BASEL IV

BCBS finalised the Basel III post crisis reforms (called as Basel IV) in Dec’17 (BCBS D424) after addressing a number of shortcomings with the pre-crisis regulatory framework. The changes as per the new guidelines include revision in Standardised Approach (SA) & Internal Rating Based (IRB) approach for credit risk, Credit Valuation Adjustment (CVA) risk, operational risk, leverage ratio framework and SA based more risk sensitive new capital floor (or output floor).

Revised framework helps to restore the credibility in RWA calculation by:

- Reducing the excessive variability of risk-weighted assets (RWAs)

- Enhancing the robustness and risk sensitivity of the SA for both credit & operational risk

- Restricting the use of IRB approaches

- Implementing the finalized leverage ratio

- Applying revised and robust capital floor

The committee introduced transitional arrangements to implement the new standards. This will be done per the jurisdictions and adjustment by the financial institutions.

This document aims to cover the details on:

- Key credit risk changes applicable to retail & real estate

- Open areas for interpretation in regulation

- Expected impact of Basel IV on financial institutions

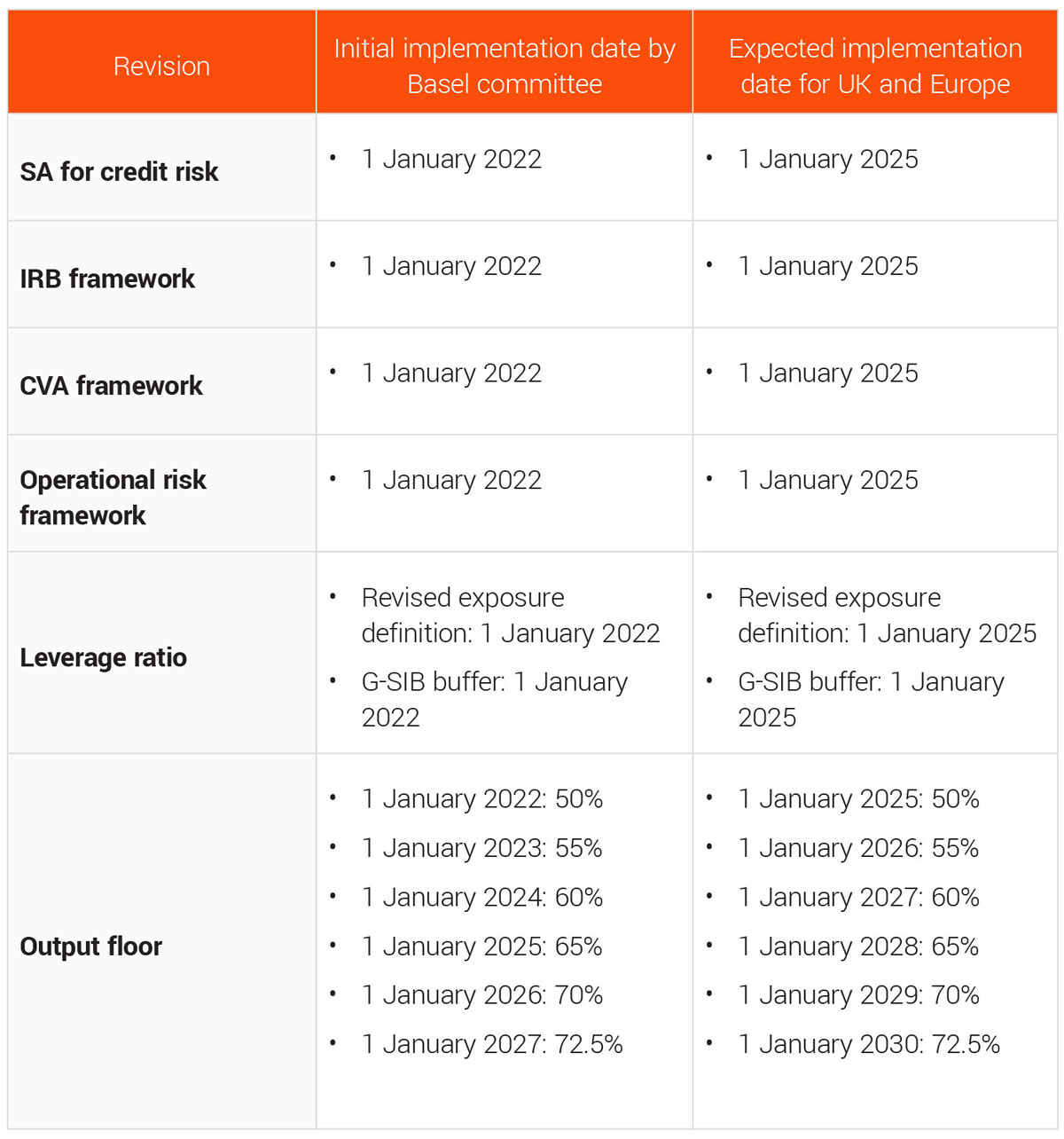

The initial and revised implementation dates are shown in the table below.

