EXL Smart Audit: AI led audit to drive regulatory compliance and revenue leakage reduction

Overview

The constantly evolving regulatory and compliance framework across industries calls for more stringent governance and stricter adherence by enterprises to mitigate risk of customer complaints or penalties from potential breaches. Additionally, evolving customer expectations have been driving businesses to enhance capability by exploiting cutting-edge technologies, and monitor trends for swift remedial action for a superior customer experience. Lastly, growth-driven organizations are also increasingly seeking optimal cost efficiencies through reduced complaints, and mitigated financial pilferages, which could be in the form of leakages, penalties and fines for compliance and regulatory breaches.

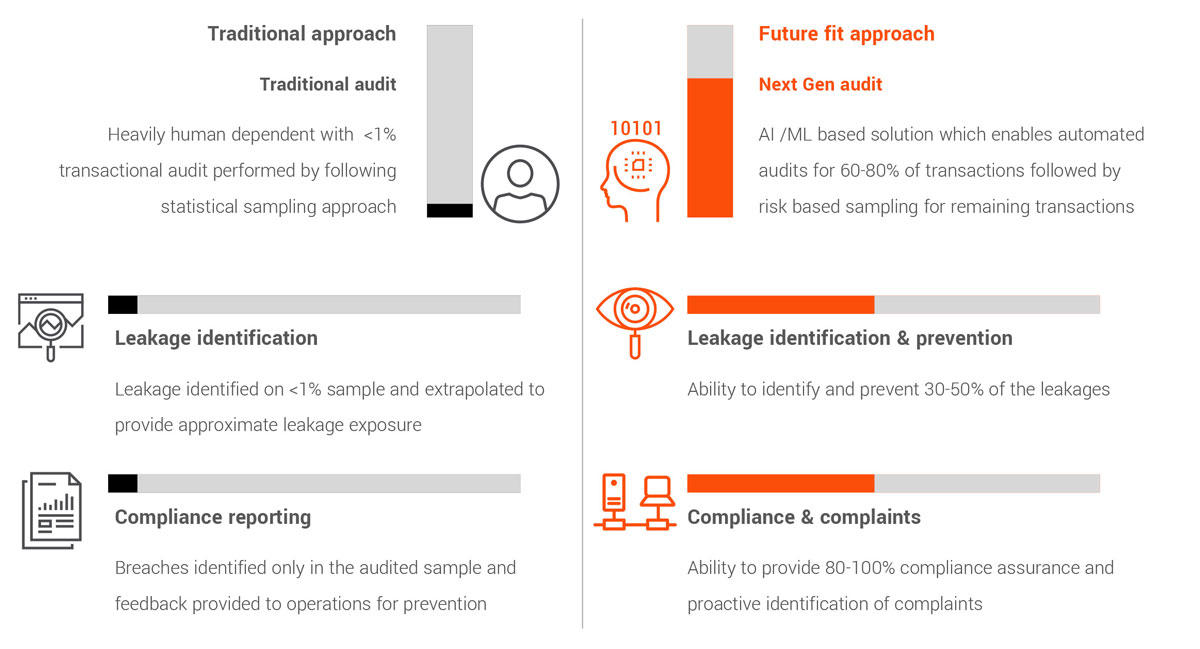

It is, thus, imperative to increase internal controls and governance in order to reduce risk, and pro-actively identify and resolve potential issues. Undeniably, accurate and timely quality audits are critical to ensure regulatory adherence by organizations, reduction in revenue leakage and strong focus on key business and customer outcomes. However, traditional audit processes are highly manual and dreary, and call for targeted embedded digitization within the audit function.

Intelligent Digitization of the Audit Function - does value yielded prevail over outlay?

The pertinent challenges, as established, necessitate a cutting-edge digitized audit solution aiming to create exceptional value for clients through the following intrinsic features:

- Increased audit coverage by 60% - 70%, with marginal increase in operational cost

- Optimal exploitation of analytics and technology for seamless automation of quality audit process

- Prime focus of manual quality assurance on high risk and/or complex scenarios

- Automated and real time dashboard offering actionable insights

- Standardized approach across all LOBs

EXL Smart Audit solution - an integrated solution combining domain expertise and advanced digital technologies to deliver enhanced customer experience and desired business outcomes

EXL Smart Audit solution is an integrated solution combining data analytics, advanced technologies like artificial intelligence and machine learning, as well as technology and process expertise. Sophisticated AI-based NLP modules enable Smart Audit to extend audit coverage beyond rule based scenarios to intelligently generate triggers for manual scrutiny for high risk or complex scenarios. Focusing on enhancing customer experience and delivering distinctly established business outcomes, the compelling quality assurance solution enables agile decision-making through relevant customer data points and actionable insights. It is predictive in nature, and robust enough to highlight pertinent gaps within the process and prevent leakages.

