Digital transformation: Health plans poised to reduce operational costs by 50% over the next 5 years

Analysis from EXL experts shows that investing in a data led strategy and embracing the widespread deployment of digital technology including GenAI will result in major reductions in waste via dramatically lowering administration costs, significantly reducing benefit expenses, and improving member satisfaction.

Learn how 8 change management strategies can make digital transformation happen

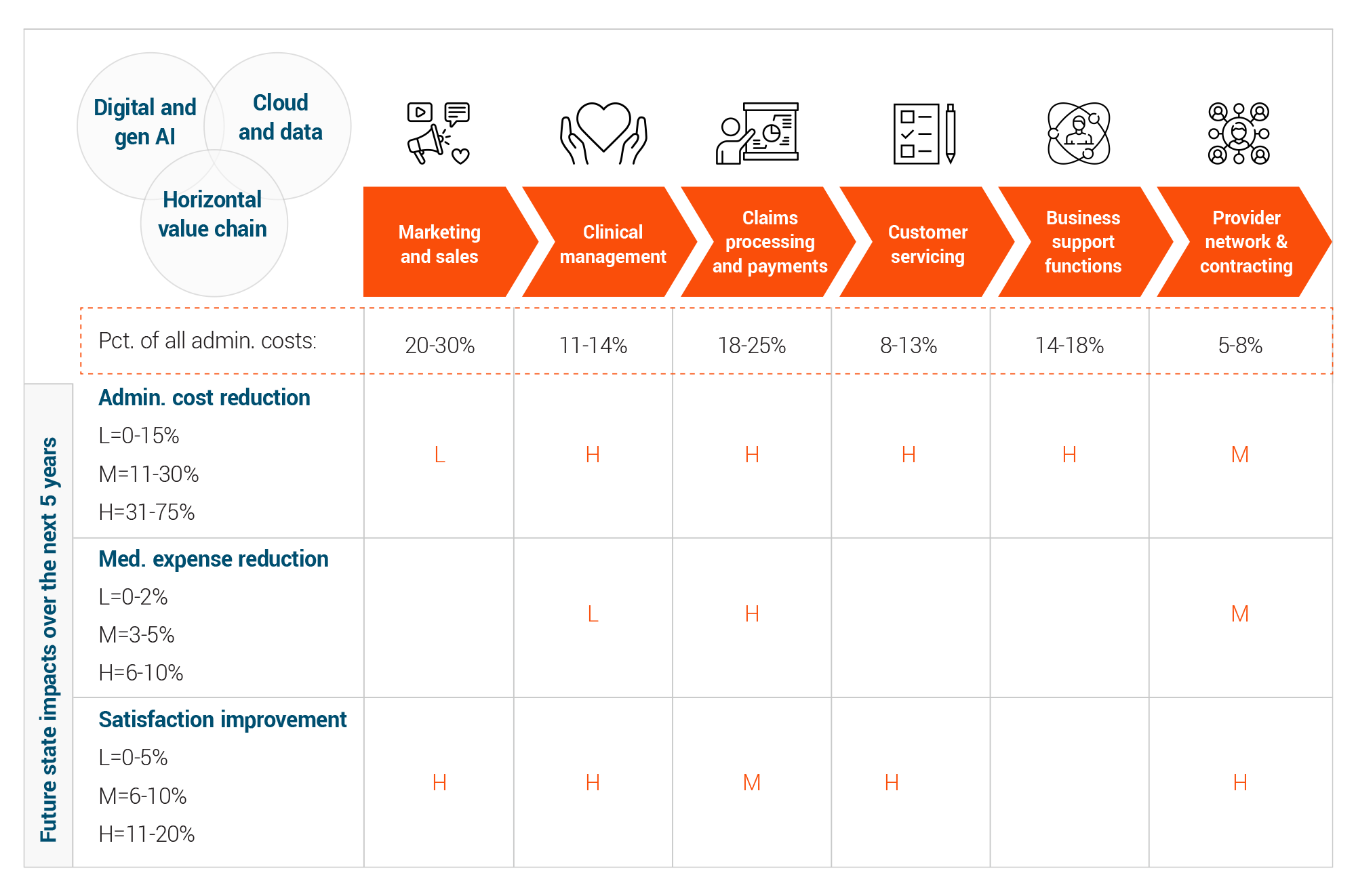

Health insurance companies manage a variety of operational activities including marketing/sales, clinical management, claims processing, customer service, business support and provider network and contracting. Innovative digital technologies implemented with a sophisticated data strategy are about to cause considerable disruption to how healthcare payers manage all these vital core operations.