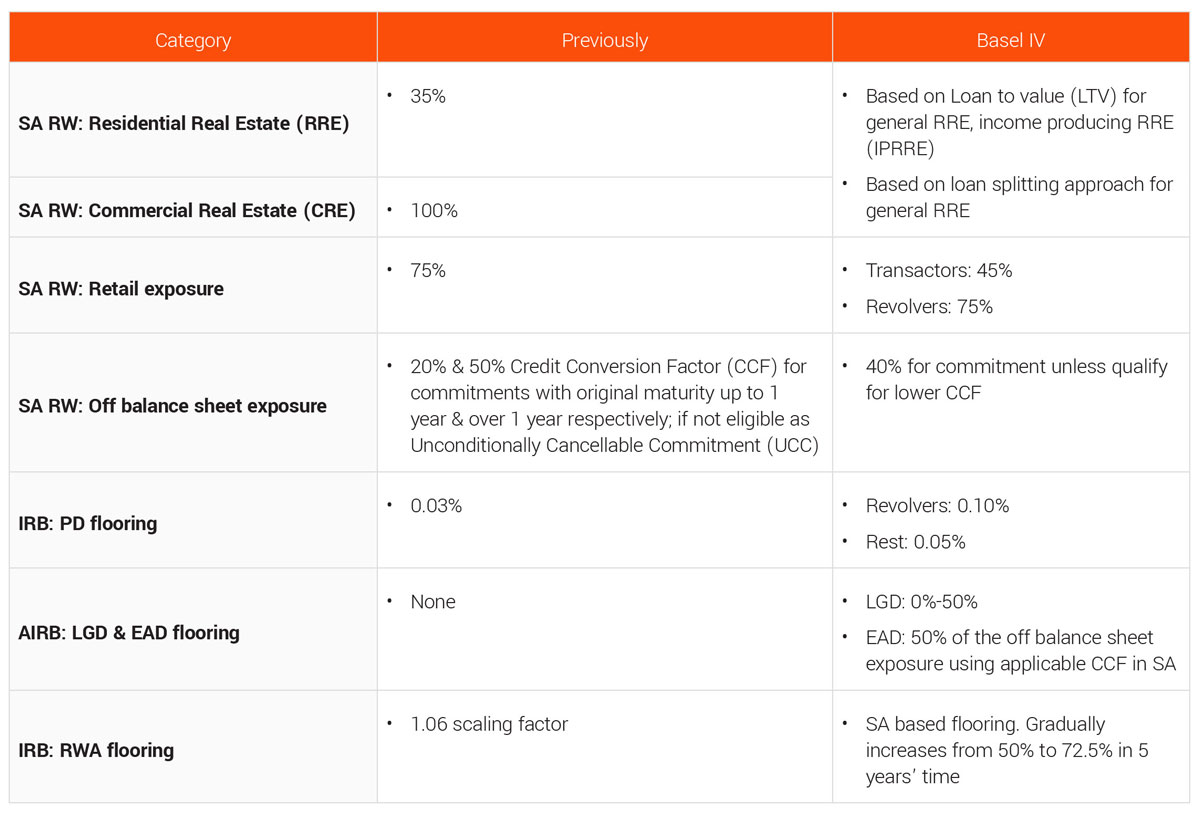

Changes overview

Changes for standardized approach

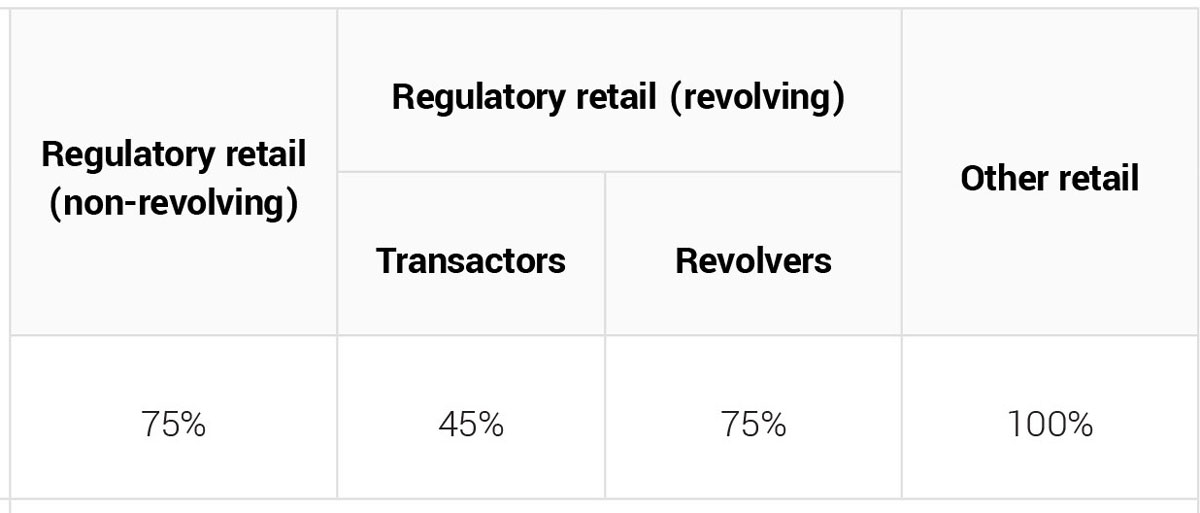

Retail exposure excluding real estate

- Transactors are obligors in relation to facilities such as credit cards and charge cards where the balance has been repaid in full at each scheduled repayment date for the previous 12 months.

- Obligors in relation to overdraft facilities would also be considered as Transactors if there has been no drawdown over the previous 12 months.

- Transactors/Revolvers for the overdraft: The part of the definition mentioned in BCBS D424, “….no drawdowns over the previous 12 months.” technically enables the following possibilities:

- Scenario-1: An account can be tagged as Transactors if it has drawn certain amount prior to 12 months and keep paying only interest, but has not drawn down any additional amount over the previous 12 months. OR,

- Scenario-2: An account can be tagged as Revolvers even if it uses the overdraft & pay back in full in a same day before applying any interest/charges (interest is applied on daily basis in general for overdraft facility, unlike the credit card where interest is applied on due date in a month).

- In Scenario-1, the account is relatively a risker one like a revolving credit card/charge card account as maintaining a positive balance for more than 12 months. Preferably this should be treated as Revolvers.

- In Scenario-2, ideally the account is less risky and should be treated as Transactors if the day end balance is ‘0”. As per the definition, technically, the account to be tagged as Transactors only if the borrower should not use the overdraft facility in the last 12 month at any point of time (no drawdown), which is not a very different from an inactive account. It can be more in line with credit card/charge card definition if day end balance is considered to define Transactors/ Revolvers indicator for overdraft facilities.

- National supervisors and financial institutions may need to determine the prudent criteria for the same.

