Transforming accounts receivable at speed

Finance functions hold the key to unlocking superior business growth and profitability, i.e. data. By becoming data-driven, finance can become a strategic and trusted partner to the business. It can provide meaningful real-time insights to help make decisions that deliver better business outcomes at speed. Yet, the transformation to data-driven finance is complex and challenging, requiring the right tools, technologies, and talent.

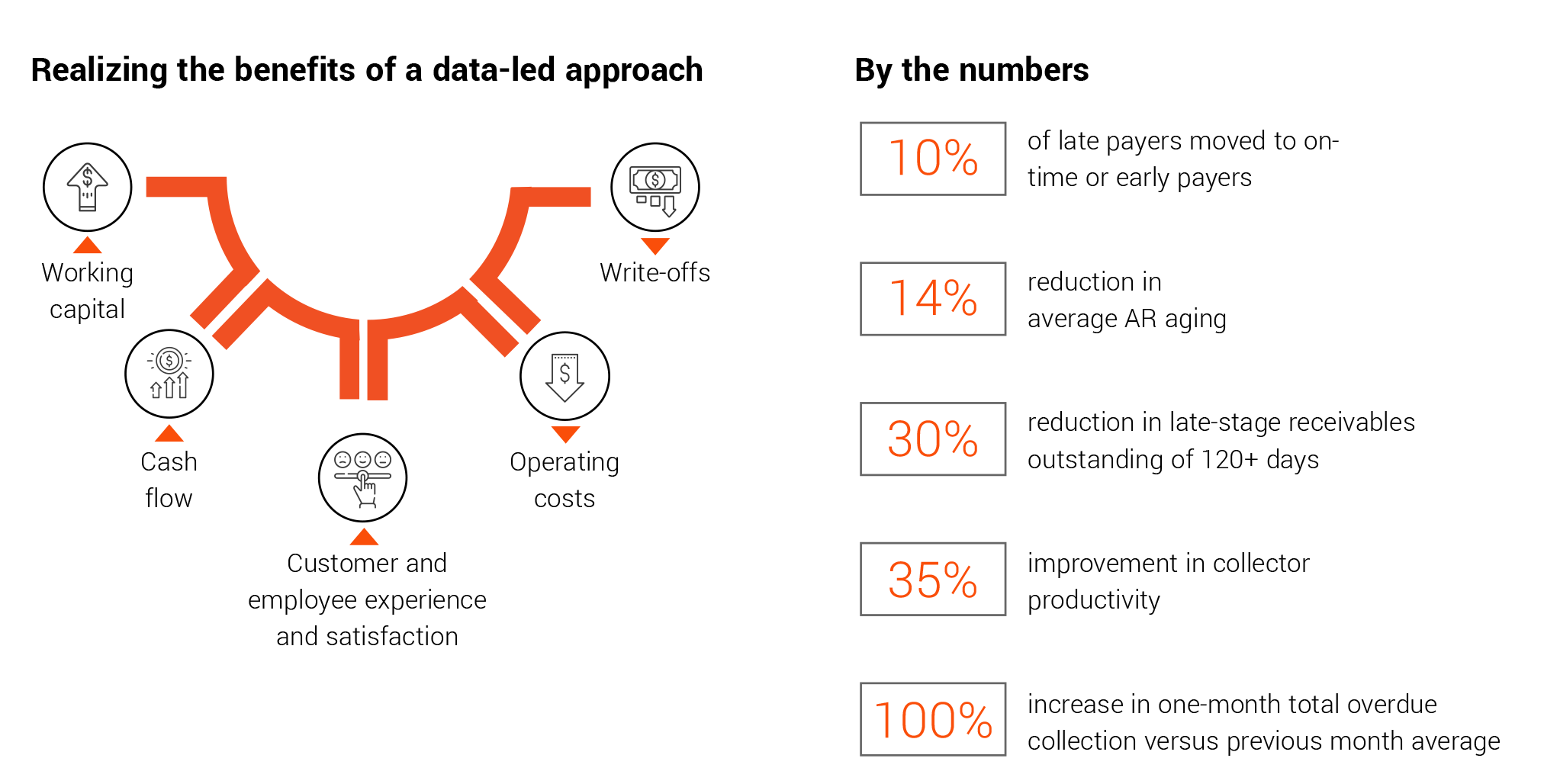

The right partner can help companies achieve a data-led mindset and design a future-ready organization. EXL helped one client implement a data-led approach to Accounts Receivables(AR). The goal was to improve cash flow and business metrics, reduce operating costs, and enhance customer and employee satisfaction.

