EXL Submission triage solution

Commercial insurance carriers struggle with loss of business from unattended submissions or delayed quotes due to sparse underwriter capacity. A data-driven submission triage solution can help Underwriters respond with quotes faster and write more profitable business.

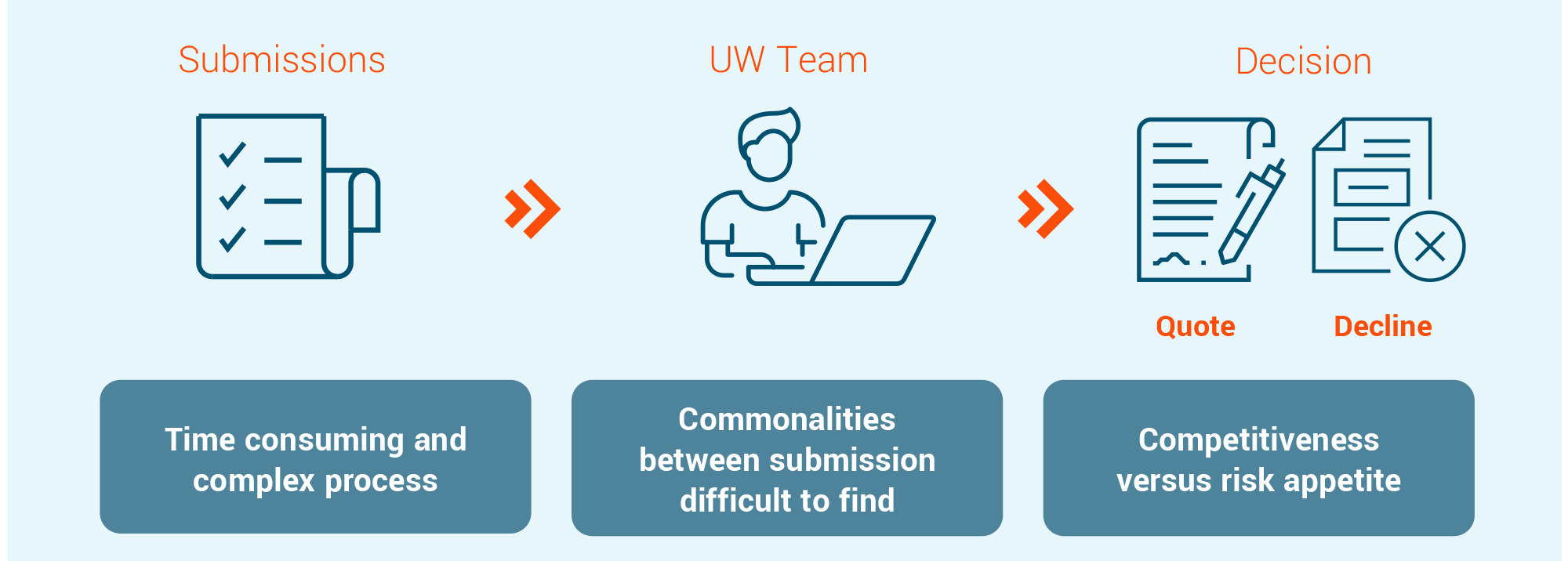

The need for a submission triage solution

Traditional approach

The traditional submission triage process is manual, complex and time-consuming. It involves extracting data from submissions, deciding on submissions to quote based on judgement or business relations, and ultimately providing the quote.