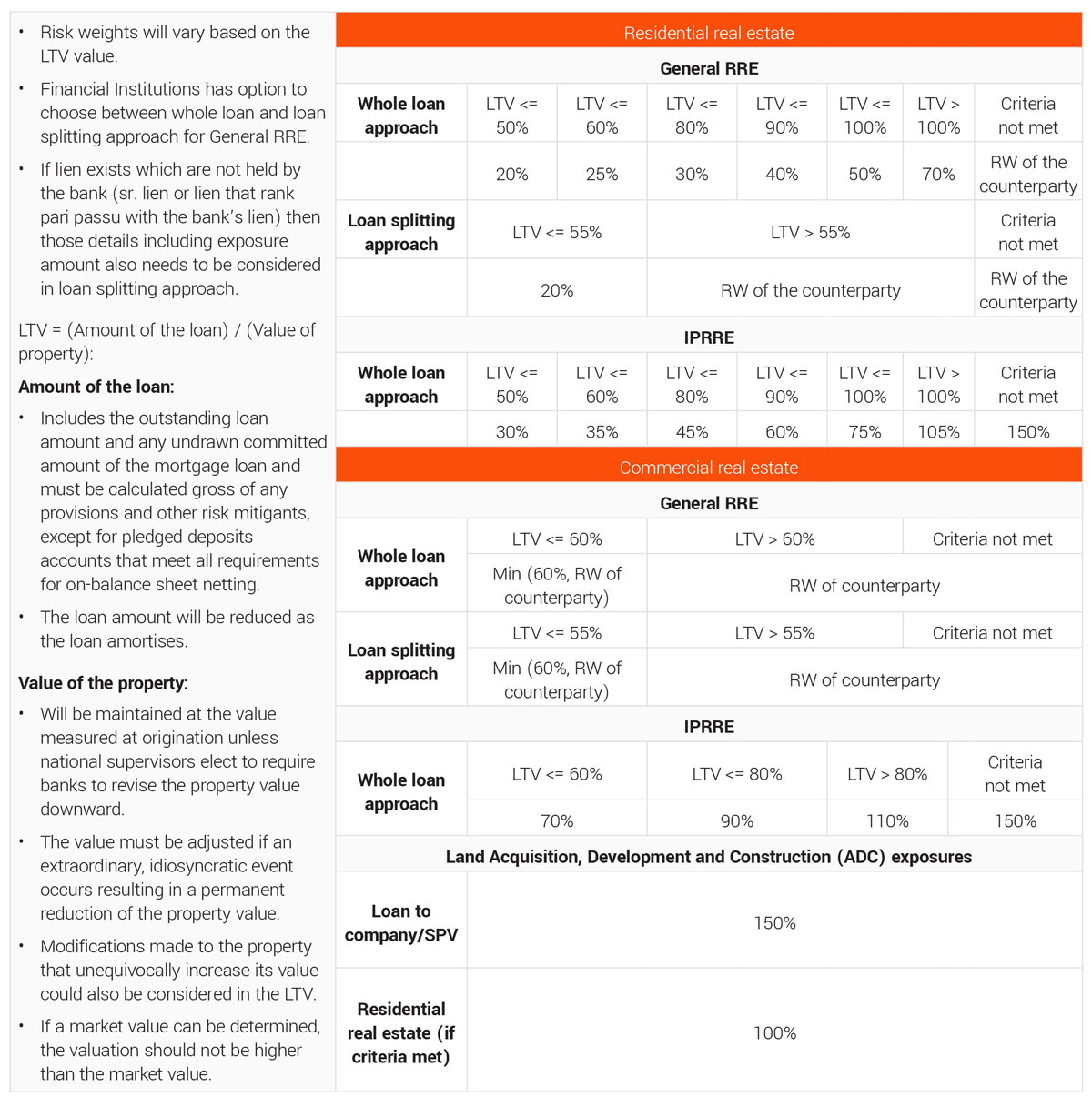

Real estate exposure

New set of criteria for property valuation has been introduced:

The Basel IV introduced a new guideline for property valuation and recommended National Supervisors to come up with the specific criteria.

The Basel IV standards specified that the property value should be maintained at the value measured during loan origination, but at the same time recommended to downgrade if an extraordinary, idiosyncratic event occurs which results in permanent reduction of the property value.

If the valuation has been adjusted to downward then the valuation can also be increased but should be capped at value at origination. Property value can be increased beyond the value at origination if any modifications made to the property that unequivocally increase its value. The valuation should not be higher than the market value, if a market value can be determined.

However, it has not been specifically mentioned the exact criteria to define when the value should be downgraded or upgraded beyond the value at origination or how to determine the market value to implement the Basel IV guidelines. National supervisors need to guide to set out the prudent valuation criteria.

Specific treatment is introduced for IPRRE loan:

Higher RW is introduced for IPRRE as these loans are tend to be materially riskier than General RRE loans as the repayment materially depend on the cash flows generated by the property securing the loan. BCBS has introduced a set of guidelines to identify IPRRE loans; however, on the exact parameters, decision lies with the National Supervisors. The guidelines include:

- Material dependence: Higher than 50% cash-flow generated from the residential property is considered as material dependence criteria in one of the example in BCBS D424. However, it is not specified as a general rule to apply. National Supervisors is to guide defining the material dependence criteria.

- Net vs gross cash-flow: It has not been mentioned whether cash-flow should be gross or net after deducting the expense on the said property including but not limited to vacancy rate, operating expense (maintenance cost, insurance, property tax etc.) etc. Ideally the borrower can use maximum the net income, not the gross income generated from the said property to serve the repayment. Use of the gross cash-flow will be conservative as higher cash-flow will increase the material dependence.

- Number of mortgage loan: An exposure secured by an IPRRE housing unit should not be treated with IPRRE RW if the individual has mortgaged less than a certain number of properties or housing units. However, the exact number is not specified. National Supervisor should specify the number.