Challenge

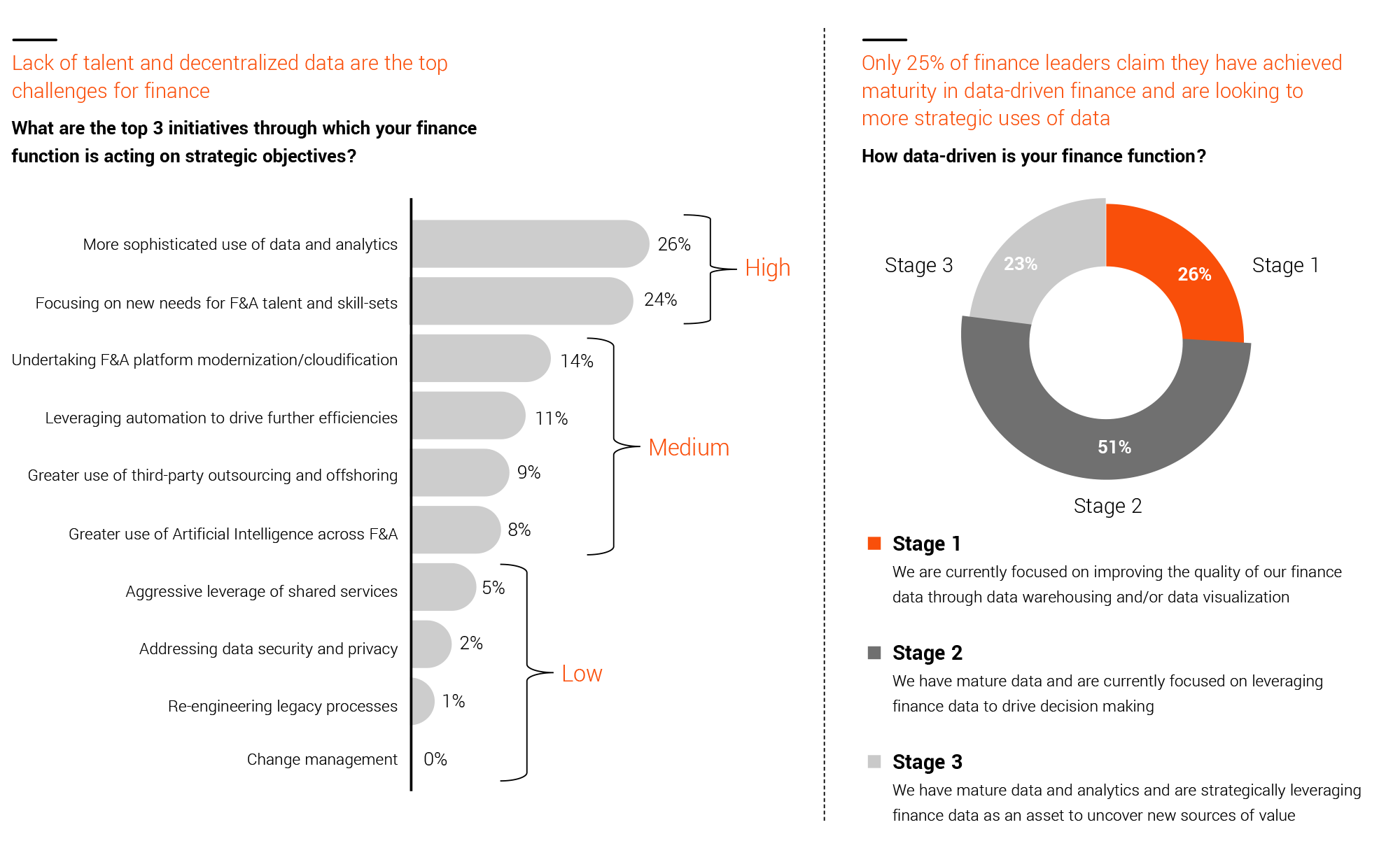

A rapidly expanding hi-tech manufacturing company wanted to consolidate its acquisitions and transform multiple ERPs into a single view. This was required to reduce operating costs and create a better experience for the company and its customers. It struggled with a great deal of data in different places, a stack of legacy systems, and operational inefficiencies. The client knew it needed new-age talent and culture change to become data-led.

These challenges aren’t unusual. EXL research has revealed that talent, data, culture, and legacy systems are common obstacles to being data-led. In fact, fewer than one in four organizations feel they have mature data-driven finance functions.

In 2022, HFS & EXL partnered on a joint data-led study, titled “Behind every successful enterprise, there is data-driven finance”. The report takes the pulse of more than 200 finance and accounting leaders globally across several different industries to identify their biggest priorities, most significant challenges, and organizational goals for the year ahead.

Solution

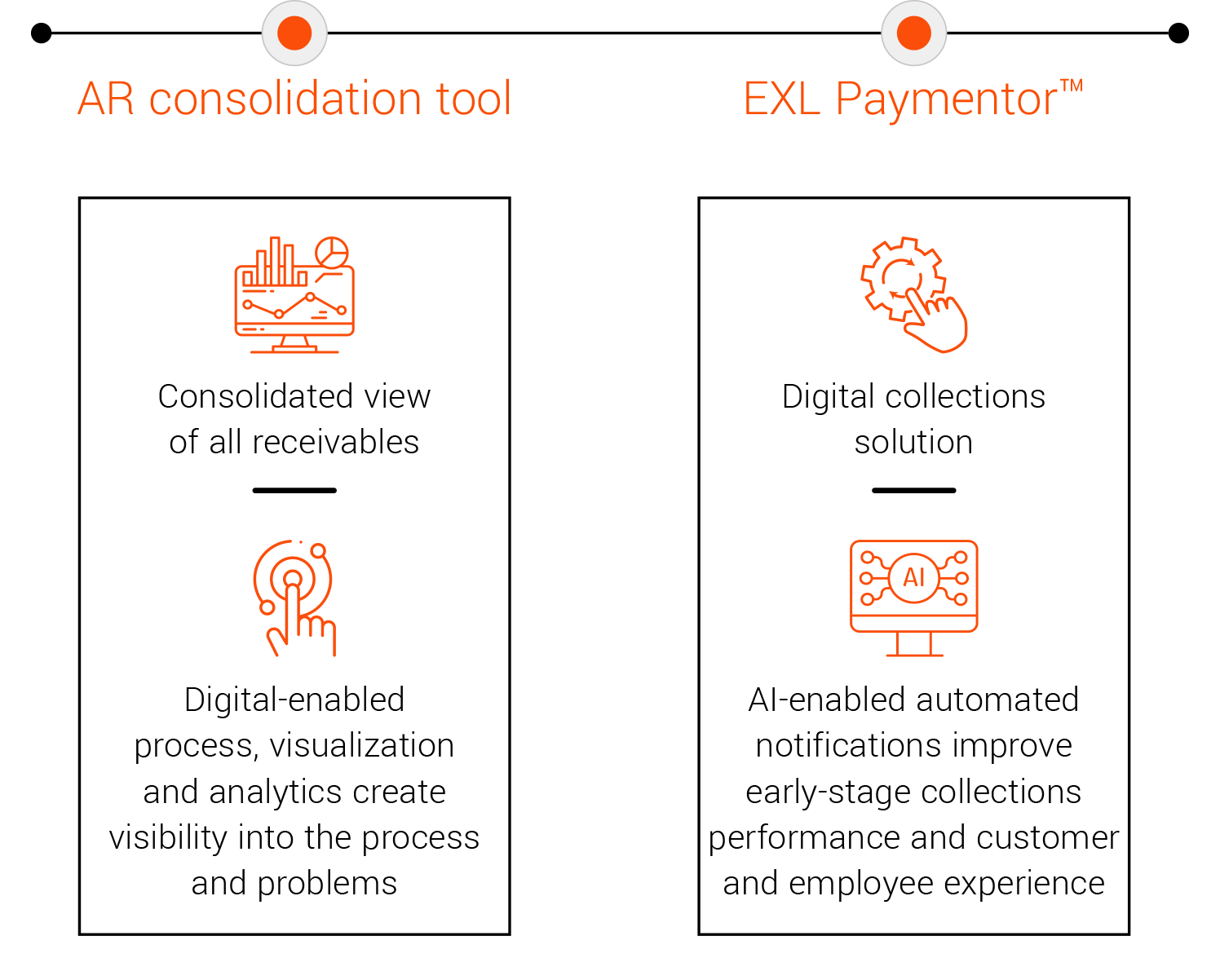

EXL worked with the company to transform its receivables process to solve growing AR aging, operating costs, and customer dissatisfaction. We first performed a thorough process diagnostic to understand the business nuances and problems in detail. Using that information, we designed and built a customized solution, the AR Consolidation tool. It brought all the receivables data from different ERPs and CRMs into a single-view Power BI dashboard to enable efficient and effective AR management. We then enhanced the solution by deploying an AI-based digital collections solution, EXL Paymentor™, to reduce the manual effort for earlystage collections. This visibility accelerated and considerably improved the AR process.

Accelerating AR

Results

In less than six months, this data-led transformation created visibility into the AR process that generated differentiating results. Customized visualization reports, dashboards, and smart solutions tremendously improved the client’s working capital situation. They also made cash flow far more predictable, boosted employee satisfaction, and significantly enhanced the customer experience. New operational efficiencies, including tapping into global talent pools for collections teams and introducing automation, reduced operating costs. By embracing a digital and data-led mindset, the company is designing a future-ready finance organization that generates exceptional and sustainable business outcomes at speed.