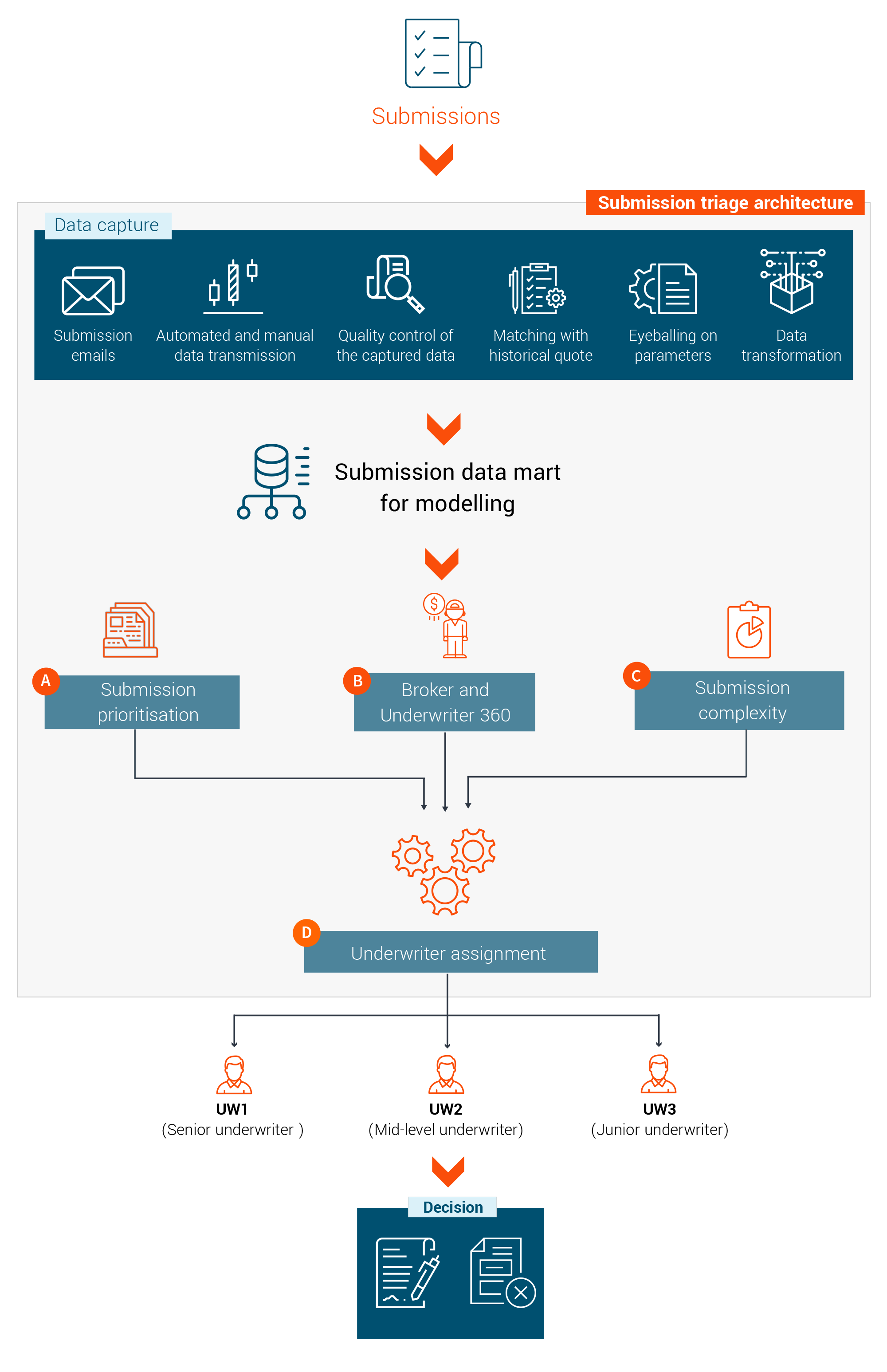

Redefining the submission triage process

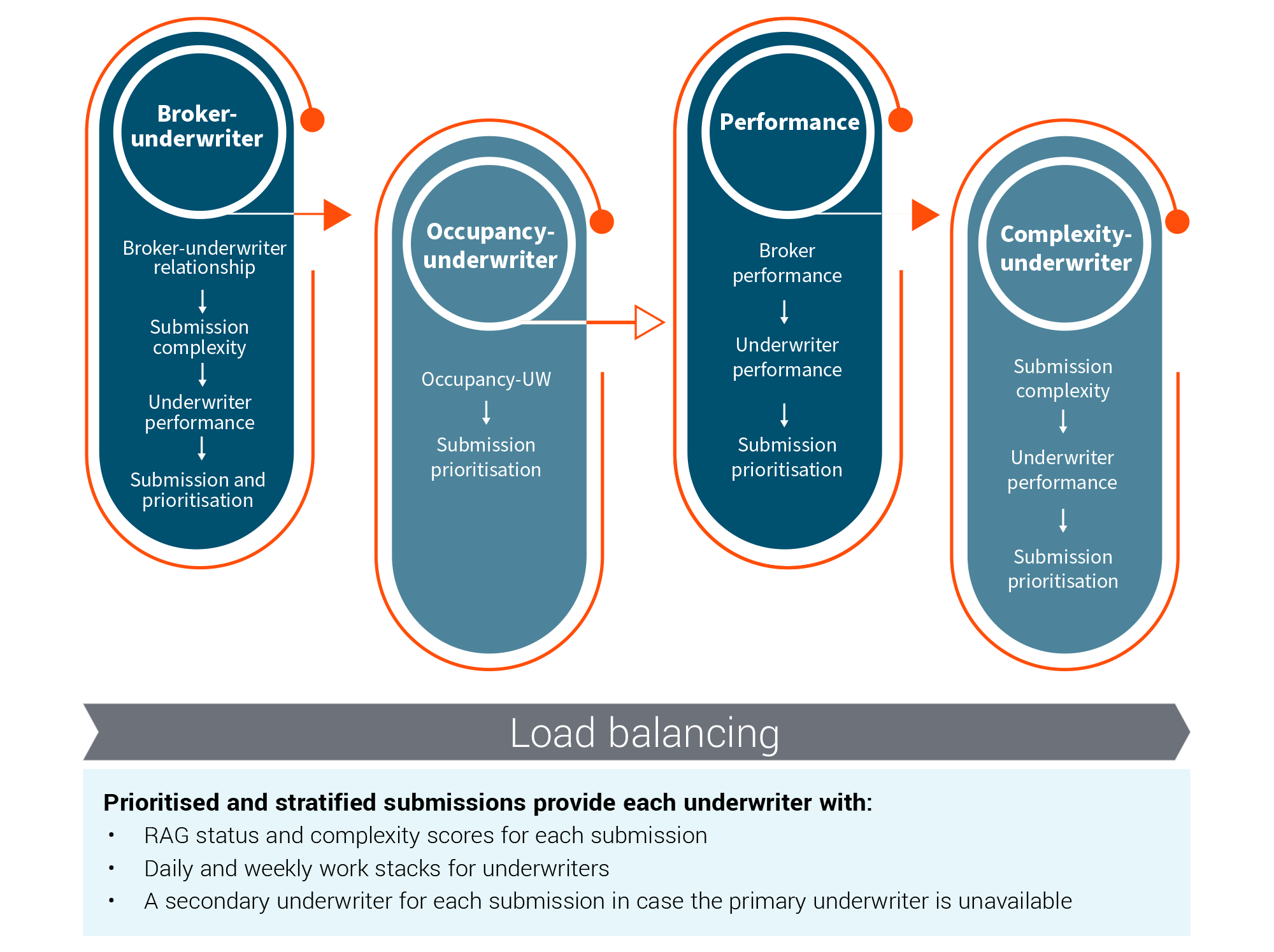

EXL’s submission triage solution process eliminates the sequential queue and instead proritise submissions on the likelihood of being quoted or bound. It then applies business rules to auto-route them to the right underwriter.