Delineated below are the salient features of EXL Smart Audit solution:

What differentiates EXL Smart Audit solution?

Data and technology driven approach to audits with significant potential to reduce leakage and risk exposure

Key solution modules

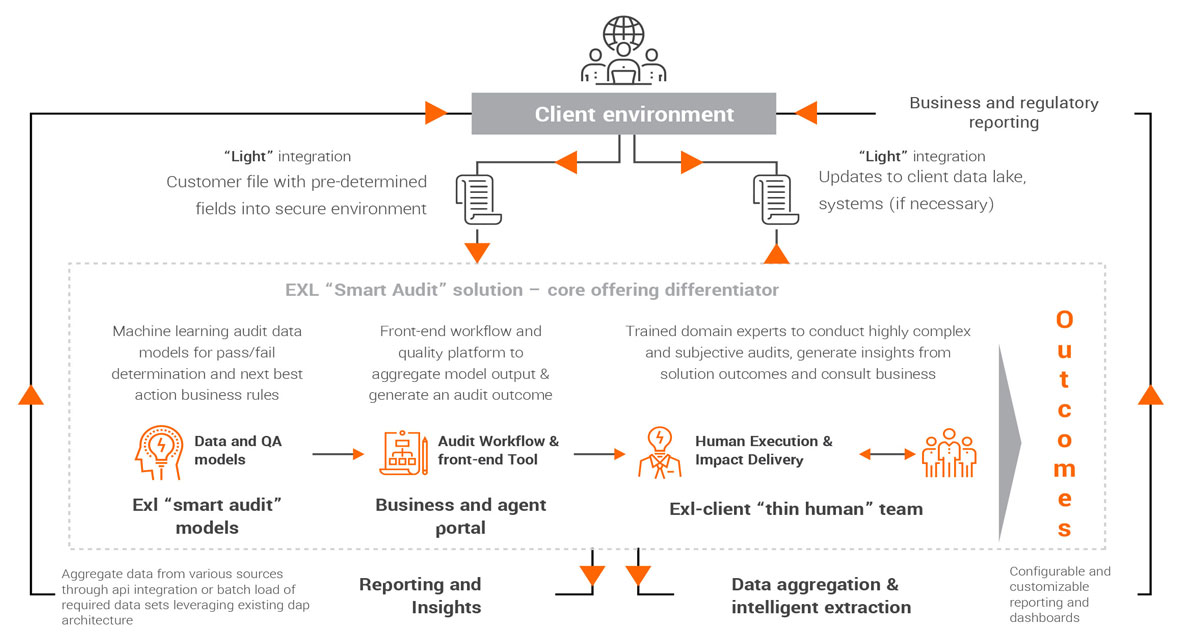

Here is a quick lowdown on the key modules comprising EXL Smart Audit solution:

Data Aggregation: aggregates various sources of data and information required to perform the audit

Q&A Model & Decision Layer: uses auditor help to identify key words or phrases, on the notes or e-mails, to answer associated questions in audit forms

Data Extraction: extracting content and intent from various structured, semi-structured and unstructured documents such as emails, documents, agent notes etc. and feeding them for model processing

Digital Quality Assurance: documents each step of the manual audit process and aggregate model output and info in each step to generate an audit outcome. Generates insights, recommendations and preventative triggers for operations to act.

EXL Smart Audit solution builds upon existing data flows and technology infrastructure to deliver tangible business impact

EXL has engaged successfully with multiple client for deployment of Smart Audit solution and shown effectiveness improvement through the solution

Unrivaled value realization for clients

The solution benefits companies across industries and geographies by targeting higher risk interactions and identifying possible leakages through analytics. Current solution architecture ensures comprehensiveness of solution, minimizing cost to build, maintain and improve, and leveraging the right solution for various inputs to arrive at the desired outcome of QA intent.

Expressly, clients benefit in the following ways:

- Prevention of regulatory breaches, early identification of complaints, potential leakages – leading to considerable reduction in penalties, complaints, and leakages

- Repeatable capability applicable across industries and LOBs

- Analytically-driven, low-touch automated audits, leading to objective assessment

- Fewer violations leading to superior customer satisfaction

- Enhanced customer experience due to end-to-end evaluation of customer journeys, as against individual touchpoints

- Manual QA review better targeted to higher risk interactions and/or more complex obligations