Cyber insurance underwriters often struggle with outdated processes and platforms. This can raise multiple challenges, including:

- Complex, labour-intensive processes: Manual data extraction and validation while rating and quoting policies increases submission processing time, cost, and complexity due to inconsistent document types and sources.

- Incorrect pricing due to limited data availability:Underwriters often lack of access to external loss history data while analyzing cyber risk profiles, leading to inaccurate prices for cyber insurance premiums and coverage loss limits.

- Poor user experience: Excessive time spent on menial tasks and sorting through disorganized structures can make cyber underwriting a frustrating experience.

- Lack of a unified platform: Underwriting platforms for the cyber market often focus on solving individual problems. However, this means underwriters are unable to get a holistic view that encompasses an end-to-end workflow solution from quote to bind that efficiently manages submissions, documents, and data.

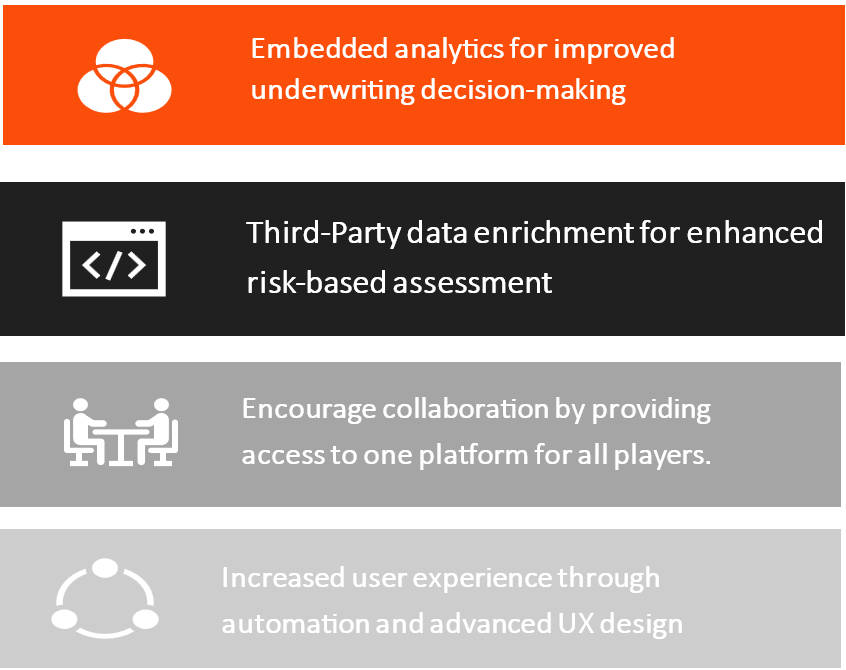

With an integrated, digitized platform that simplifies and accelerates the quote to bind process for underwriters by collating all data and processing needs into one intuitive platform, EXL’s cyber workbench transforms the underwriting process using embedded analytics. The end result is an underwriting platform that’s logical, organized, and intuitive.

How the cyber workbench helps underwriters

1) Improve quote-to-bind ratio.

- Accelerates underwriter turnaround times through end-to-end digitization of the entire process

- Superior underwriting analytics improve quote accuracy and decision making

2) Automate core cyber underwriting elements

- 24/7 real-time tracking and processing of new applications with notifications

- Minimizes data entry through automatic data extraction from various document types and file formats including pdf, Excel, broker forms, and emails.

3) Enhance user experience

- Creates an end-to-end journey from data intake to quote to improve user experience and increase retention

- Expands the underwriter’s ability to scale through quick integration of diverse data sources

4) Third-party data enrichment

- Seamlessly integrates with third-party data sources for more accurate cyber risk profiles and scores

- Enhances risk assessment and underwriting support services

Download this infographic to learn more.