Generative Artificial Intelligence (genAI) refers to AI techniques that learn a representation of artifacts from data, and use it to generate brand-new, unique artifacts that resemble but don’t repeat the original data.

GenAI can produce totally novel content (including text, images, video, audio, structures), computer code, synthetic data, workflows, and models of physical objects. GenAI also can be used in art, drug discovery or material design.

Analysis from EXL experts shows that investing in a data led strategy and embracing the widespread deployment of digital technology including GenAI will result in major reductions in waste via dramatically lowering administration costs, significantly reducing benefit expenses, and improving member satisfaction. Indeed, by fully embracing a digital strategy and optimally leveraging technology, health plans could reduce their overall administrative expenses by about 40% to 50% over the next five years, according to EXL analysis. This will create a new level of benchmark performance by which plans will be measured and translate into meaningful reductions in premium expenses.

Health plans are sitting on the precipice of opportunity. To start, legislation and the move to value based care is paving the way for transformation.

Overcoming long-standing challenges

Technology and digital data have been hovering around the healthcare industry for quite some time. Despite their availability, however, health plans have struggled to effectively apply operative use of technology and data. As a result, there is a preponderance of waste and fragmented member experience.

The big question: Why is there such limited progress even though automation has been around for decades?

The problems are many. Indeed, many payers are:

- Still working with computer systems that are 15- to 20-years old

- Struggling with the disconnect between back- and front-office systems, fragmented data, and across the value chain ‘silos’

- Dealing with a disjointed and broken member journey

- Realizing that in the past, some innovative technologies have failed due to misguided implementation efforts

The good news: Health plans are sitting on the precipice of opportunity. To start, legislation and the move to value based care is paving the way for transformation.

Perhaps most importantly, technology has matured to the point where it is ready to disrupt operations more than ever before. For example, GenAI has evolved to include natural language processing and speech recognition. In addition, large language models (LLMs), which act as the algorithmic basis of chatbots, can now not only summarize massive amounts of data but also create new, original content. As such, GenAI can be used to create highly sophisticated tools that can significantly enhance a variety of functions, such as payment integrity.

GenAI also can help health plans that are looking to reduce overall expenses, as automation dramatically improves the productivity of humans as they carry out core health plan operations such as member contact centers and utilization management. What’s more, it can help to reduce requisite staffing levels, which is welcome news as many health plans are also struggling, as the labor pool is diminishing.

The maturation of cloud technology and increased interoperability among information systems is also empowering health plans to cut costs more strategically. Now somewhat ubiquitous cloud technology can enable greater levels of interoperability.

With increased interoperability, payment integrity can improve by connecting providers, contracts, agreements, and billing algorithms at the point of care. In addition, use of AI will enable dramatically better interoperability among payers, providers, and patients. This can support much needed vertical integration, specifically between payers and providers that reduces friction and unlocks greater value within vertically integrated payer-provider systems.

Data led AI strategies will empower health plans to take costs out of the value chain. For example, health plans can rely on enhanced ‘smart agents’ for customer service benefits inquiries.

Perhaps most importantly, this evolution of technology is enabling health plans to mount more sophisticated data strategies. For example, with increased data integration as well as data input from mobile devices, it is possible to expand beyond simply leveraging traditional data sources such as claims, membership and enrollment to include social determinants of health (SDOH), clinical data, consumer segmentation and Internet of Things metrics. As a result, strategic data initiatives will support smarter care and utilization management by leveraging predictive models that make use of SDO and consumer preference information. As such, health plans can drive strategic advantage by delivering personalized, tailored outreach directly with members and sharing intelligence to enable network providers.

Data led AI strategies will empower health plans to take costs out of the value chain. For example, health plans can rely on enhanced ‘smart agents’ for customer service benefits inquiries. GenAI also can automate prior authorization intake and approvals, thereby improving utilization management.

Indeed, the use of technology and the implementation of a sophisticated data strategy can help health plans address administrative costs, medical expenses, and customer satisfaction across the spectrum. Most notably, health plans can strategically address operational costs in areas such as marketing and sales, which accounts for 20% to 30% of overall costs; claims processing and payments, which accounts for 18% to 25% or overall costs; business support functions, 14% to 18%; clinical management 11% to 14%; and provider network and contracting, 5% to 8%. (See chart below).

