Alternative data sources for safe, efficient fluid-less underwriting

According to a recent report by McKinsey, the pandemic only accelerated “fluid-less” underwriting practices, as insurers that modernized core underwriting systems prior to COVID proved to be better positioned to adapt to the new realities experienced during the pandemic.

A prevalent topic of discussion among life insurance professionals in 2021 has been the idea of alternative underwriting, or alternative sources of data for life underwriting. Some suggest that COVID-19 has much to do with the acceleration of alternative sources of data, as traditional fluid-based underwriting protocols were severely impacted by the lack of face-to-face interactions during the pandemic. However, even prior to the COVID-19 pandemic, alternative data-powered underwriting had been gaining ground among life insurance carriers.

According to a recent report by McKinsey, the pandemic only accelerated “fluid-less” underwriting practices, as insurers that modernized core underwriting systems prior to COVID proved to be better positioned to adapt to the new realities experienced during the pandemic. In fact, the report went on to say that insurers who launched a streamlined underwriting program “saw a 14 percent median increase in sales volume.”1

This article will examine some of the pros and cons of adopting alternative data sources, as well as the challenges and benefits of transforming the status quo around modernized underwriting systems and practices.

Manual processes associated with unstructured data management and preparation can retard efforts to get the right data to underwriting teams, even if automated processes are in place.

Benefits and challenges of alternative data sources

Life insurance sales have risen over the past year. According to a December 2020 MIB Life Index, insurance applications last October spiked 7.6 percent, representing the largest year-over-year increase in nine years.2 While this trend is partially caused by short-term factors such as COVID-19, it also stems from long-term trends such as the increasing convenience and ease of applying for life insurance.

This increase in demand for life insurance products challenged traditional methods of gathering data under COVID-19 restrictions. As a result, a great number of life insurers had to shift away from in-person medical exams and instead utilize data sources, such as electronic health records (EHR) and other third-party databases, to close business.

These new sources of data have provided insurers greater insights into an applicant’s medical history, without the need for the applicant to undergo invasive tests, which can affect the applicant’s desire to stay the course and complete the process.

Traditionally, insurers have utilized information collected through customer applications and medical examinations to qualify applicants. Attending physician statements (APS) have been used as a primary source of information during the underwriting process. But now, we have entered a new paradigm whereby alternative data sources provide underwriters with a more holistic view of the applicant. From data retrieved through digital channels, such as biometric wearables, to electronic health records (EHR), life insurers are managing mortality risk with a more in-depth knowledge of the applicants.

As available data sources increase, however, variable data formats become a challenge, most notably the tremendous amount of unstructured data from sources such as images, emails and personal notes. APSs may contain thousands of pages of information that need to be reviewed to make an intelligent underwriting decision. Many times, collaboration among multiple business units within the firm is necessary to ensure successful operations. In any case, manual processes associated with unstructured data management and preparation can slow down efforts to get the right data to underwriting teams, even if automated processes are in place.

A next-generation, AI-based framework can bring significant efficiencies to historically manual processes, such as data extraction and document classification.

To address the issue of unstructured data, various solutions have emerged to quickly convert unstructured data into structured formats that can be fed into an engine for real-time outputs and decision-making. No longer will multiple teams have to sort through data. APSs can be summarized and presented to the underwriter in a graphical, easy-to-read format. Moreover, other digital data, such as information from EHRs, can be converted into a structured format using an automated tool that reduces underwriting time and increases operational efficiency, while leveraging more data for better pricing decisions.

A next-generation, AI-based framework can bring significant efficiencies to historically manual processes, such as data extraction and document classification. This framework would provide insurers with an intelligent data ingestion capability that understands the nature and content of documents, then extracts and transmits any relevant information to the right place. It would enable insurers to build a near-touchless data ingestion capability that unlocks efficiencies and reduces costs.

Strong analytics supported by workflow automations are essential ingredients to efficiently accelerating underwriting decisions without incurring added risk.

