Rebuilding Payment Integrity in a post-pandemic world

Address recent challenges and redefine your program with innovative solutions that impact both presubmission, pre-payment and post-payment auditing needs

The COVID-19 pandemic caused major disruptions within the healthcare system, impacting everything from care delivery and health-seeking behavior to healthcare programs and processes to legislative and regulatory changes.

These changes are reflected in the numbers. In 2020, healthcare expenditures experienced a 9.7% growth rate, the fastest growth since 2002, resulting in $4.1 trillion national spending . These increased costs and the associated medical cases and claims caused responsive measures for all stakeholders within the US healthcare system.

Providers and payers bypassed financial checkpoints in favor of treating afflicted patient populations. While the heroic efforts within the medical community are deservedly lauded in the face of the crisis, the ensuing fast-track billing practices adopted during the pandemic presented opportunities for administrative errors and fraud, waste and abuse (FWA).

Further compounding opportunities for errors, the healthcare system was troubleshooting additional complexities, including strained resources, remote trainings for new staffing, and legislative measures, all of which enabled bad actors to blend in with the general population that otherwise may have never slipped through the system.

Pandemic impacts to the payment integrity programs

Payment integrity programs act as a sentinel to the industry, and as such, any strains on the programs and resources result in a burden carried across the entire healthcare ecosystem.

Post-pandemic, legislative measures were enacted to provide healthcare support for the country. While valuable, these changes expanded membership and plan coverage, adding administrative demands for both payers and providers, without increasing the already-strained care support services.

For example, the Bipartisan Safer Communities Act provides a significant investment in mental health initiatives for adolescents, committing to $3.3 billion over the next five years. However, the benefits for this population will also invoke a new inventory of claims that currently have very little economic oversight.

Payer and provider organizations are still struggling to maintain compliance with the No Surprise Billing Act and Price Transparency Order, enacted in December of 2020, which require industry-wide upfront transparency on charges.

The industry is also facing a long list of lingering effects that continues to cause aggravation in our post-pandemic world:

Workforce shortages

typical of the early days of COVID, persist with a record number of employees leaving their jobs during The Great Resignation, resulting in diminished staffing capacity and poorly trained reinforcements to address the aging account reconciliations and collections.

Labor is at a premium

Any rapid transition to automated digital solutions is hamstrung by limited resources, further deterring from the path towards greater automated efficiencies.

Inter-organizational competition

for limited resources to address member, provider, payment issues, etc. is causing priority shifts.

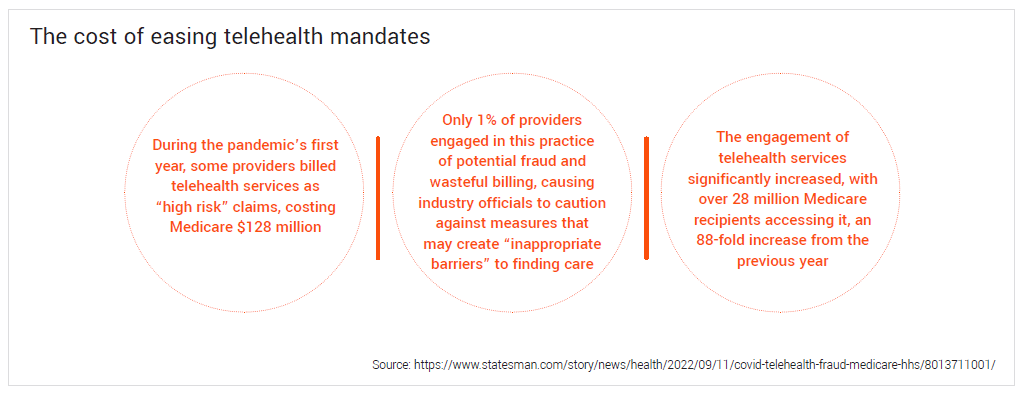

Telehealth claims

continue to represent an expanding pandemic-related phenomenon that demand scrutiny. While legislators continue to search for ways to regulate the billing of these services, payers remain in reactionary mode, mired in a hotbed of new unpredicted costs and areas for errors.