How will digital technology enable health plan operations over the next five years?

Not surprisingly, then, the health plans that invest in data infrastructure and mount sophisticated AI strategies will reap the greatest benefits of digital transformation. In fact, health plans can expect to experience a variety of benefits associated with digital transformation.

Top digital transformation benefits

- Use of data led digital strategies will connect functional operational siloes, resulting in less duplication, waste and greater productivity and member satisfaction.

- With data, the back office will become the front office – and there will be less need for customers to call plans.

- Artificial intelligence will be used to assist agents, create “smarter” customer experiences while maintaining a ‘human in the loop’ where necessary.

- Call centers will become care centers, eliminating the need for staff members to manage member interactions upfront.

- GenAI will change the sales function, personalized products and support the sophisticated ability to target prospective customers and drive growth.

- GenAI will transform the middle of the value chain – clinical management, claims processing and customer service, functions resulting in significant reductions in both administrative and claims expense while increasing member satisfaction.

- Smart data signals are being used to automate Property and Casualty claims today and will do the same with health plan payment integrity and claims processing operations.

- Currently about 25% of payment integrity related claims operations are automated but that will reach 80-90% in the next two to three years. This will not only reduce administrative costs of the function but significantly increase claims savings yields and enable a ‘shift left’-- going upstream to prevent claims overpayments from occurring.

- Payers are now at 80% to 85% automated claims adjudication capabilities but still are using manual payment integrity methods; the move to automated payment integrity will result in significant cost savings.

- Digital adoption rates across operating centers will flip, going from today’s 80% manual, 20% digital to 80% digital, 20% manual.

- Digital transformation will yield year-over-year efficiencies in productivity that result in a total 40-50% cost reductions in five years and enable staff to operate top of license.

Facing the change

Success with promising digital operations and technologies, however, hinges on proficient change management. As such, health plan leaders need to embrace the following strategies:

- Ensure product, technology and business teams are working closely together. To move from about 20% adoption of digital technologies to about 80% in a short period of time requires that product and business teams work closely together. Essentially then, when a product or a feature is released and there’s an experience issue or a roadblock that the users face, feedback will quickly be provided back to the product teams and improvements can quickly be implemented.

- Take a layered implementation approach. To ensure success, it’s important to systematically deploy change one crosscutting process at a time. With a layered approach, a health plan might start by automating one horizontal aspect of claim operations first, such as claims re-work, then move on to other processes. In addition, health plans can start by targeting situations that drive the greatest amount of member dissatisfaction and implement AI strategies with them first – and then continue with other situations as time goes on.

- Experience an organizational paradigm shift. Most health plans are still doing things the way they were 15 or 20 years ago. They continue to view claims adjudication as their primary purpose. What’s needed, however, is a paradigm shift where health plans think of themselves as custodians of patient health, not merely transactional processors.

- Change the relationship between payers and providers and overcome interoperability issues. Payers and providers need to align their financial incentives and then share information via interoperable systems. As such, they would diminish the amount of work required on the back end to correct claims information while reducing friction. Misalignment in how one system is interpreting what one system interprets as an accurate transaction versus what another system deems as accurate is common. The systems need to create a handshake that is transparent and mutually agreed upon to eliminate the confusion and improve efficiency.

- Address limitations with legacy operational systems. Deploy Application Programming Interfaces (APIs) to make a broad array of information available from legacy systems that enables rapid digital development to take place with minimal changes to APIs at a more modest cost.

- Tap into a multidisciplinary team to create a roadmap. A panel of internal experts and leaders need to come together to determine exactly what the health plan’s roadmap looks like. This interdisciplinary team with representatives from claims, legal, clinical, and other areas need to ask questions such as: What does your roadmap look like? What’s your end goal? What are you trying to accomplish?

- Zero in on data governance. Leaders need to consider just how data is used. It’s important to focus on what information is required to drive operational performance and then ensure the processes and technologies are in place to ensure data is effectively integrated, enriched, managed, and accessed to unlock the potential of AI to power both strategic and operational business needs.

- Remember that a human touch will always be required. While automation is poised to take over many health payer operations, it’s important to acknowledge that health care is, in essence, personal and will always require a human touch. No matter how digitally sophisticated health plans become, there will always be a desire for the member to talk with health plan staff. The challenge for health plans will be to fully leverage digital tools while still providing a high level of personal empathy to members.