EXL’s Basel 4 calculator

The European Commission’s CRD6/CRR3 package and the UK PRA’s CP16/22 aims at implementing Basel 4/3.1 by 2025. As a result, banks will need to be able to easily manage intricate computations and perform in-depth analysis on the fly. EXL’s Basel 4 calculator helps achieve these goals through dedicated modules on data modeling and governance, RWA calculation, regulatory reporting, and stress-testing.

A. Data modeling and governance

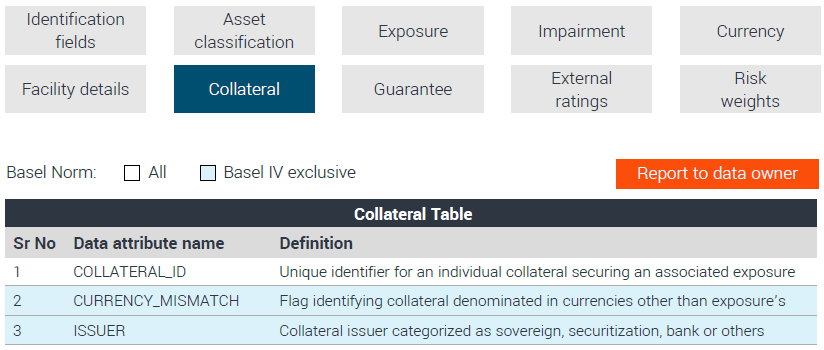

A1 The module provides even banks just starting their Basel compliance path with ready-to-use data models. Also included are support capabilities for the relevant data types, attribute definitions, and sample data views.

A2 Ensure governance through BCBS 239 and appropriately using data in the context of CRR. Establish data quality through this dedicated module featuring data validation and reconciliation checks, with options to report or request data changes.

Ingested data dimensions and attribute definitions

B. Basel 4/3.1 calculator

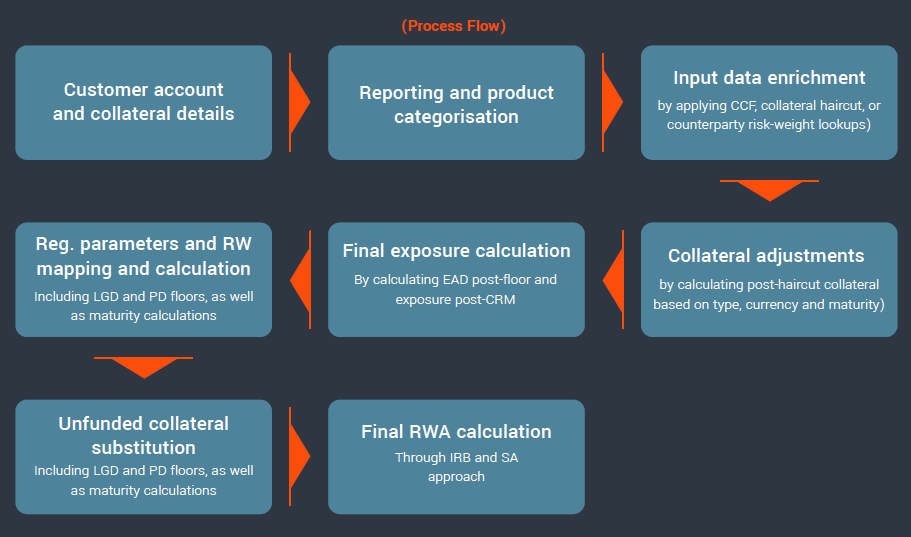

300+ capital rules have been converted a into live implementation with a mapping available for each regulation. Calculation rules range across Standardised, F-IRB, and A-IRB approaches, with the flexibility to incorporate newer directives for future.

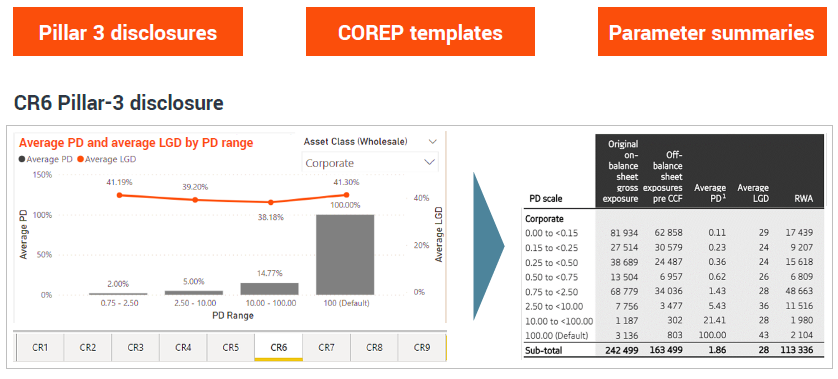

C. Reporting module

Seamlessly automate reports that comply with Basel and CRD regulations. Regulatory reports can be delivered on a self-serve, automated, or pre-scheduled basis with robust data integration and best-in-class visualization.

D. Analysis module

Conveys scenario changes and driver impacts in a concise and impactful manner. The right benchmarks and interactive elements allow users to further analyze the data.

To find out more on this and our other risk analytics and data offerings, please get in touch with the EXL EMEA Risk CoE: