Buy now, pay later (BNPL) regulations: Curtailing growth or leveling the playing field?

BNPL has grown rapidly as a lending product for consumers over the last few years. The idea of paying for purchases over time through a few interest-free payments is highly appealing to customers. BNPL firms have rapidly grown revenues as product adoption has increased. Most of this growth is led by fintechs while banks have been trying to play catch-up. Arguably, banks have lagged behind because fintech firms have been able to use their tech advantage to appeal to a wide consumer base and have reduced friction in the customer lending journey. However, industry experts also admit that a lot of this performance disparity may be due to regulatory arbitrage. Large banks face higher scrutiny when compared to fintechs and non-banking lenders on policies, processes, and analytical strategies.

Recent actions from the Consumer Financial Protection Bureau (CFPB) and Congress indicate that the limited regulatory oversight environment which may have helped – if not fueled –the initial boom in BNPL industry, may soon end. The CFPB recently announced plans to start regulating BNPL products1. The CFPB has already asked for data and information on business practices from major BNPL companies including Affirm, Afterpay, Klarna, Paypal, and Zip2. Expectations of interventions and regulations from the CFPB have been welcomed by industry leaders to better protect customers. A regulated BNPL industry creates the possibility of leveling the playing field between banks and fintechs.

Experience from international markets

Early adopter and mature BNPL markets, such as the UK and Australia, have started to rollout rules to regulate these loans in various shapes and form. These largely focus on clarity in consumer communications, as well as applicable penalties in case of missed payments. This includes:

- Financial Conduct Authority (FCA), a UK regulator has proposed rules to:

- Ensure lenders provide clear communication that BNPL products are loans and have the potential to affect a customer’s credit file

- Require that lenders must tell the customer that loans are subject, or may be subject, to interest and fees in a missed payment scenario

- Take sufficient action to alert customers of an upcoming payment that is due and that a late payment may/will incur a penalty

- Restrict retroactive interest charges due to missed payments on balances already paid off

- Australian Finance Industry Association (AFIA) and its members have introduced BNPL self-regulatory practice codes to:

- Restrict marketing to minors, young adults, and the financially vulnerable. Lenders must make a demonstrable effort to follow ethical marketing practices that prevent the targeting of customers that are likely to fall into a debt trap.

- Ensure providers adopt sufficient anti-money laundering policies

- Restrict further BNPL loans to customers already delinquent and offer hardship assistance

- Restrict retroactive interest charges due to missed payments on balances already paid off

- Regulate and clarify terms of loans and penalties to customers, provide clear directions to customers to prepay a loan or restructure a loan, if intended

- Mandate issuers to require customers make a payment upfront for the loan, assess the ability to pay through credit checks or customer provided income documents

- Ensure collection policies follow and state regulations

BNPL regulations: What to expect? Drawing parallels from historical regulations.

