EXL property insight Solution

Drive decision making and business process redesign for insurance underwriting, marketing, and claims processing

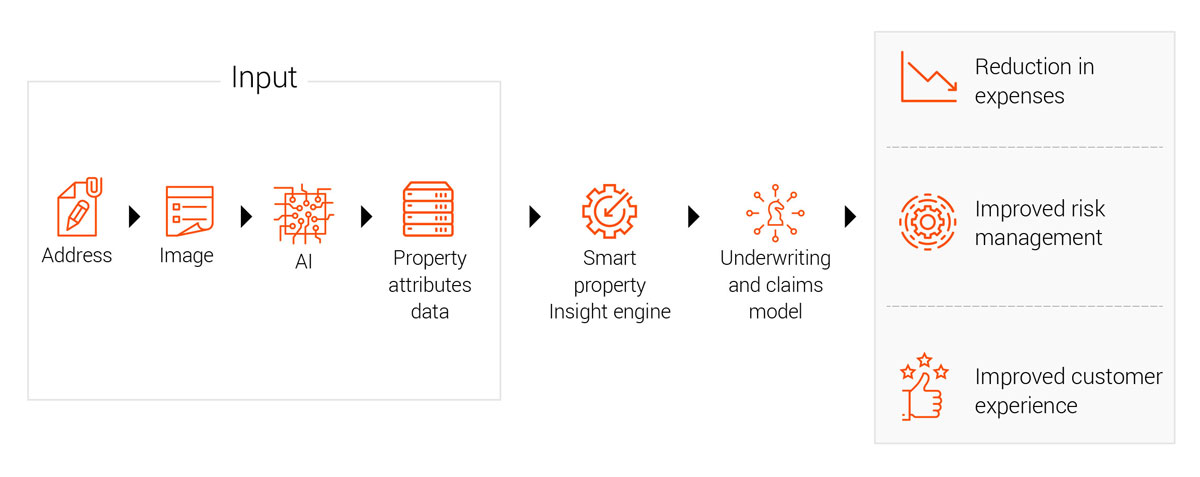

EXL Property Insights, our proprietary image analytics solution, leverages AI and ML to provide accurate, real-time insights to help insurers better evaluate their portfolio risk, develop new risk models, and combine individual peril scores into an overall risk score. The solution combines property attributes from high-resolution aerial imagery with additional property-level features that influence risk. For underwriters, the solution offers risk scores for fire, weather and flood, as well as liability detection, property value, and individual property parameters. For claims processing, it provides a severity score, helps with triaging and reserve setting, and supports assessment of replacement value. The solution can also help carriers increase marketing ROI by supplementing market and customer insights.

EXL Property Insights is available on AWS Marketplace and can be quickly and easily deployed within your existing cloud environment.

Solution highlights

Unlike other image analytics solutions, EXL directly impacts business performance by offering increased visibility, as well as lower loss ratios and operational expenses, by extracting property attributes from multiple geo-spatial data sources and combining them with streamlined analytics workflows, leading to better decision making.

End-to-end solution

- Support a variety of use cases across your enterprise with a single solution that brings together an ever-growing pool of third-party and partner data to optimize decision making.

Speed to market

- Get to market quickly with minimal development effort and an on-demand consumption model.

Flexible deployment

- Choose the right combination of image and data features, as well as technical integration models, to meet your specific needs.

Solution approach

Tenets of our solution

Underwriting assistance

Use of property attributes

Underwriting risk scores that can help

- Fire risk categorization

- Flood risk categorization

- Liability Assessment

- Replacement value calculation

Renewal decision

Change in property attribute

Detecting change of the property attributes over time

- Premium adjustment

- Discuss risk mitigation strategies

- Denial of renewal

Roof condition

Image based assessment

Roof condition can be tagged as good, fair and bad

Ability to go granular based on

- Tarp sheet

- Missing shingles

- Roof material

Claims processing

Damage assessment

Attributes can help in detecting:

- Rooftop damage severity

- Missing number of shingles

Combining image data with unstructured claim handler notes

- Help in reserve setting

- Triaging claim to right adjustor

Potential savings

Lower loss ratio & claims lifecycle

- 10% Lower Loss Ratios

- -7% Premium Increase

- -3% Efficiency Gains

Better business efficiencies

- Reduced expense ratios by 5%

- High Return on Invested Capital (ROIC)