An uptick of services

including excessive lab panels or unbundling services increase costs and burden of healthcare resources.

Determination of the patient placement of care

outpatient versus inpatient, was a growing focus of the industry. However, the pandemic made the situation even more critically urgent as readmission rates rose over COVID and continue to be a widespread concern.

The move to value-based payments

is requiring more acute control on provider reimbursement and documented, granular detail over patient improvement.

Health plans are struggling to preserve provider relationships while maintaining a viable healthcare ecosystem for patients face increasing pressures. How do you help financial teams recover every possible dollar, when provider network management leaders are seeking to limit special investigations and audits?

With the massive backlog of claim audit inventories, managed by vendors who are paid on contingency and thereby incentivized to continue to find errors over solutions, finding a way of effectively and efficiently to stem the flow of improper payments is a challenge. The associated administrative and reputational costs are substantial. Consequently, there’s never been a better time to address the issues and correct the trajectory of payment integrity than now.

Seize the opportunity to innovate Payment Integrity now

While payers went into pandemic with a strategy, plans are now looking to navigate their existing programs and re-evaluate their priorities, resources, and partnership needs.

Unfortunately, much of the pre-pandemic structure, resources, talent and funding available to payment integrity departments has since been shifted or lost. So, while the industry is in a state of flux, and the urgency for reform has never been higher, the opportunity exists to reinvent payment integrity practices and rebuild those programs for better payment accuracy across the claims continuum, using a smarter, more innovative plan of attack.

The unprecedented payment and cost disruption brought on by the pandemic has created need to change how payment integrity programs are delivered and managed. Leveraging digitally enabled data mining, clinical reviews and audits that address root cause errors are vital to control the scale of payment errors occurring in today’s environment. Additionally, deploying those capabilities in a end-to-end framework (pre-submission, pre-payment, post-payment) is a critical component for payment integrity programs moving forward. Now is the time to lift and shift.

Proactively address payment integrity across your organization and the claims lifecycle

Payment integrity processes align with multiple business units so interorganizational collaboration is critical to addressing healthcare waste and issues. Payer organization teams mutually benefit by the Enterprise Payment Integrity Office (EPIO) process by which stakeholders or organizations work together towards a common goal. When payers work to establish a Steering Team, they can save exponentially medical cost and administrative expenses.

In addition, the most proactive approach is to solve economic errors in the presubmission stage. Here, a clear, orderly pre-submission process can go a long way to minimizing provider abrasion, while maximizing downstream payment integrity. This framework also has the opportunity to unite the healthcare ecosystem at its most broken intersection … the unhealthy triangle between payer, provider and patient.

Prior to the pandemic, existing infrastructure and hesitancy around financial investments prevented the shift to pre-payment and pre-submission programs. The pandemic and its aftereffects changed the status quo. Within the current state, an increase in errors paired with workforce shortages – has created a resource gap to address an increasing rate of payment errors. One analysis reviewed government-wide programs and determined that the improper payment rate increased from 5.6% to 7.2% between fiscal year 2020 and fiscal year 20215.

This will require a smart platform with access to the best available data, along with automation capabilities tuned to spot billing and payment anomalies accurately in real-time. The moment a big dollar amount goes in, or an outlier claim is made, an automated alert should be raised to immediately flag the transaction. Artificial intelligence and machine learning technologies already exist to perform this task and refine program effectiveness as time goes on.

In the post-payment stage, the same platform can likewise be configured to spot anomalies. This frees up valuable staff from the task of manually auditing claims and allows them to focus more on managing exceptions, where a deft handling of the matter can improve provider relations and ensure greater system compliance.

Digitize for efficiencies end-to-end

After a smart platform, the next logical step is to digitally modernization the payment integrity function. Many health plans today work off spreadsheets, relying on manually managed audits to reconcile accounts. All too often, data is lost, errors occur, and both time and money are wasted in a process that yields too small a rate of return.

