Digitization: A looming crisis for community banks and credit unions

In recent years, consumer expectations have accelerated the need for digital transformation of credit products across all lines of business, from unsecured installment and credit cards to auto loans and mortgages.

While mid-tier banks have invested in front-end digital capabilities, issues with legacy data infrastructure, competition for analytic talent, and manual compliance processes have made it difficult to implement high-quality, real-time credit decisioning in a timely fashion.

Large banks and fintechs, through early adoption of big data, AI and machine learning, have been able to meet consumer demands more quickly – creating a competitive advantage over regional banks and credit unions.

Please fill out the brief form below and one of our experts will be in touch shortly.

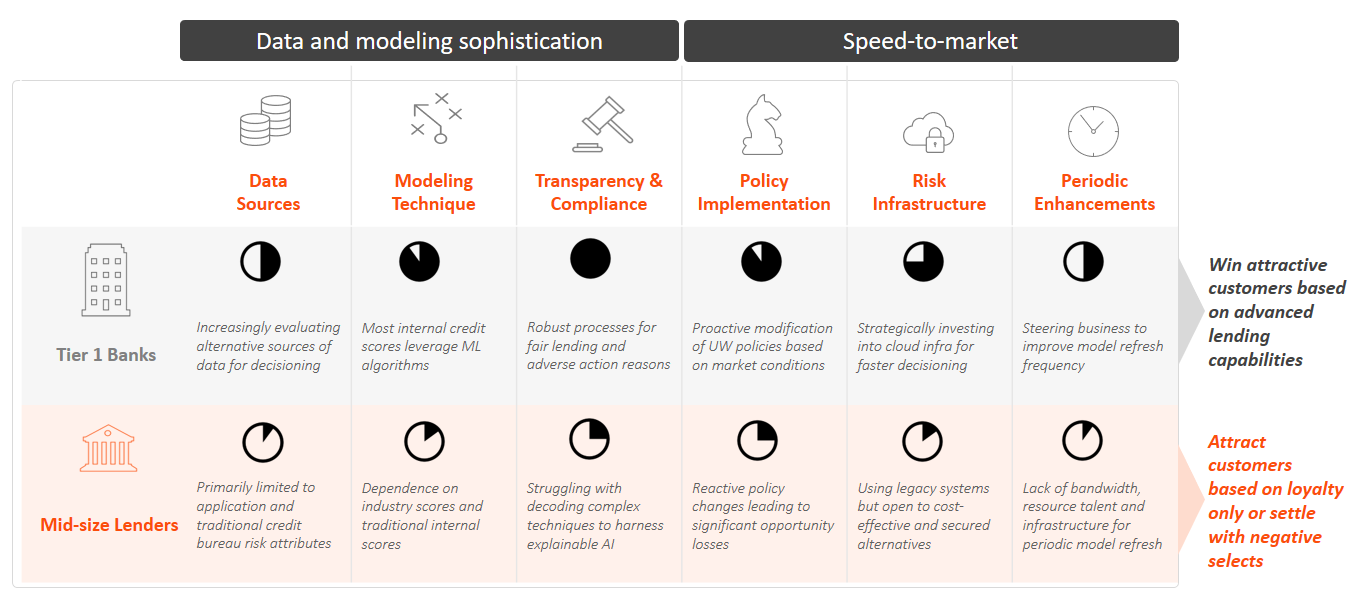

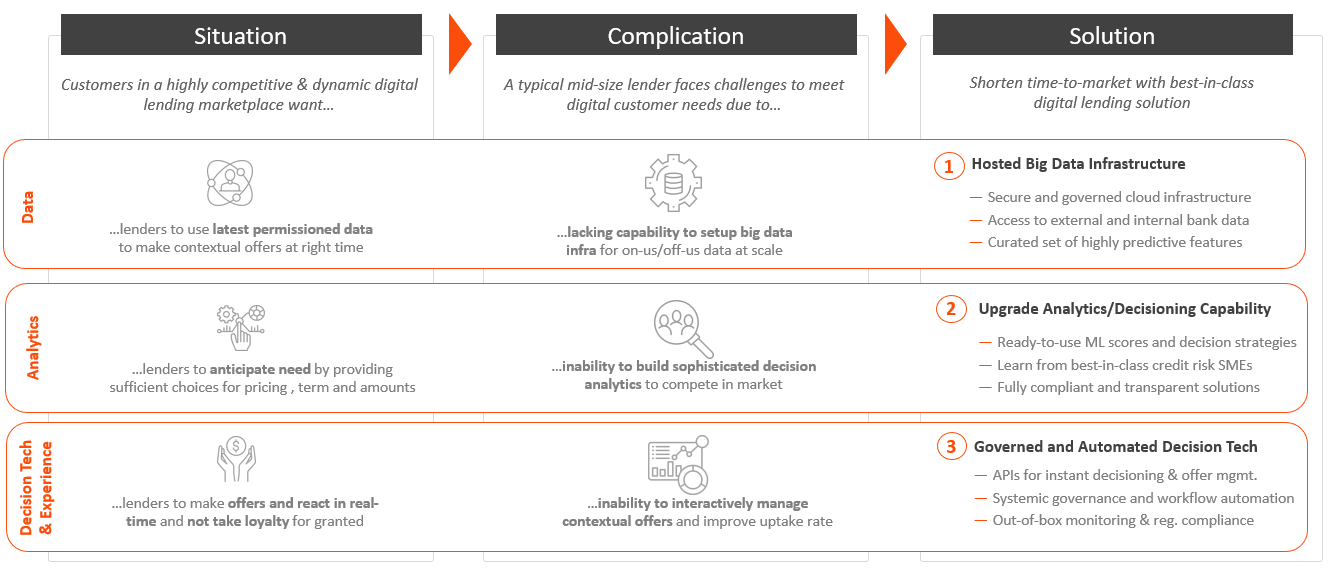

Challenges for a mid-size lender in US

Decisioning-as-a-service enables turnkey digital lending programs

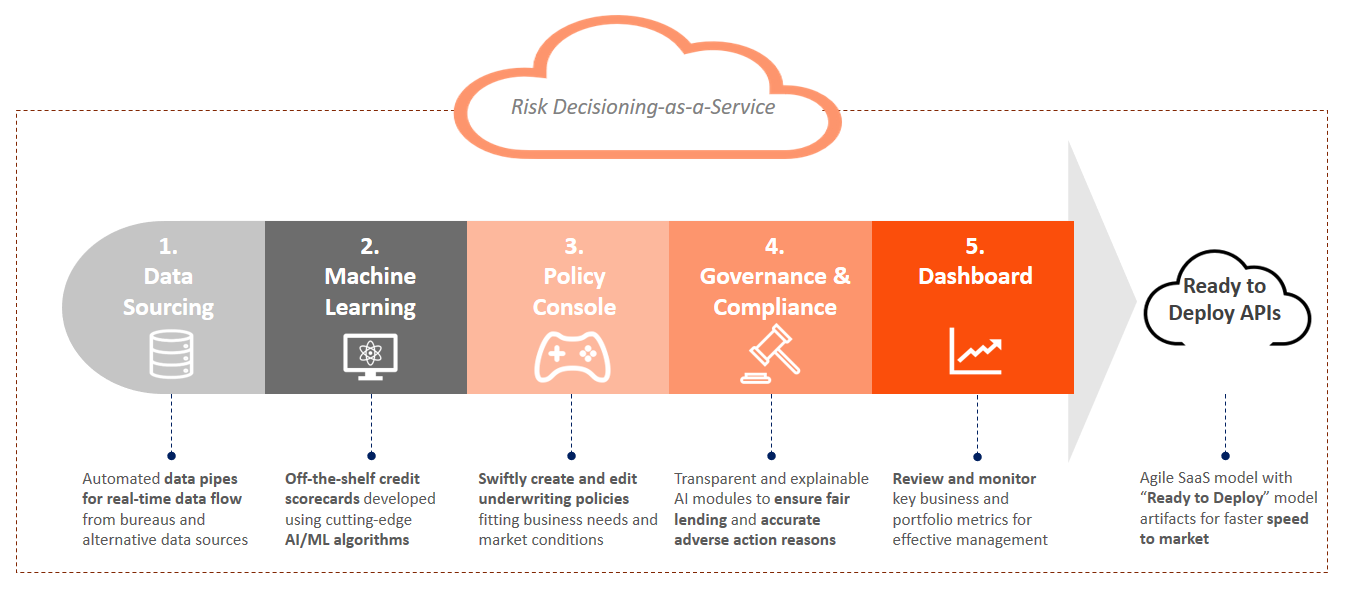

EXL, Oliver Wyman, and Corridor Platforms have partnered to develop a credit risk decisioning solution for financial institutions, bringing together the deep data and analytics experience from EXL, decision workflow automation capabilities from Corridor, and extensive regulatory compliance expertise from Oliver Wyman. The joint solution leverages advanced analytics, AI and the cloud to deliver instant credit decisions to support digital lending initiatives such as point-of-sale financing, digital loans, mortgage approvals and real-time credit limit changes.

Enabling mid-size banks with “best-in-class” risk capabilities

Ready-to-deploy capabilities

Our secure, compliant cloud-based solution provides the modular components that can be customized to your unique needs and rapidly deployed to enhance your digital lending capabilities within 2-3 months.

Modular components to enable speed to market

Our value to you

Our models can help generate up to 25% in incremental volume at your current risk level through superior decisioning. At the same time, our built-in AI ensures protection against high volatility in your credit portfolio, enabling you to avoid high losses in a stressed economic environment.

Innovation with built-in compliance