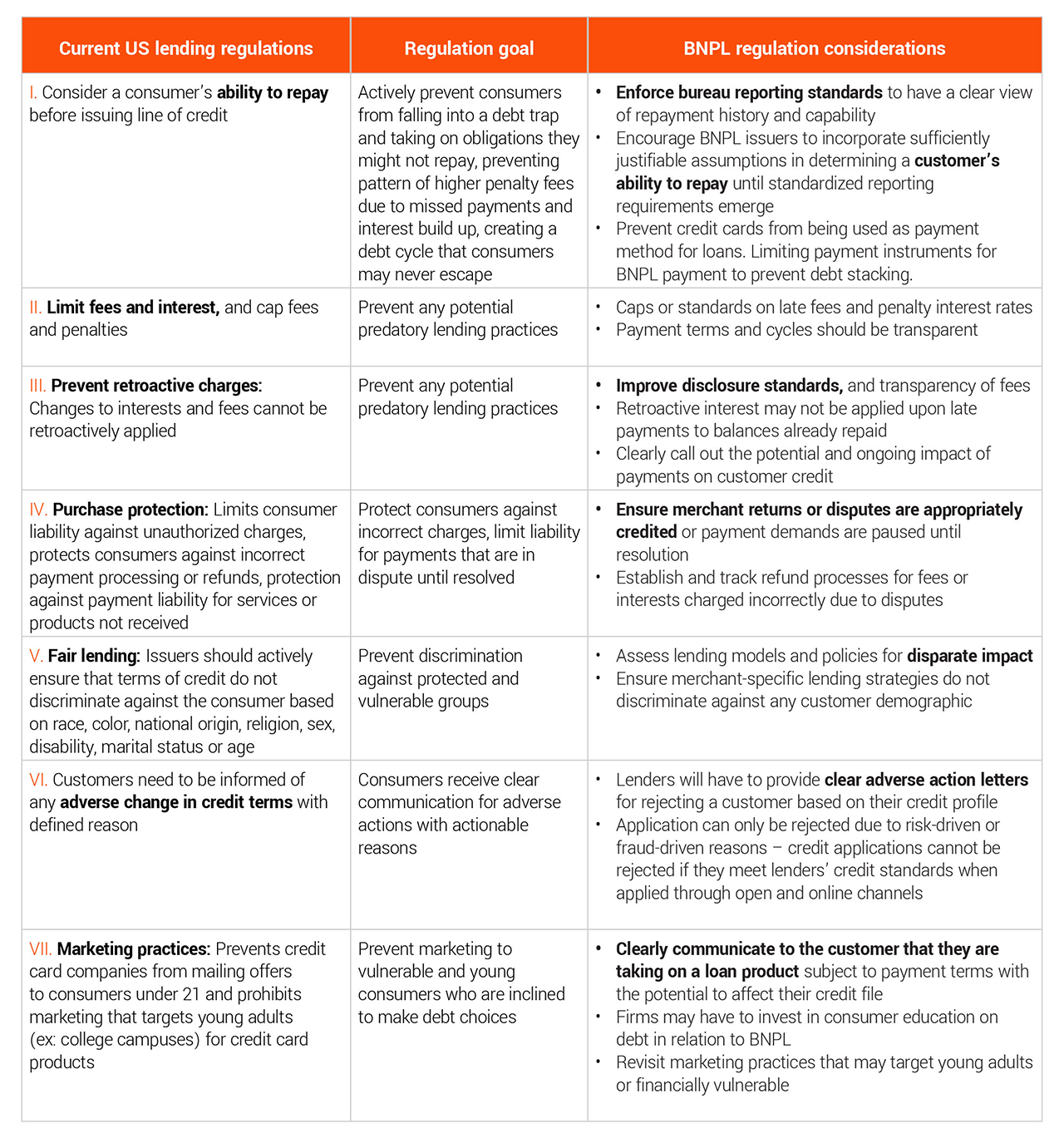

Looking at the rules and codes recently formulated and historical US regulations affecting traditional lending instruments and banks, (such as the CARDS Act, Fair Credit Reporting Act (FCRA), Equal Credit Opportunity Act (ECOA), Fair Credit Billing Act, Truth in Lending Act (TILA) Regulation Z, and Unfair Deceptive Acts and Practices (UDAP)),can help gauge the future regulatory considerations that will govern the BNPL industry in the next three to five years.

BNPL regulations: Our viewpoint and what we expect to emerge:

