Introduction

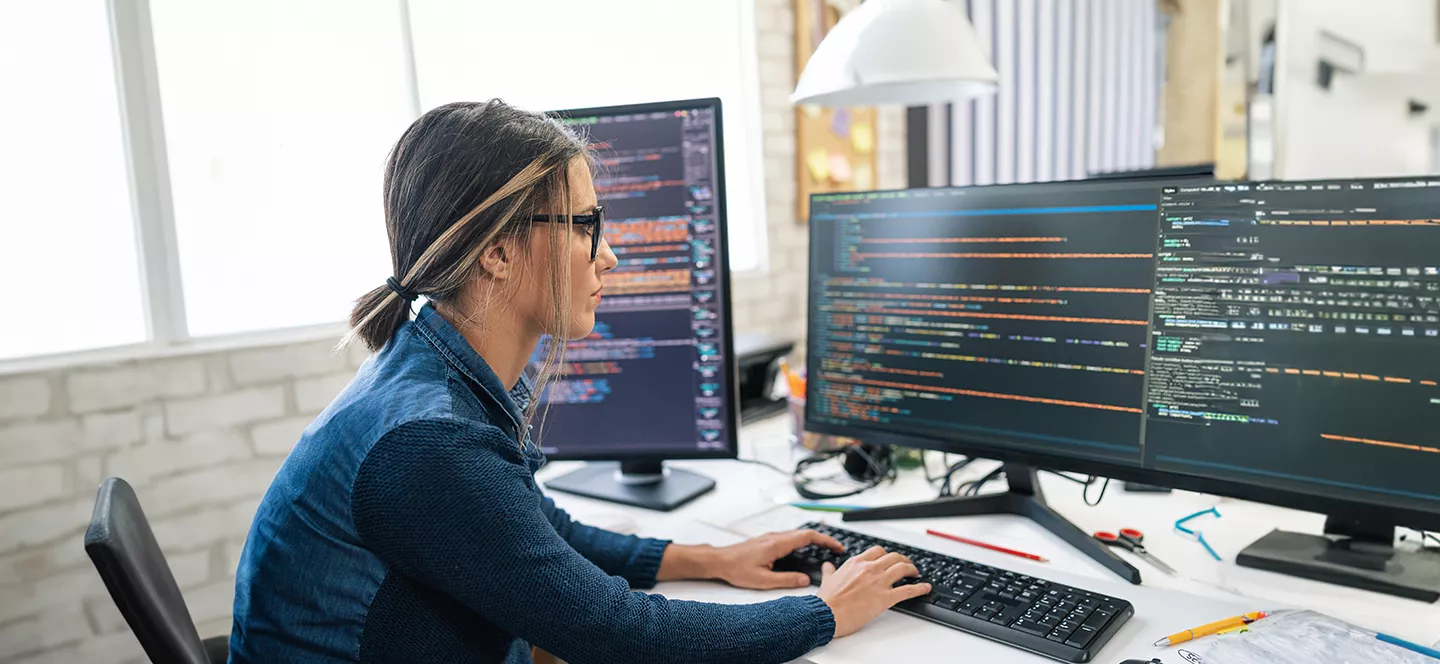

Employees expect the benefit election process to be highly intuitive and personalized however there are three key issues with the current process.

- Nearly 1 in 3 Americans don’t understand employee benefits they selected during their most recent open enrollment according to a recent survey by Voya Financial.

- The current enrollment process does not offer any personalization or recommendation on what employees should elect based on their personal details including demographic, financial and claims details.

- The impact of benefits on Financial wellness of employees remains unclear despite sizeable payroll deductions. This is causing poor employee experience, low utilization of products that they eventually select.

Employers and Brokers expect Insurance carriers to support a quick enrollment set up so that employees can go and elect benefits. However, their experience is poor due to delays and incorrectly set up enrollment. Enrollment set up is complicated by employer and employee data and plan designs. Data exchanged electronically often via EDI file feeds require manual effort to process and monitor. These complications often result in delayed and inaccurate enrollment set up causing downstream issues.

Insurers want a quick and frictionless process to issue coverage to clients and members. However due to a variety of Ben Admin platforms that they must work with, consuming data in multiple formats becomes a challenge.