Distribution, digital transformation, operations and portfolio solutions for asset managers, wealth managers and insurer-owned investment managers

EXL’s biggest impact for asset managers, wealth managers and investment managers comes from leveraging data and advanced analytics to improve their distribution and marketing effectiveness, building efficient investment operations with end-to-end automation, driving portfolio investment decisions through intelligent algorithms/signals and deploying a suite of marketing analytics solutions for digital transformation. EXL has worked with leading managers in multiple geographies to gain in-depth understanding of industry third party data sources and has developed frameworks and solutions that are easily transferable to any client platform.

What we do

Distribution Intelligence

EXL's state of art end-to-end products in distributions combine our deep expertise in internal & 3rd party datasets with predictive analytics capabilities, to help our asset management clients achieve better engagements and revenues

Objectives

Higher Revenues;

Enhanced Client Experience

Select Solutions

Predicting Investor Behavior

Personalized Digital Marketing

Fuel Growth from Targeted Leads

Client Master Data Management

CRM Intelligence and User Support

Client Life Time Value

Best Time and Reasons to Contact

Lead discovery for upcoming products like Alternatives, ESG & ETFs

Institutional client analytics

Investment Operations

EXL's experience in creating operational efficiencies at scale while lowering costs in investment operations has been touted as the best in class by asset management companies

Objectives

Lower Costs;

Improved Operational Efficiency

Select Solutions

Trade Execution and Surveillance

Pricing Threshold Recommendations

Reporting: Pricing, Regulatory, Client

NAV Calculation and Validation

KYC and Adverse Media Monitoring

Faster and Accurate Reconciliations

Master/Reference Data Management

Portfolio Management

EXL's data driven offerings help portfolio managers make informed decisions at speed and achieve higher investment alpha

Objectives

Investment Alpha;

Data-driven Investment Decisions

Select Solutions

Investment Research Support

Credit Risk Modeling

Alternative Data Usage for Valuation

Risk Analytics

Improved Trade Execution Algorithms

Performance Attribution Analysis

Digital engagement framework

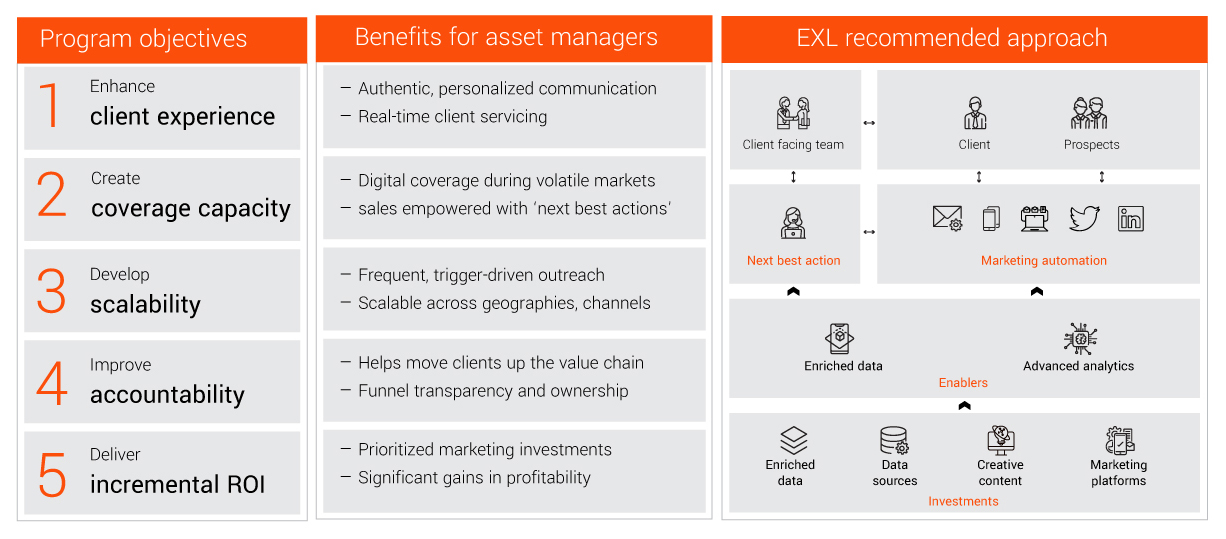

Building an effective digital engagement framework requires a deep understanding of the fundamental success elements that empowers the entire distribution organization across sales and marketing. This helps us delivers incremental returns on investments both in human capital and technology.

Why EXL Asset Management

Sophisticated and integrated analytics combined with deep domain knowledge.

In today’s financial services industry, increasing regulatory and compliance requirements, the mandate to improve ROI following the recent Covid-19 crisis, and the imperative to harness digital technologies to improve the customer experience are all intensifying the drive to transform. EXL partners with institutions to help them stay competitive, improve customer centricity, enhance compliance and risk management and accelerate growth and profitability.

Our professional team has deep experience in all key areas of financial services, including asset and wealth management, investment banking, non-banking financial services, retail banking and brokerage services. This context enables us to apply domain-specific analytics, data management, digital and business intelligence tools to all aspects of your business, from the front office through the middle office to the back office.

Together, we create real, measurable value by deploying advanced analytics, AI, robotics, data, human intelligence and other domain-specific technology solutions to help you stay ahead.