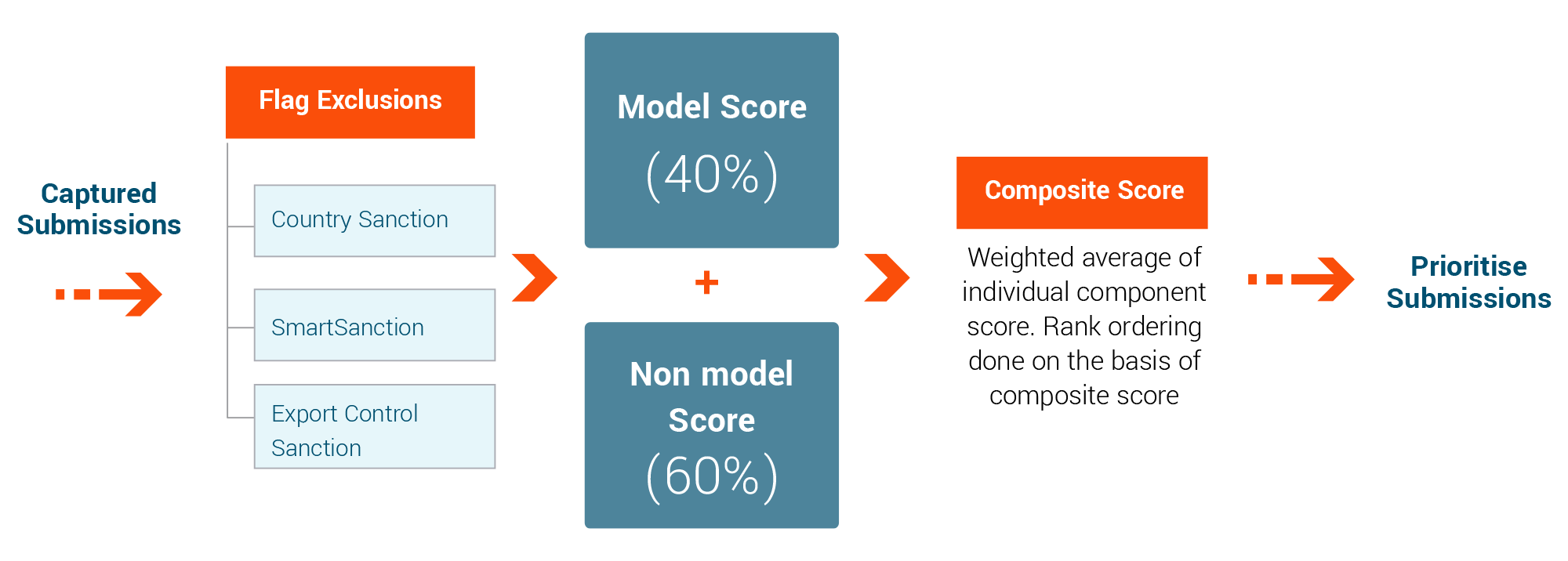

A: Submission prioritisation

The solution provides underwriters with rank-ordered submissions by combining analytical judgment models based on historical data, business priorities, and the underwriters' knowledge and judgment

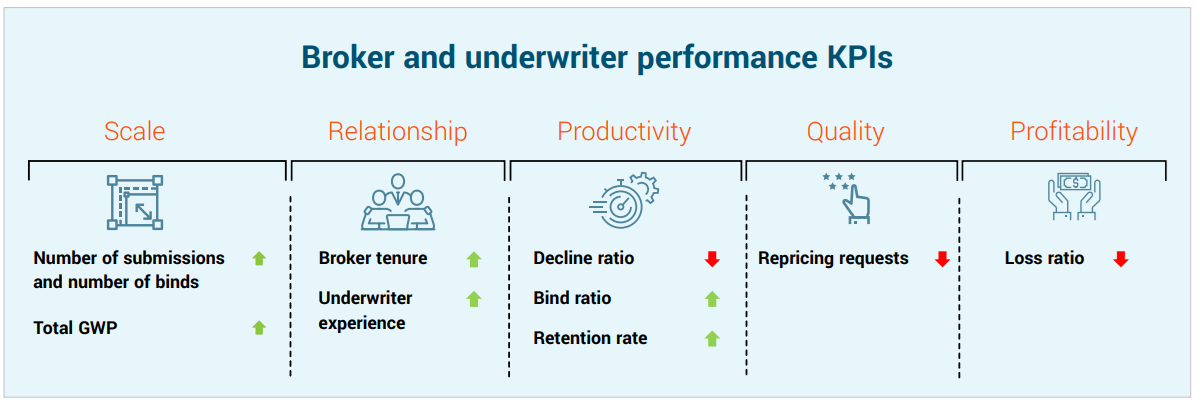

B: Broker and Underwriter 360

A broker and underwriter performance score can provide a 360 single source of truth. C

C: Submission complexity

The submission complexity score determines how complex a submission is based on scale, sanction, flags, and type of risk. This is then used to match the business and risk appetite with the appropriate underwriter.

