EXL Reports 2024 Fourth Quarter and Year-End Results; Issues 2025 Guidance

Tuesday, February 25, 20252024 Fourth Quarter Revenue of $481.4 Million, up 16.3% year-over-year

Q4 Diluted EPS (GAAP) of $0.31, up 28.4% from $0.24 in Q4 of 2023

Q4 Adjusted Diluted EPS (Non-GAAP) (1) of $0.44, up 26.1% from $0.35 in Q4 of 2023

2024 Revenue of $1.84 Billion, up 12.7% year-over-year

2024 Diluted EPS (GAAP) of $1.21, up 10.0% from $1.10 in 2023

2024 Adjusted Diluted EPS (Non-GAAP) (1) of $1.65, up 15.4% from $1.43 in 2023

NEW YORK, Feb. 25, 2025 (GLOBE NEWSWIRE) -- ExlService Holdings, Inc. (NASDAQ: EXLS), a global data and AI company, today announced its financial results for the quarter and full year ended December 31, 2024.

Rohit Kapoor, chairman and chief executive officer, said, “As we executed our data and AI strategy in 2024, we achieved several key milestones, including launching an enterprise AI platform in partnership with NVIDIA, introducing our insurance-specific large language model (LLM) and expanding our data management capabilities with the acquisition of ITI Data. Our focus on innovating with speed led to industry-leading full-year revenue growth of 12.7% and adjusted EPS growth of 15.4%. As AI adoption continues to increase, EXL is well positioned to capture this opportunity and continue its strong growth momentum.”

Maurizio Nicolelli, chief financial officer, said, “We finished 2024 with robust growth across our business segments, a formidable balance sheet and strong free cash flow. For the full year 2025, we expect revenue to be in the range of $2.025 billion to $2.060 billion, representing a 10% to 12% increase year-over-year on a reported basis and 11% to 13% on constant currency basis. We expect adjusted diluted EPS to be in the range of $1.83 to $1.89, representing a 11% to 14% increase over 2024.”

1. Reconciliations of adjusted (non-GAAP) financial measures to the most directly comparable GAAP measures, where applicable, are included at the end of this release under “Reconciliation of Adjusted Financial Measures to GAAP Measures.” These non-GAAP measures, including adjusted diluted EPS and constant currency measures, are not measures of financial performance prepared in accordance with GAAP.

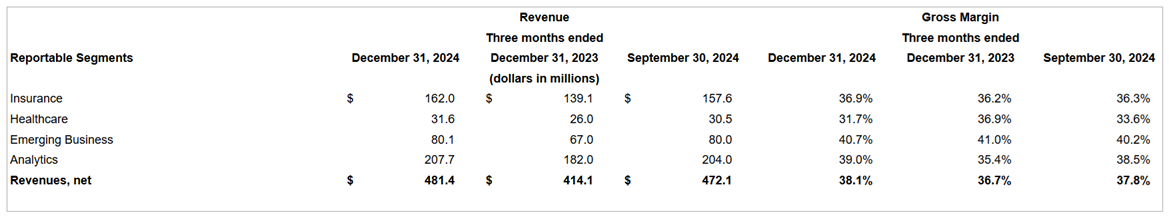

Financial Highlights: Fourth Quarter 2024

- Revenue for the quarter ended December 31, 2024 increased to $481.4 million compared to $414.1 million for the fourth quarter of 2023, an increase of 16.3% on a reported basis and constant currency basis. Revenue increased by 2.0% sequentially on a reported basis and 2.4% on a constant currency basis, from the third quarter of 2024.

- Operating income margin for the quarter ended December 31, 2024 was 14.8%, compared to 13.1% for the fourth quarter of 2023 and 14.7% for the third quarter of 2024. Adjusted operating income margin for the quarter ended December 31, 2024 was 18.8%, compared to 17.8% for the fourth quarter of 2023 and 19.9% for the third quarter of 2024.

- Diluted earnings per share for the quarter ended December 31, 2024 was $0.31, compared to $0.24 for the fourth quarter of 2023 and $0.33 for the third quarter of 2024. Adjusted diluted earnings per share for the quarter ended December 31, 2024 was $0.44, compared to $0.35 for the fourth quarter of 2023 and $0.44 for the third quarter of 2024.

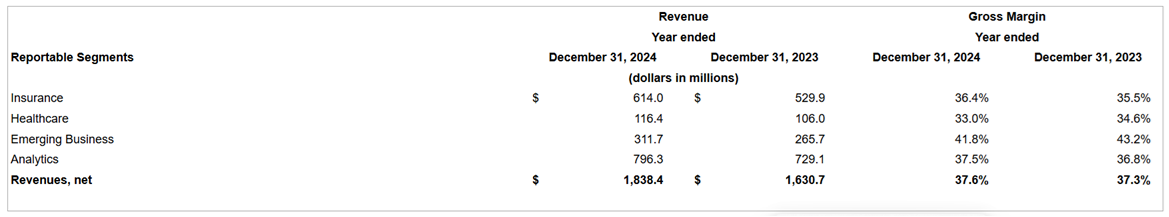

Financial Highlights: Full Year 2024

- Revenue for the year ended December 31, 2024 increased to $1.84 billion compared to $1.63 billion for the year ended December 31, 2023, an increase of 12.7% on a reported basis and constant currency basis.

- Operating income margin for the year ended December 31, 2024 was 14.3%, compared to 14.6% for the year ended December 31, 2023. Adjusted operating income margin for the year ended December 31, 2024 was 19.4%, compared to 19.3% for the year ended December 31, 2023.

