosystem: Tailored solutions to elevate customer satisfaction and drive growth.

- Flexible TPA Models: Customized approaches to manage costs, complexity, and market readiness.

- Agile Product Launch Support: Expertise in rapid, efficient new product rollouts.

Insurance ITO Services – Midmarket

- Transforming Workflows with GenAI: Advanced AI solutions for improved insights and operational efficiency.

- Practical Digital Transformation: Expert guidance in integrating AI and analytics for reliable automation.

- Tailored Roadmaps: Customized strategies to achieve digital transformation goals effectively.

Download the full report to get exclusive insights into how EXL is reshaping the insurance industry with cutting-edge solutions and unmatched expertise.