APS summarization – digitized and automated underwriting

Effective APS, EHR, and lab reviews require skilled underwriters with a medical background to analyze conflicting pieces of information while faced with:

Inconsistency

Duplicative Records

Voluminous Documentation

Expensive Record Collection

Our approach

EXL MedConnection team includes 2000+ MDs, nurses, and clinicians at EXL to provide a turnkey solution for underwriters making these critical decisions. Our solution helps increase underwriter productivity, reduce time spent in medical review and at the same time increase straight through processing rates.

Approach

- Underwriting Blueprint

- Medical underwriting team

- Best-in-class policy admin platform

- Dedicated data scientists

Platform

- Full customer journey

- Underwriter workbench

- 500+ accelerated underwriting rules template

- Reinsurer partnerships

Scoring and Analytics

- Custom models & underwriting scores

- External data access pre-configured

- Visualization dashboards

Solution highlights

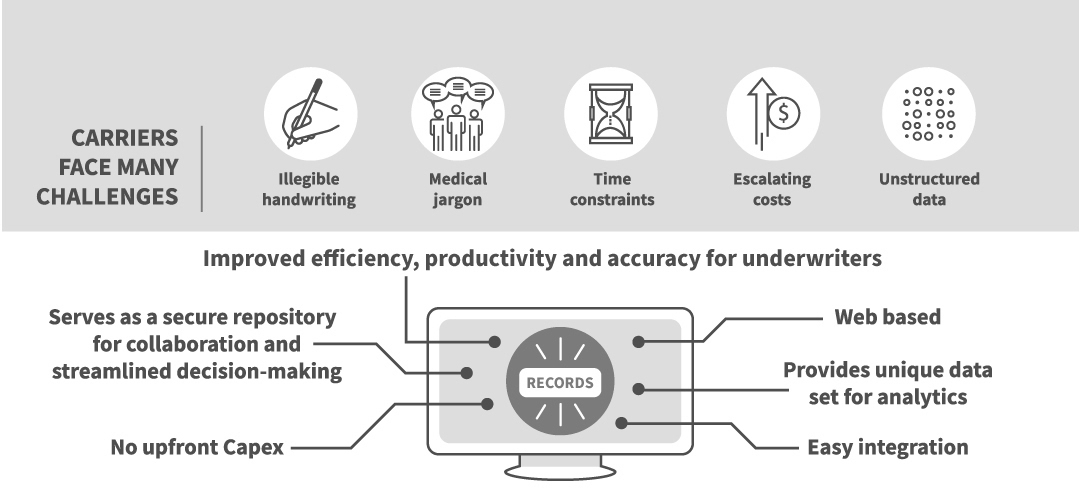

Underwriters face a variety of challenges, including illegible handwriting, complex medical terminology and ever more pressure on making quick decisions.

MedConnection team can work as an extension of the current team or use our proprietary web based platform to ingest data and provide a structured and summarized output to improve underwriter efficiency and decision accuracy.

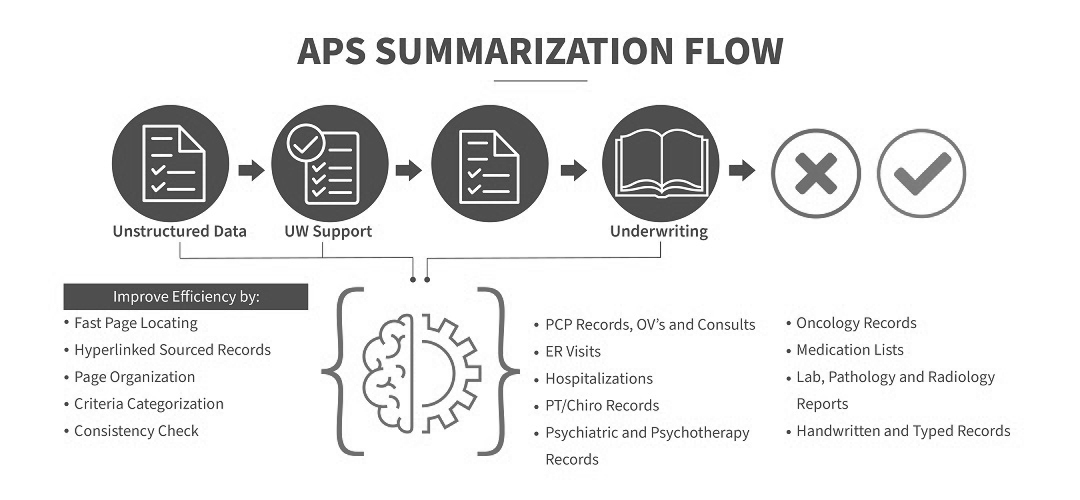

Hyperlink functionality enables underwriters to quickly review files, locate pages and sort by criteria for any type of medical record.

EXL’s MedConnection team provides users with a significant cycle time reduction and improvement in NPS scores. Advanced, automated processing can reduce underwriting reviews by 20% or more.