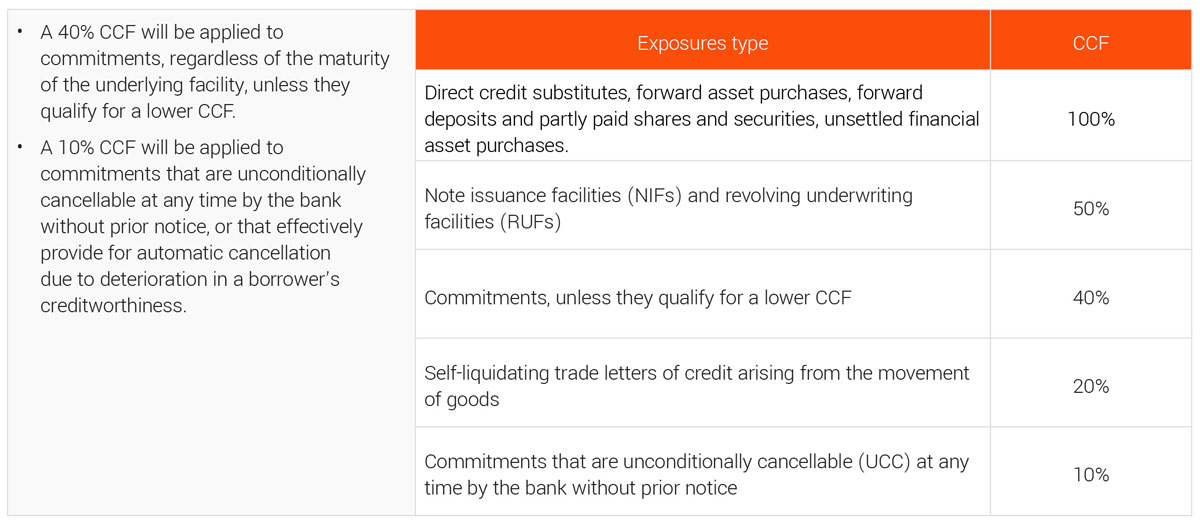

Off balance sheet exposure

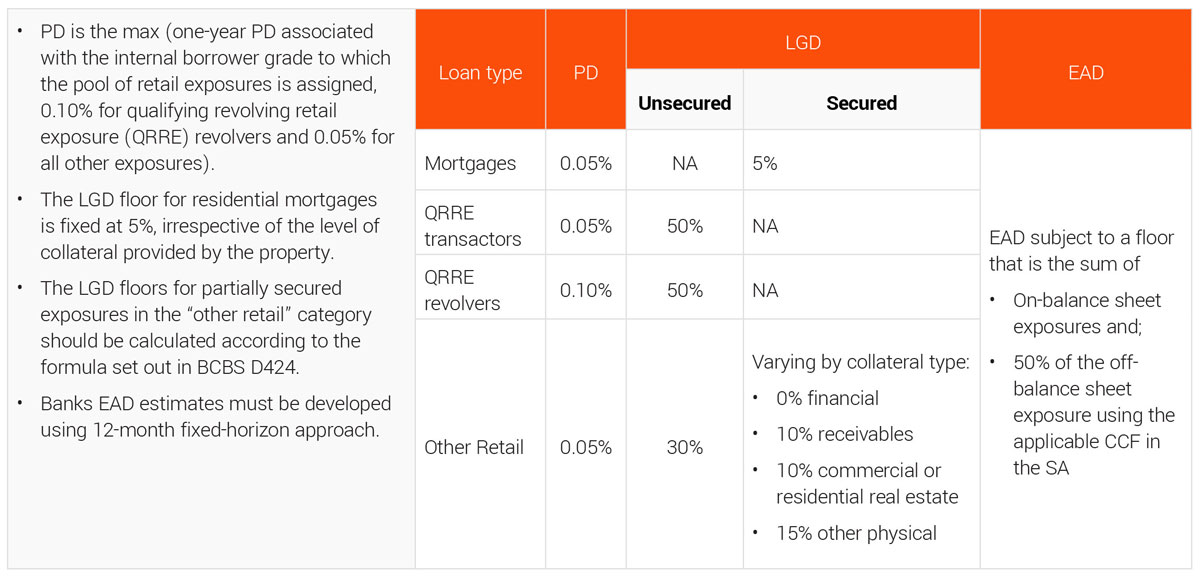

Changes for internal rating based approach

Overall impact assessment

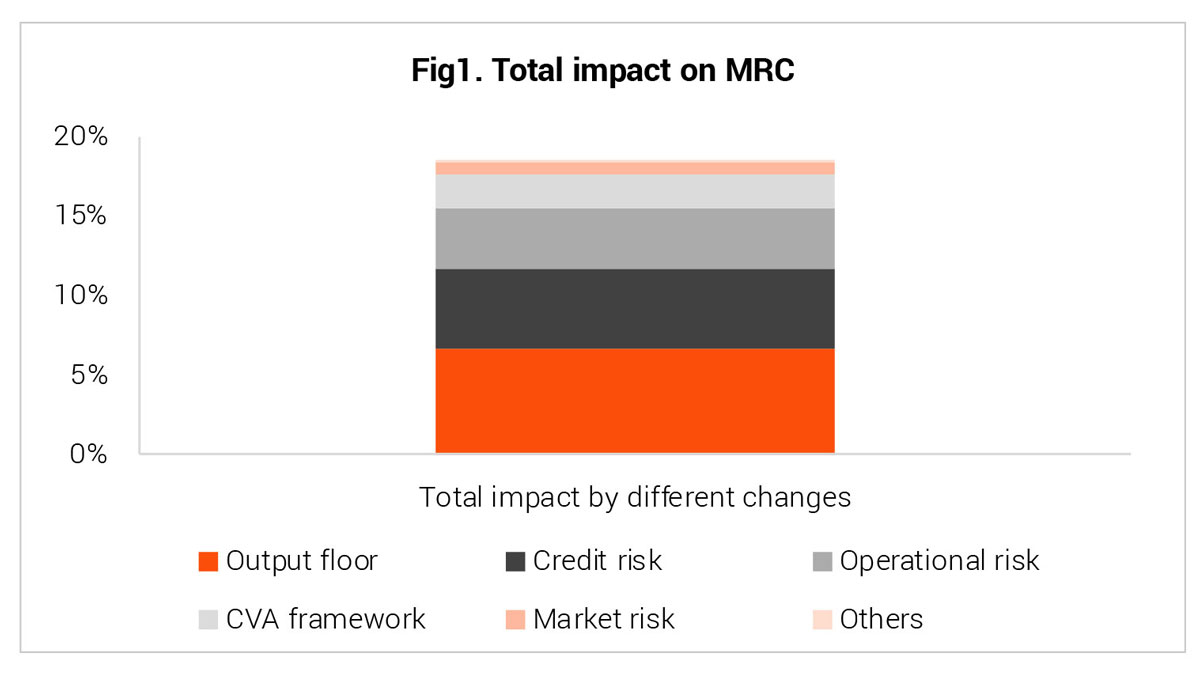

Overall impact across risk types and portfolios estimated to be 18.5%.

The impact assessmentA on minimum required capital (MRC) as shown in the Fig1 graph that the RWAs will increase by an average of +18.5% with an estimated total capital shortfall is about EUR 52.2 billion after the full implementation of the new rules. The