Taking action

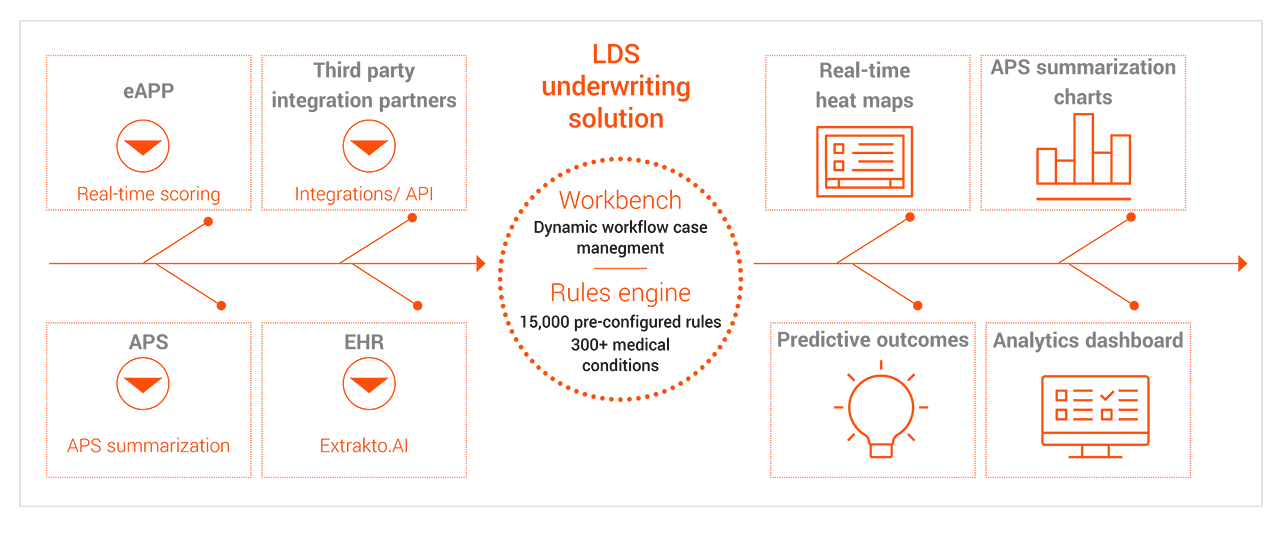

The first step in the underwriting process is to get the data necessary to make informed decisions. We have shown how various data sources can be structured in such a way that a tool or solution can utilize this data and take action on it. There are various tools and solutions on the market and many homegrown solutions that carriers utilize to process data. A comprehensive solution will allow you to utilize your own rules or leverage any number of pre-configured rules within the platform. By leveraging rules, you can save time in getting your products out to market and in the hands of your distribution partners.

Look for a workbench that provides robust workflow and case management in sync with your rules engine. The objective is to increase automation and straight-through processing, while easily handling exceptions that emerge in the process.

Some underwriting workbenches do more than just automate the process of capturing and analyzing data. A modern underwriting workbench will enable advanced business intelligence and analytics. Underwriters can efficiently analyze risk and determine pricing, collaborate with colleagues, communicate with agents and customers, comply with internal underwriting guidelines and track risk exposure in real-time with the right solution.

A comprehensive workbench will enable you to act on the data that is fed into the engine. Think of it as the user interface for underwriters following their unique internal processes. It should provide insight into the information required to make decisions on individual risks and allow automated decisions based on rules. In addition, it should support case tracking, pipeline management and overall portfolio performance.

Additionally, there are software-as-a-service (SaaS) solutions available that can be spun up quickly to enable you to take advantage of a myriad of underwriting capabilities. With little effort, you can find solutions and services that provide you with the means to act on your data for greater speed-to-market and more accurate decision-making.

Insightful output

The road to achieving insightful outputs from alternative data in the underwriting world comes down to putting in place a data-led business framework at the center of the decision process. A data-led business framework is based on two key concepts.

First, analytic insights, leveraging data to generate actionable information based on data that provides a 360° view, must be a core focus. And second, there must be an ability to apply intelligence to digital operations, so that they are seamless, touchless and drive better business outcomes. Together, strong analytics supported by workflow automations are essential ingredients to efficiently accelerating underwriting decisions without incurring added risk.

Moving towards the new normal of alternative data sources for underwriting

The ever-changing technological landscape has provided underwriters the ability to perform more accurate and informed risk assessments in less time. Data is being fed into rules engines and quality output is at the heart of a successful underwriting decision. Underwriters on the move towards a more fluid-less underwriting model need the right data to make the best decisions. Data from numerous sources can now be leveraged and acted upon for reporting, and with business analytics that Strong analytics supported by workflow automations are essential ingredients to efficiently accelerating underwriting decisions without incurring added risk. monitor the business in real-time, carriers can adjust and change as they see fit to control mortality risk in a more proactive manner.

Output that consists of easy-to-navigate charts and dashboards provides a level of sophistication and analysis unattainable until just a few years ago. Moreover, this analysis continues to improve predictive outcomes and real-time views into the underwriting portfolio.

As the industry accelerates the pace toward fluid-less underwriting, sales will continue to increase, quickly and efficiently, for carriers ready to seize the opportunity. No longer constrained by sources of data, today’s underwriters can leverage reliable data inputs, process it through powerful engines and quickly move on the outputs generated for unprecedented gains.

2 https://www.thinkadvisor.com/2020/12/31/what-2020-shows-us-about-selling-life-insurance-in-2021/

Written by:

Rick Barkal

Vice President, Insurance