Orchestrating multiple technologies & automation tools

EXL’s Hyperautomation approach combines the power of Automation, AI and Analytics, and orchestrates these levers on Cloud to accelerate digital transformation. Our focus is to shift the business from people-intensive legacy OS to a future ready, thin human AI Operating System (EXL AI:OS™).

EXL’s Hyperautomation CoE takes enterprises a step closer to EXL AI:OS™. It is a cohesive automation suite that:

- Marries different digital transformation tools

- Consists of highly modular, cloud-enabled, pre-built accelerators and solutions

- Executes with speed for optimum business and customer outcomes

- Enables end-to-end digital transformation at scale

How is EXL Hyperautomation different?

Helps progressing from Automating Process maps to Digitizing E2E Data flows

50-100%

higher returns than traditional automation

20-30%

higher YoY impact

3x-4x

ROI

10x-20x

more data available for advanced analytics

30%-40%

benefit on Ops spend in a steady state

Scale and flexibility

offered in our hyperautomation solutions

Enables shift

from input-based commercial models to ROI-led models

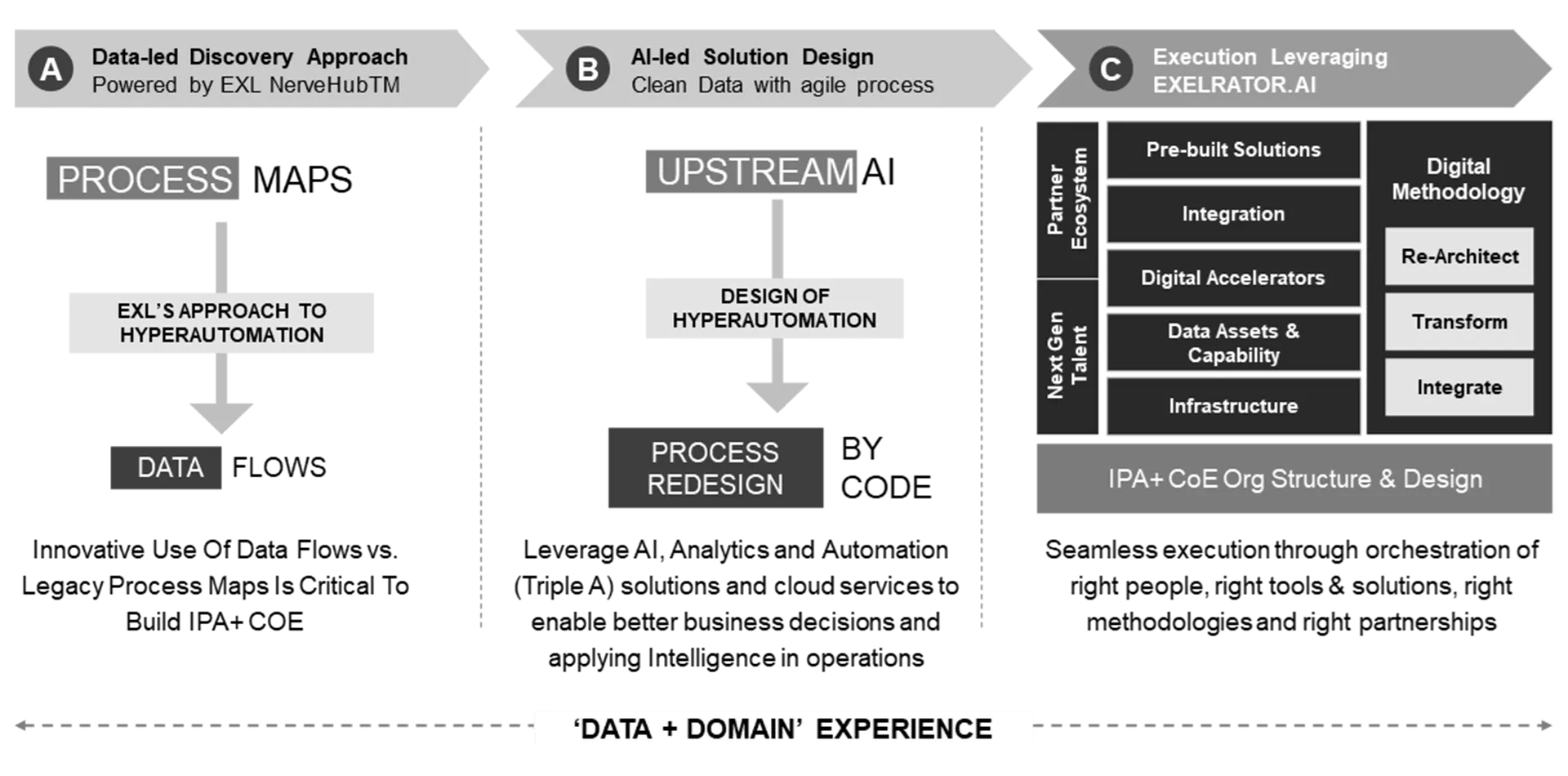

3 step framework

EXL’s uses a defined 3 step framework from discovery to execution for successful hyperautomation program outcomes.