main drivers of the impact remain the output floor (+6.7%), followed by credit risk (+5.0%) and operational risk (+3.8%), CVA framework (+2.1%) and market risk (+0.8%).

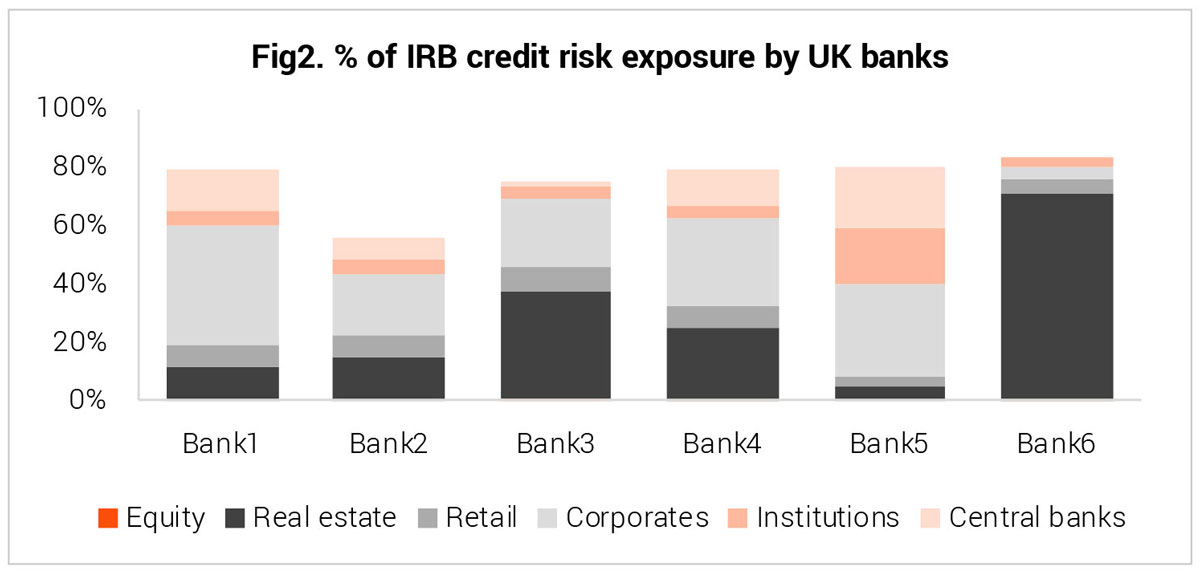

Product mix, riskiness and IRB/SA mix will determine the impact on financial institutions and countries.

- Fig2B demonstrates a comparison between major 6 banks of the UK. Bank 1 & 3 are anticipated to have similar impact given the product mix and IRB credit risk exposure percentage. However, the impact on Bank 2 expected to be different.