- Diluted earnings per share for the year ended December 31, 2024 was $1.21, compared to $1.10 for the year ended December 31, 2023. Adjusted diluted earnings per share for the year ended December 31, 2024 was $1.65, compared to $1.43 for the year ended December 31, 2023.

Business Highlights: Fourth Quarter 2024

- Won 17 new clients in the fourth quarter of 2024, with 8 clients in digital operations and solutions and 9 in analytics. For the year, we won 69 new clients, with 32 in digital operations and solutions and 37 in analytics.

- Launched EXLerate.ai, an agentic AI platform designed to help enterprises reimagine and build AI-native workflows that drive greater efficiency, lower costs, and increased accuracy and scalability across business operations.

- Named a Leader in the ISG Provider Lens™ Generative AI Services 2024 report. Analysts cited EXL’s data integration capabilities, domain-specific expertise, and robust transformational framework as key differentiators driving its leadership in this space.

- Recognized as a Market Leader in the HFS Research 2024 AADA Quadfecta Services for the Generative Enterprise™ 2024 study. The study evaluated 27 leading analytics, AI, data platforms, and automation service providers on their ability to unlock deep insights from data, automate complex processes, and enhance operational efficiencies. The Market Leader designation is the report’s highest distinction.

2025 Operating Model

To accelerate the execution of our data and AI strategy, capture a greater share of the growing AI market and drive EXL’s long-term growth, the company is changing its operating model. The new model is comprised of Industry Market Units focused on delivering higher value to clients leveraging our full suite of capabilities; and Strategic Growth Units focused on rapidly advancing our capabilities specific to various industries and client needs.

This enhances our ability to deepen client relationships, unlock new buying centers, expand our addressable markets across industries and geographies, accelerate investments in data and AI capabilities and industry-specific solutions, and create more professional development opportunities for our employees. This model enables us to deliver AI-powered integrated solutions more effectively and evolve engagements to maximize value for our clients.

EXL will adopt new financial reporting segments consistent with how management will be reviewing financial information and making operating decisions beginning in the first quarter of 2025. Our data, AI and analytics capabilities are driving all our solutions and business lines. Accordingly, we will now report data and AI revenue alongside our new reporting segments beginning with the first quarter of 2025. This shift will provide a higher quality and more relevant representation of our business performance as we continue executing our data and AI growth strategy. The new reportable segments, aligned to our Industry Market Units, are as follows:

- Insurance

- Healthcare and Life Sciences

- Banking, Capital Markets and Diversified Industries

- International Growth Markets

The change in segment presentation will not have any effect on our consolidated statements of income, balance sheets or cash flows. The revised presentation will be reflected in our periodic and annual reports beginning in the first quarter of 2025.

2025 Guidance

Based on current visibility, and a U.S. dollar to Indian rupee exchange rate of 87.0, U.K. pound sterling to U.S. dollar exchange rate of 1.25, U.S. dollar to the Philippine peso exchange rate of 58.0 and all other currencies at current exchange rates, we are providing the following guidance for the full year 2025:

- Revenue of $2.025 billion to $2.060 billion, representing an increase of 10% to 12% on a reported basis, and 11% to 13% on a constant currency basis, from 2024; and

- Adjusted diluted earnings per share of $1.83 to $1.89, representing an increase of 11% to 14% from 2024.

Conference Call

ExlService Holdings, Inc. will host a conference call on Wednesday, February 26, 2025, at 10:00 A.M. ET to discuss the Company’s fourth quarter and year-end operating and financial results. The conference call will be available live via the internet by accessing the investor relations section of EXL’s website at ir.exlservice.com, where an accompanying investor-friendly spreadsheet of historical operating and financial data can also be accessed. Please access the website at least fifteen minutes prior to the call to register, download and install any necessary audio software.

To join the live call, please register here. For those who cannot access the live broadcast, a replay will be available on the EXL website ir.exlservice.com for a period of twelve months.

About ExlService Holdings, Inc.

EXL (NASDAQ: EXLS) is a global data and artificial intelligence ("AI") company that offers services and solutions to reinvent client business models, drive better outcomes and unlock growth with speed. EXL harnesses the power of data, AI, and deep industry knowledge to transform businesses, including the world’s leading corporations in industries including insurance, healthcare, banking and financial services, media and retail, among others. EXL was founded in 1999 with the core values of innovation, collaboration, excellence, integrity and respect. We are headquartered in New York and have more than 59,000 employees spanning six continents. For more information, visit www.exlservice.com.

Cautionary Statement Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to EXL's operations and business environment, all of which are difficult to predict and many of which are beyond EXL’s control. Forward-looking statements include information concerning EXL’s possible or assumed future results of operations, including descriptions of its business strategy. These statements may include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are based on assumptions that we have made in light of management's experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although EXL believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect EXL’s actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. These factors, which include our ability to maintain and grow client demand, risks related to the use of AI technology, impact on client demand by the selling cycle of our contracts, fluctuations in our earnings, our ability to hire and retain sufficiently trained employees, and our ability to accurately estimate and/or manage costs, are discussed in more detail in EXL’s filings with the Securities and Exchange Commission, including EXL’s Annual Report on Form 10-K. You should keep in mind that any forward-looking statement made herein, or elsewhere, speaks only as of the date on which it is made. New risks and uncertainties come up from time to time, and it is impossible to predict these events or how they may affect EXL. EXL has no obligation to update any forward-looking statements after the date hereof, except as required by applicable law.

For a full view of EXL’s financial tables, click here