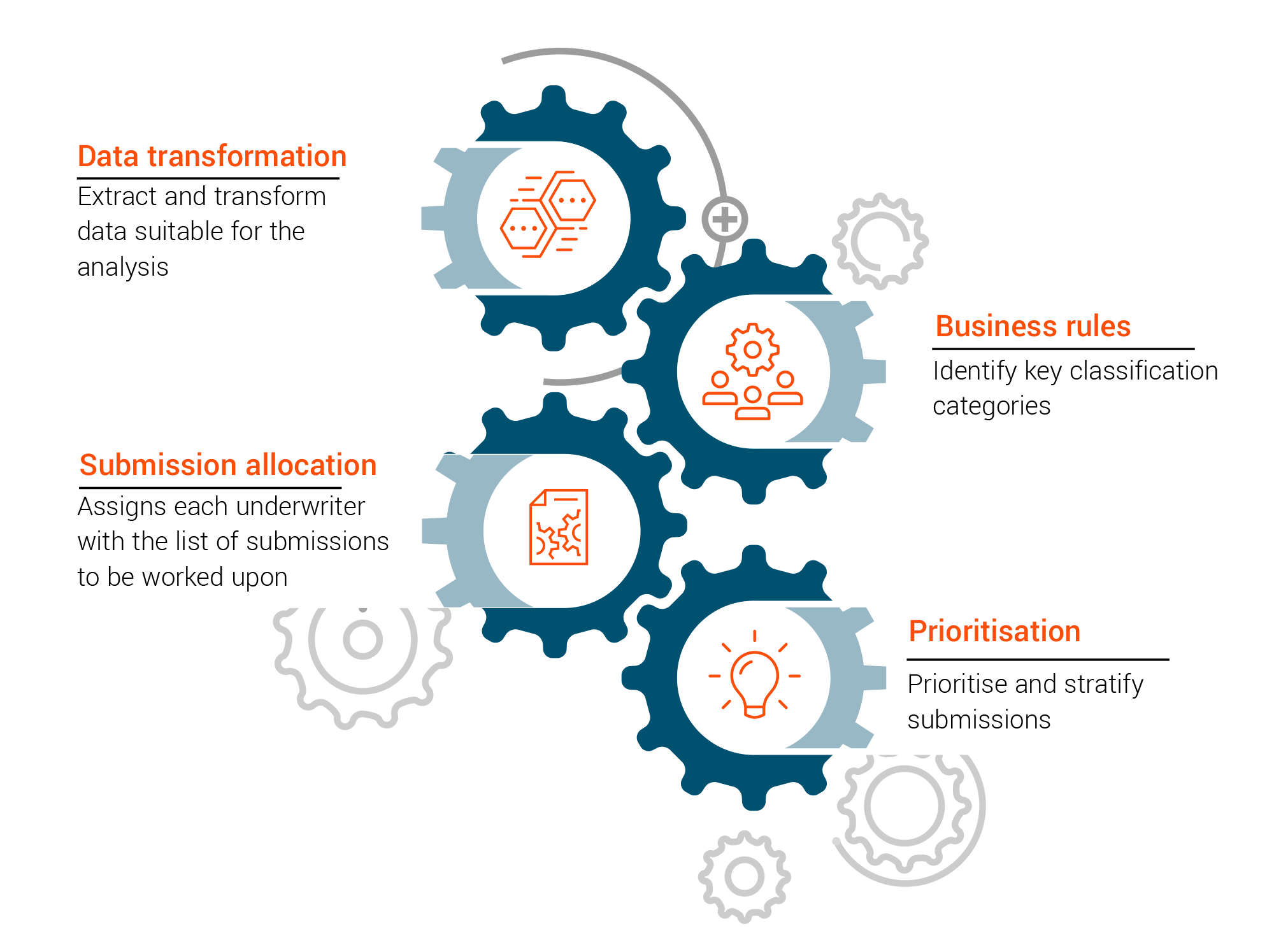

D: Underwriter assignment - Approach and business rules

The module assigns each underwriter with the list of submissions according to set rules.

Assignment business rules

Underwriting triage takes a rule-based approach to prioritise and assign submissions considering the right drivers based on relationships, occupancy, performance and submission complexity.

Business benefits