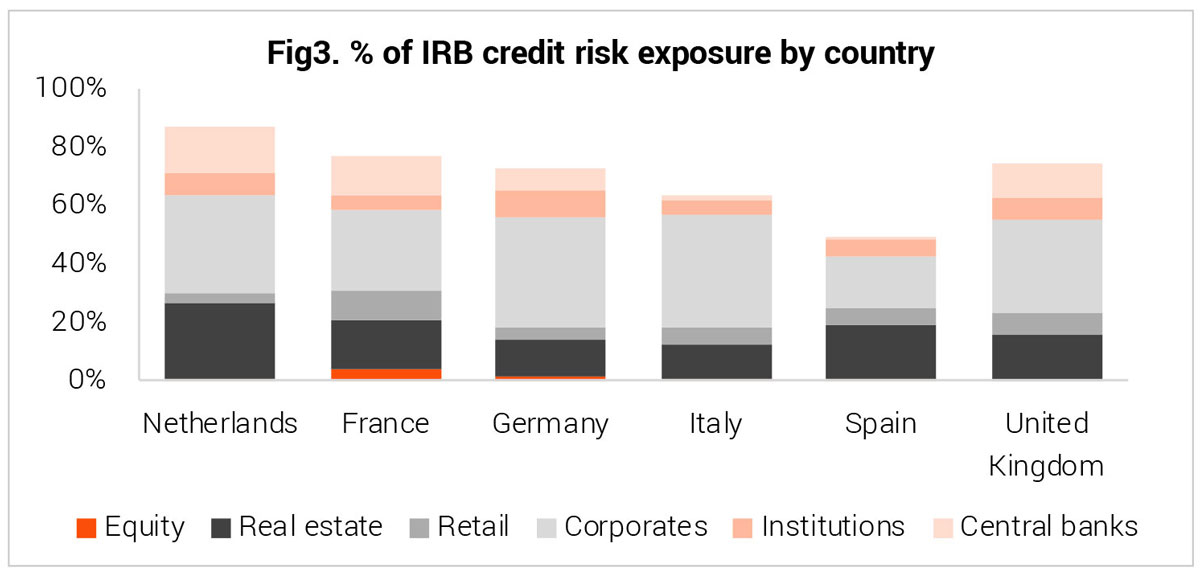

- The argument of Fig2B can be further extended in a country comparison in Fig3B where it can be anticipated that the Netherlands with ~87% IRB credit risk exposure expected to have a different impact from the UK with ~75% IRB credit risk exposure

