Utilities in the age of electric vehicles

The impact of vehicles on the environment has driven regulatory mandates to adopt a more sustainable way of commuting. As a result, electric vehicles (EVs), and the necessary infrastructure to operate them, has changed the automobile and utility industries over the past decade.

Electric vehicles are powered by a charged battery pack and can be separated into two categories:

- Battery Electric Vehicles (BEVs): These EVs are purely electric with lithium ion batteries suitable for short to medium distances.

- Plug-In Hybrid Electric Vehicles (PHEVs): Electric vehicles with an internal combustion engine (ICE) with support from a small electric motor.

Why Electric Vehicles?

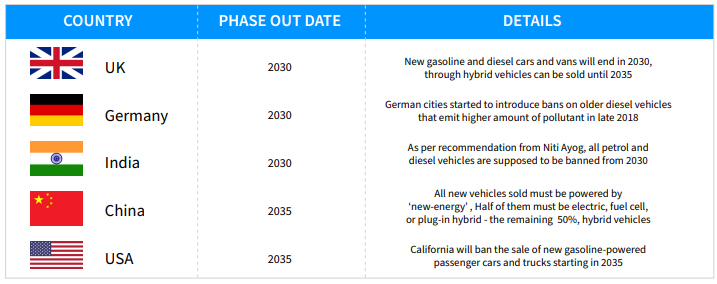

The 2015 Paris Agreement has challenged countries to reduce their carbon emissions to “net zero” over the coming years. This international treaty has prompted governments around the world to phase out gas and diesel powered vehicles, shifting instead to EVs:

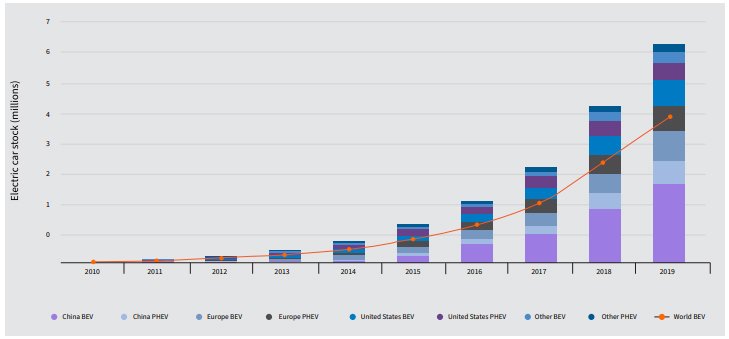

Sales of electric vehicles have grown steadily over the last decade. The following chart from the International Energy Agency shows China leading market share at 47%. Twenty other countries have reached a market share of above 1%: emissions. As a segment, the automobile industry can tout sustainability and the environmental benefits of emerging technologies to entice consumers to buy EVs.

According to a study by IRENA (International Renewable Energy Agency) on EVs:

- Electric passenger cars will reach 200 million by 2030

- Electric two-wheeled and three-wheeled vehicles could outnumber four-wheeled vehicles, with as many as 900 million on roads by 2030

- Electric buses and light-duty vehicles could surpass 10 million by 2030

Factors Contributing to EV Adoption

1. Consumer Interest:

Eco-friendly consumers who want to decrease their carbon footprint prefer to buy EVs. Transportation around the globe is one of the biggest contributors of carbon emissions. As a segment, the automobile industry can tout sustainability and the environmental benefits of emerging technologies to entice consumers to buy EVs. A 2019 international electric vehicle consumer survey (of 7,600 consumers in seven regions) shows consumer interest in electric vehicles is high. 50% of consumers say they’re interested in owning an EV and 28% say they’ll purchase one as their next vehicle.

Consumer benefits to owning electric vehicles:

- Reduced operating costs, lower charging prices and simpler maintenance

- Quieter driving experience

- Exemption in Clean Air Zones – areas that charge fees to vehicles that pollute the environment

- Government subsidies that make EVs cheaper than ICE vehicles

- Preferential parking permits in dense urban areas

2. Technology:

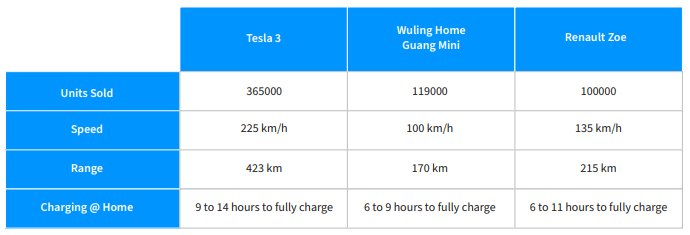

EV technology has vastly improved. Range limitations and charging times have been addressed, alleviating concerns and increasing purchase momentum. Consider these three, top selling EV models in the world in 2020:

3. NetZero Target:

In support of the 2015 Paris Agreement, utility and automobile companies are working to achieve net-zero emissions. To do this, they’re offering customers low-carbon products such as renewable electricity and electric vehicles. By taking advantage of these offerings, individual consumers can reduce their carbon footprint. Businesses can reduce their overall cost of fleet ownership, and organisations can reduce fuel costs, reap tax benefits and take advantage of government incentives.