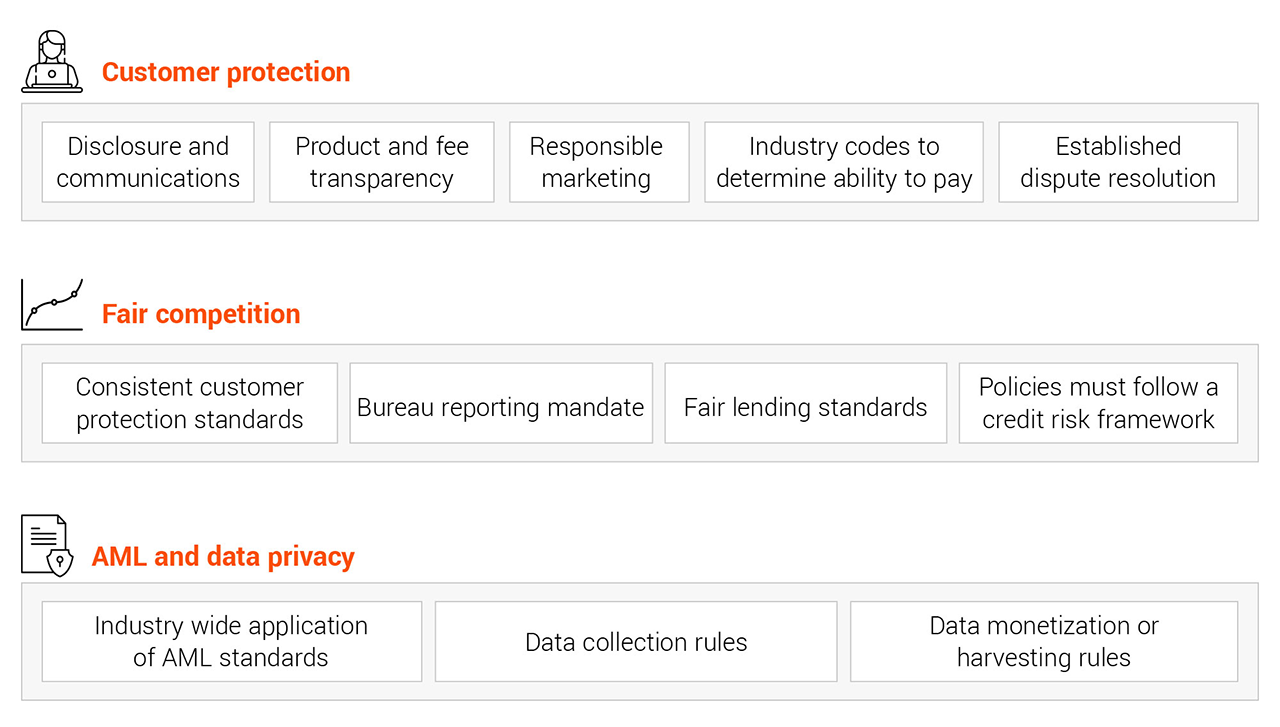

At EXL, we believe regulating BNPL products is necessary to ensure consumer protection, limit regulatory arbitrage to create fair competition between lenders, and ensure the long-term health of the lending industry. BNPL is clearly a popular product for credit access among consumers and represents shifting choices in the way they use credit. Well-crafted and well-intentioned regulations will help scale the product and fuel further innovation. Based on our industry experience, we expect regulations across three pillars:

a. Customer protection

BNPL issuers have started to self-regulate and adopt industry standards from traditional lending products for customer protection. However, codifying these rules into law will help ensure faster and uniform adoption across players. Surveys on pay-in-four and pay-in-six products have highlighted some concerns on the way customers perceive BNPL. A high proportion of customers don’t consider BNPL a loan or that it has the potential to affect their credit file. Based on a recent survey by Business Wire3, 40% customers have missed at least one BNPL payment. This could be due to a combination of product perception and customer liquidity, highlighting the importance of ensuring ability-to-pay standards.

BNPL products may seem easier to pay at the point-of-sale due to the perceived small payment amount, however BNPL loans by design are less flexible than credit cards. Multiple BNPL loans with other debt obligations may leave customers with lower liquidity than what they expected or are used to. Thus, the ability to pay calculation may require industry codes, policies, and standardization to ensure enough coverage.

b. Fair competition

Regulatory scrutiny is tighter for larger banks vs. other players. This not only limits competition but also affects the overall industry innovation and scale that big and regional banks can bring. Banks have been careful, almost to the point of lagging behind, by choice to observe how the regulatory environment will unfold in relation to BNPL. Regulations must look to address the regulatory arbitrage that currently exists around these products.

Bureau reporting of these loans is expected to be a requirement. While some providers currently report to bureaus, many do not. Enforcing bureau reporting of past BNPL loans and payment histories will help existing players better gauge application risk, more significantly it will help banks on the sidelines to enter with a better view of credit risk for these products. The first mover advantage for fintechs from a data perspective may likely become limited.

Regulators will also try to ensure that they have a way to de-stress the system that will increasingly be affected by BNPL loans. We expect to see specific stress testing and capital adequacy exercises for these loans to mitigate contingency risks focused on both fintechs and banks. Requirements for capital adequacy will play a significant role in leveling the playing field between players.

Banks have a significant advantage in terms of infrastructure and the capability to execute consumer protection and fair lending requirements. On the other hand, non-banking players will have to re-direct their investment spotlight towards these areas to catch-up. Collectively, introducing uniform laws for both banks and non-banks will create a fair marketplace for competition and innovation. Regulations should also provide a clear roadmap especially for big banks on how they should approach and scale their BNPL offerings.

c. Anti-money laundering and data privacy

BNPL apps are well-integrated with customers’ phone devices and shopping platforms. Regulations on how this data is stored and used for marketing and customer targeting are expected. Data collection disclosures and app tracking notifications may become mandatory.

Lastly, we also expect to see a significant focus on AML requirements from a regulations standpoint. The promise of approving small loans with limited credit checks through real-time decisions may result in issues around customer due diligence. Traditional banks would also have to level-up their identification verification and analytics capabilities vs. larger banks who have developed sophisticated AML capabilities over the years.

To learn more about EXL’s point-of-sale financing solutions and banking analytics expertise, click here.

2 https://www.finextra.com/newsarticle/40966/cfpb-ready-to-regulate-bnpl

Written by:

Vikas Sharma

Senior Vice President, Analytics, EXL

Ankit Maheshwari

Engagement Manager, Analytics, EXL