Industry challenges we address...

Increased complexity impacting speed due to unstructured data inputs from multiple sources

Certificates of Insurance (CoIs) are point-in-time documents

The process of managing Certificate of Insurance (CoI) is costly & inefficient

It is difficult to maintain a reasonable level of compliance between renewals

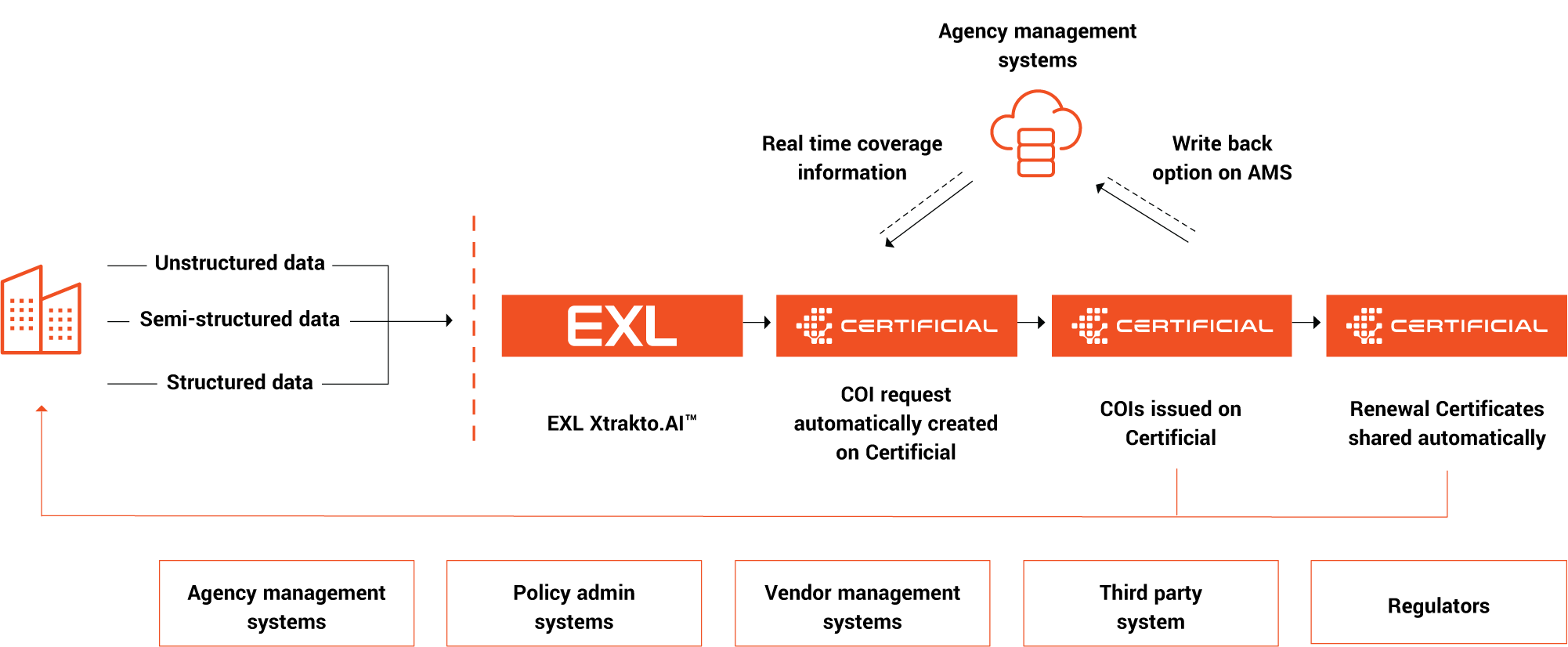

Our solution combines EXL XTRAKTO.AI™ and Certificial

Embedded with AI | ML based capabilities helps carriers/brokers

- Extract data from Unstructured/Semi Structured and Structured document

- Create digital request in Certificial through seamless integration

- Continuously enhance extraction accuracy reducing manual effort from employees

- Move to cloud Native platform with expert Human-in-loop

Real time coverage information

- Real time coverage information flow between Brokers/Carriers and Requestors through integration

- Instant coverage comparisons against Certificate holders requirements

- Continuous coverage monitoring for Certificate holders/Requestors

- Shift industry from Document to data driven coverage monitoring

Delivered results

50%+

Reduction in cost of operations

5-10%

Reduction in error rate

Increased

Self service & customer experience

Key benefits to requestors

Real time verification & monitoring

Reduce risk

Always be aware of your Suppliers’ current coverage by receiving notifications when a Supplier’s insurance coverage lapses is canceled or is reduced below your required limits.

Save time and money

Reduce overhead and operating expenses up to 90% by using templates to quickly request insurance coverage. Once a connection has been made with the Supplier and their Agent Certificial takes over

Reduce complexity

Manage all your Suppliers on a single data-driven system. No more spreadsheets. You can also quickly and easily hit a toggle button to switch to “Insured Mode” to share your coverage with your Clients.

Eliminate uninsured activity

By utilizing dynamic data Certificial has partnered with leading technology companies that allow you to take action when a Supplier is not compliant with your coverage requirements.

Key benefits to insurers

Here are just a few of the benefits:

Reduce risk

- Reduce operational costs

- Improve customer service

- Automate annual renewal process

- Reduce certificate requests

- Increase ROI from commissions

Save time and money

- Ability to support unlimited Certificate Holders

- Provide a client portal for sharing and monitoring insurance

- Improved insight into client’s B2B/B2C interactions

- Offer new value-added services