One economical solution for rapid digitization is BPaaS, or Business Process as a Service. For a set subscription rate, BPaaS allows payers to contract the automated workflows, applications and technologies needed to warehouse and mine large volumes of medical records and provider contracts for a more streamlined payment integrity operation.

Pick and choose the applications that promise the fastest payback. Look for a customizable, end-to-end audit workflow management application, tailored to your needs, to start. This will ensure a number of benefits:

- A central auditing system of record to identify insights and manage activities effectively and efficiently.

- Sophisticated reporting capabilities delivering real-time access and transparency into processes and activities.

- Advanced security and reduced risk when working with sensitive healthcare data subject to regulatory oversight.

Work with an experienced, domain-specific partner

Lastly, with qualified labor at a premium, it is wise to leverage payment integrity vendors throughout the transition. Collaborating with partners on the frontlines can alleviate the burden on overtaxed staff and bring valuable expertise to bear immediately. Longer-term, a savvy partner can help educate service teams on best practices, implement behavioral campaigns to change aberrant practices, and help reverse negative trends.

Look for a strategic partner with the resources to support the transition to selfsustainability and help maintain operational capacities if necessary. The right vendor will possess the domain-specific knowledge and experience to bring useful insights to light. Further, they will have ready access to the digital solutions best suited for payment integrity operations, including purpose-built technology assets, analytics capabilities and audit services available on demand.

Vendor collaboration is key

Each payment integrity program is unique, accommodating for different business challenges, goals, populations and available technology. Working with collaborative, flexible partners that offer modular solutions provides the best opportunity for success, achieving results with speed to performance, minimal lift, and streamlined efficiencies.

During the last year, the healthcare industry saw significant mergers and acquisitions that has made the vendor landscape more intricate for payers to navigate. As healthcare organizations merge, they lose their ability to act as agile and responsive partners. With conglomeration comes complexity, causing less flexibility to address each payer client’s specific shortand long- term needs.

The parent companies for these conglomerate vendors are often payers, looking to widen their competitive footprint. By sharing data on their platforms, the assumed firewalls do not protect essential intellectual property, which can include:

Competitive strategies

Network rates

Contracting information for providers and employer groups

Details on partnerships

When researching vendors, the larger organization is part of the package. The question must be asked: who are you ok with accessing your data?

Partnering with organizations that are not a competitor-affiliated choice ensures that payment integrity needs are being met and payer data is safe.

Create a purposeful blueprint and begin

In hindsight, the pandemic cut a fork in the road for payor organizations to either stay the course and fade away or make the move toward innovative, proactive payment integrity management. Every plan has its own priorities, resources and partnership needs. And, with a prime opportunity to rebuild the right way and correct the errors of the past ahead, now is a good time to find a capable partner and begin.

Start with a strategic goal-setting and benchmarking session to engage top management and identify root causes, bottlenecks and roles and responsibilities moving forward. Lean on the experts to guide, advise and inform the process, but own the process from day one. Select a pilot program to launch the effort in an area of high need, high return and branch out from there.

Determine an ideal payment integrity state and the preferred timeline to reach that goal. A frontline, collaborative partner can provide insights on the payment integrity landscape and the operational roadmap specific to short and long-term goals.

It is possible to correct the errors of the past and build a more effective payment integrity administrative practice. One that identifies inaccurate billing and payments while preventing FWA throughout the claims lifecycle. It also must engender trust and support positive provider relations.

Take the lead with EXL

Contact EXL for an initial analysis and recommendations on the right tools, solutions and practices needed to institute a best-in-class payment integrity management program today. For more information, visit EXLservice.com/ industries/health.

3https://nbcc.org/govtaffairs/newsroom/bipartisan-safer-communities-act-includes-new-mental-health-funding

4https://www.bls.gov/opub/mlr/2022/article/the-great-resignation-in-perspective.htm

5https://www.whitehouse.gov/omb/briefing-room/2021/12/30/updated-data-on-improper-payments/

Written by:

Tina Azar,

Vice President, Market Leader

tina.azar@exlservice.com