Challenges for Utilities:

EVs help combat climate change. However, barriers to adoption exist:

Charging Pricing: An increase in the number of electric vehicles can lead to disorganised charging. This makes peak shaving difficult, creates incremental costs for generators, increases transmission and distribution pressures and reduces grid reliability and security. It also degrades power quality and increases the harmonics of the grid. Ultimately, an unreasonable pricing structure can lead to its failure. A dynamic pricing strategy can help utilities overcome the challenges of EVs and can reduce the burden of power on a grid.

Complex Billing: EVs also present billing challenges for utilities:

- Number of Stakeholders: Charging hosts, charging point operators, eMobility service providers, roaming network providers, etc. are all involved in the billing process. These stakeholders have to manage multiple plans – pre-paid, postpaid, ad hoc, group plans, etc.

- Customer Type and Charging Location: Plans offered will vary based on customer type such as individual, fleet, business, public and private. They’ll also vary based on location, including home, office, fleet charging center, parking lot, multi-tenant unit, municipal location and more.

- Price Per Charge: The customer can be charged based on charge point, price per kWh or by minute/ hour (flat fee). The charging session may include ancillary fees such as a connection fee or a waiting fee for staying connected after reaching a full charge.

Charging Infrastructure: The mechanics of charging pose challenges to utility companies:

- Network: Availability remains limited

- Technology: Fast-charge still in its initial stage and widely unavailable in the network

- Customer Experience: Unpredictable charging experience negatively affects customer opinion

Service and Maintenance: Electric vehicles require specialised mechanics who are still difficult to find. According to a study done by UK’s Institute of the Motor Industry (IMI), 97% of today’s mechanics aren’t qualified to work on electric vehicles. Of the 3% of mechanics who do qualify, many work directly for EV dealerships, limiting service options for general EV buyers.

Higher Upfront Investment: Higher manufacturing costs vs. the cost to make a combustion engine vehicle make EVs more expensive to buy. This sticker shock feeds consumer doubt about the long-term economic benefits of an electric vehicle. Government subsidisations help alleviate that doubt, but total consumer buy-in will take time.

The Utility Opportunity

As more people switch to electric cars, the impact of EV charging loads on generation, transmission and distribution networks translates into more energy and more revenue opportunities for utility companies.

- Charging Infrastructure: Utilities can play a vital role in modulating charging rates and shifting charging times to provide grid services that support supply and demand. Consider these energy giants already investing in charging infrastructure:

- Shell recently announced the rollout of 500,000 electric charging stations over the next four years.1

- Ecotricity a “Big Six” UK energy supplier, partners with Moto, RoadChef and Welcome Break to offer 45-minute fast-charge stations. They call the network “The Electric Highway.”2

- In the UK, companies like Centrica are building out their EV charging capabilities by acquiring smaller independents. Centrica invested in Driivz, a software company that manages EV fleets and charging networks, to create Centrica Electric Vehicle Services (CEVS) 3

- New EV Tariffs: Consumer tariff structures (e.g. time-of-use tariffs) reward consumers who slow-charge during off-peak hours. These tariffs, which reduce consumer bills and prevent overloads on the grid, help influence EV drivers to shift their charging behavior. By partnering with EV manufacturers, utility companies can create custom electricity tariffs that can be bundled into the purchase of an electric vehicles. Energy suppliers in the US, UK and other European countries have already begun offering EV energy tariffs.

- Improved Customer Experience: Careful planning, phased execution and synergy with non-utility businesses can help electric utilities facilitate a smooth transition to EV adoption. With the right customer relationship management (CRM) platform in place, utilities can offer consumers “charging ecosystems” – chargers, charging plans, etc. - for their vehicle. This positive consumer experience, combined with the financial upside of aligning with non-utility companies, translates into increased revenue for the utility company.

- Vehicle-to-Grid (V2G): While EV tariffs can prevent overloads by shifting charging behavior, they also present challenges. If too many EV drivers charge during off-peak times, it can spike load levels and lead to grid congestion. To counter this, vehicle-to-grid (V2G) enables energy to be pushed back to the power grid from the battery of an electric vehicle. This helps balance the variations in energy production and consumption. Furthermore, V2G can support the integration of renewable energy resources into the grid.

- AI Driven EV Marketing: With electric vehicle purchases on the rise, utilities must position themselves at the forefront of energy innovation to ensure brand credibility. AI-driven marketing helps identify crucial digital touchpoints for targeted messaging.

- Data Advantages: Utilities can use data analytics and data science tools to develop services, applications and hyper-personalised product offerings. They can also leverage the data to expand into non-core markets. This allows for:

- Joint offerings with automotive companies

- After sales services in conjunction with car dealerships

- Installation of charging stations at locations where customers park electric vehicles for more than an hour

Conclusion

Globally the uptake of electric vehicles is leading to the transportation and electricity sectors becoming increasingly connected.

Even though barriers to EV adoption exist they are phasing out due to technological advancements. Innovation is the key in identifying opportunities to minimise costs and reducing pain points.

For utilities the biggest challenges is to ensure grid reliability and resilience. Providing a successful infrastructure for EV adoption will require coordination among various parties - Vehicle & charging manufactures, Electricity service providers, Distribution network operators, and Regulatory authorities

In the long run - Utilities that invest in electric vehicle infrastructure and technology will be well-equipped to offer solutions that benefit future customers.

References

2Ecotricity and Nissan install UK electric-car-charging network | Guardian sustainable business | The Guardian

EXL Utilities Academy