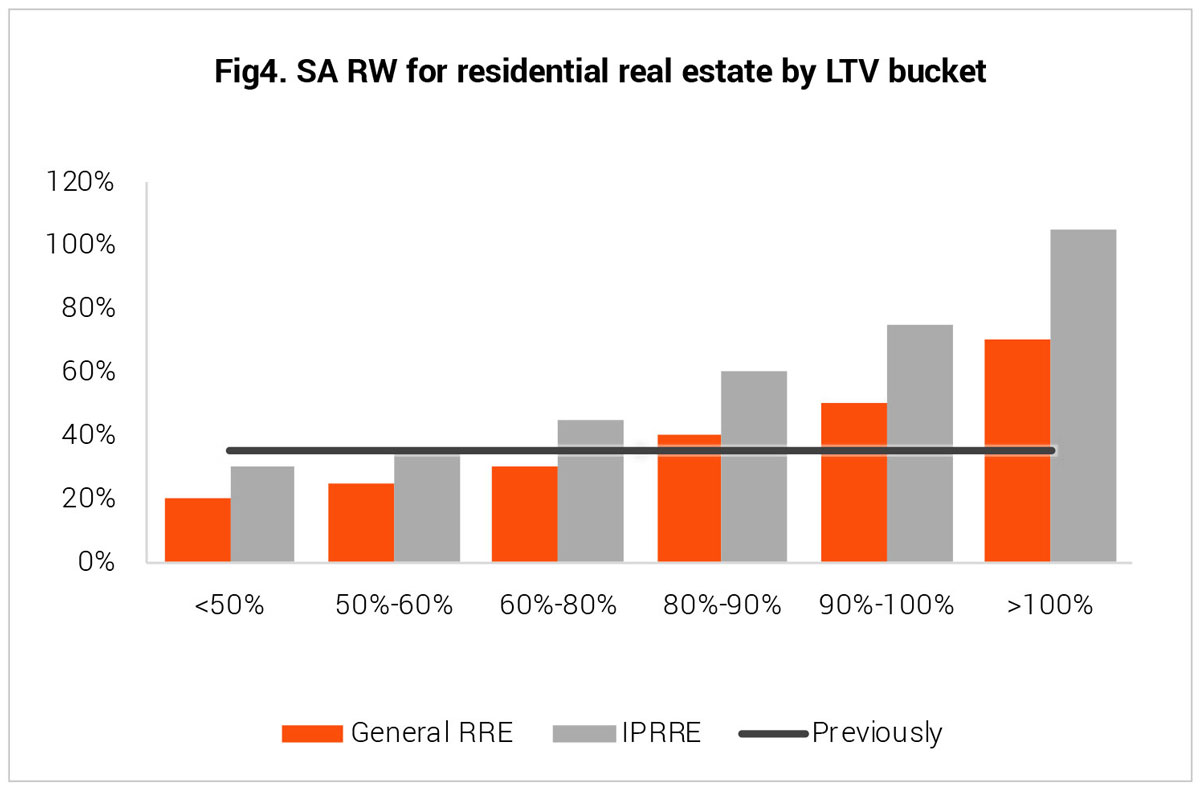

Revised RW for real estate loan will have a significant impact on capital requirements. Further, the effect will be contrasting for conservative vs. aggressive mortgage lenders.

- Portfolio with low LTV may observe a reduction in capital requirement whereas portfolio with high LTV may lead to increase in capital requirement.

- Fig4 shows that the revised RW is higher for general RRE when LTV >80%; whereas it is higher for IPRRE when LTV> 60% compared to previous RW. Additionally, IPRRE loan will observe much higher impact than the general RRE because of the prescribed higher RW.

Additional operational requirements may further increase RW for mortgages.

The banks need to cater to additional compliance areas including,

- Finished property

- Legal enforceability

- Claims over the property

- Ability of the borrower to repay

- Prudent value of the property

- Required documentation

It might be difficult for financial institutions to meet these for existing borrowers. If criteria are not met then further higher RW to be applied.

Basel IV gives a level playing field to small and medium banks vis-à-vis large banks.

- Small financial institutions primarily operate on SA, and with the introduction of output floors the gap between SA and IRB is reduced and accordingly in the capital requirement.

- On the other hand, large financial institutions which operate primarily on IRB approach, may face an increase in capital requirement.

- Small financial institutions might also see this as a new business opportunity and to compete with the large banks in terms of product offering as the new Basel IV rules reduces the gap between SA and IRB.

Conclusion:

- Overall, Basel IV credit risk will be a challenge for every financial institution with an expected uplift of the capital requirements. However, the severity of changes will vary bank to bank due to the various level of changes applicable on different portfolio and business model.

- Implementation of new capital flooring and other changes are going to be an additional workload specially for financial institutions mostly use IRB approach.

- Due to this capital flooring banks also may end up with higher capital for many products.

- Financial institution needs to revisit their business and operation strategies accordingly to mitigate the impact. It may have a long term impact on the product pricing and hence expected to observe a restructuring in product offering in future.

Note:

A. Held by European Banking Authority (EBA) in December 2020 based on a sample of 99 banks.

B. Data used from 2019 European Union (EU) wide transparency exercise by considering 5 major financial institutions from each of the given countries. In Fig2 above, Bank1 to Bank6 are kept in decreasing order based on total assets.

Contacts

Soumya Hait

Basel Regulatory SME

soumya.hait@exlservice.com

Raman Thakral

Associate Director, UK & EU Banking

raman.thakral@exlservice.com

Kunal Chawla

Director, Decision Analytics

kunal.chawla@exlservice.com

Alok Rustagi

Director, Decision Analytics

alok.rustagi@exlservice.com

Sources:

1. BCBS D424

Basel III: Finalising post-crisis reforms (bis.org)

3. EBA Basel III full implementation impact study

EBA updates its Basel III impact study following the EU Commission’s call for advice | European Banking Authority (europa.eu)

4. EU transparency exercise 2019

EU-wide transparency exercise archive | European Banking Authority (europa.eu)

5. EBA policy advice on Basel III reform

Policy Advice on Basel III reforms - Credit Risk.pdf (europa.eu)

6. Bank of England: Implementation of Basel standards date

Implementation of Basel standards | Bank of England

7. European Commission: Implementation of Basel standards date

Q&A: Banking Package 2021 (europa.eu)

Abbreviations:

- BCBS - Basel Committee on Banking Supervision

- EBA - European Banking Authority

- EU - European Union

- RWA - Risk Weighted Asset

- IRB - Internal Rating Based

- SA - Standardised Approach

- CVA - Credit Valuation Adjustment

- MRC - Minimum Required Capital

- UCC - Unconditionally Cancellable Commitments

- CCF - Credit Conversion Factor

- LTV - Loan To Value

- RRE - Residential Real Estate

- CRE - Commercial Real Estate

- IPRRE - Income Producing Residential Real Estate

- QRRE - Qualifying Revolving Retail Exposure

- ADC - Land Acquisition, Development and Construction