EXL XTRAKTO.AI™ credit management

Reduce cost, save time and eliminate human error for a game-changing customer experience that accelerates onboarding and lowers exposure to risk

How AI, ML and deep learning can turn your credit review process into a competitive advantage

The global pandemic of 2020, with its ensuing economic turmoil and geopolitical uncertainty, has forced many organizations to tighten control on extending credit limits. In response, credit risk strategies, policies and practices have changed, along with the credit review process itself, causing the number of credit reviews conducted per month to increase.

Unfortunately, commercial credit departments are plagued by a preponderance of manual data collection and data cleaning activities that generally consume about 80% of their time in making credit decisions. But does the process have to be so all-consuming? Is there a more efficient and effective way of sifting the data to arrive at a sound business decision?

Think about what goes on during the basic quote-to-cash process. Before a customer can be on boarded and extended due credit, a detailed analysis must be performed. And when the stakes are high, involving millions, or even billions of dollars in revenue, a long, painful credit analysis can put the business at risk of losing the customer to a more nimble, decisive competitor.

Why does it take so long?

Commercial credit, also known as trade or business credit, is credit exchanged from one business to another. This credit is offered to a business for running day-to-day operations, with a commitment to pay invoices at the end of the credit period. Frequently used pay terms include Net15, Net30, Net45 and up to Net90 in some cases. Multiple factors go into determining an effective credit line.

Information posted on company websites, along with data provided by mutual funds (including money market funds), exchange-traded funds (ETFs) and variable annuities can also provide valuable insight.

When assessing a private company, where financial statements are typically not provided, analysts must rely on reports from reputable credit agencies. Three credit bureaus may be consulted: Experian, Equifax and Dun & Bradstreet, each having its own algorithms and criteria for rating customers.

In addition, other underlying documentation provided by the company requesting credit may be gathered, including business size and age, demographics, industry classifications and other permissible information. Uniform Commercial Code (UCC) filings, government contracts, press releases, court documents, trade references and more may be considered.

In all, the process involves mountains of structured and unstructured data to sort and sift, with graphic files, hand-written notes, emails and documents requiring special attention. At the extremes, text and voice messages, social posts and other esoteric internal and external details can extend an approval out as far as three-to-four weeks.

In all, the process involves mountains of structured and unstructured data to sort and sift, with graphic files, hand-written notes, emails and documents requiring special attention. At the extremes, text and voice messages, social posts and other esoteric internal and external details can extend an approval out as far as three-to-four weeks.

Developing a full customer profile

A quality credit review process will effectively answer the question, “Does the business have the ability to repay its obligation?” To arrive at an answer, four types of credit analysis must be conducted:

Types of credit analysis

Fundamental questions: Does the business have the ability to repay its obligations?

1. Industry analysis: Understanding the dynamics of the market, supply and demand issues, competitive climate, future state, technological influences and the customer’s position within this environment.

2. Business analysis: Review the stability of operations, length of time in business, long-term viability, and the company’s vision

3. Management analysis: Including business overview, operational performance, liquidity, financial condition, acquisitions, restructuring activities, future state and decision-making processes.

4. Financial analysis: Assessing historical performance, future projections, leverage, growth, profitability, liquidity, efficiency, cash flow, rates of return, valuation, competitive benchmarks and trend analysis.

Clearly, to perform such broad and deep due diligence in a short amount of time – even in as little as a week – can be a tall order under the best of circumstances.

We have already reviewed the manual, time-consuming and error-prone methodologies of traditional credit evaluation. Assembling the skillsets to complete these tasks alone can be a challenge, not to mention the gathering and validating of information, time to analyze and interpret, and process of capturing numbers to derive accurate ratios.

In a highly competitive market with multiple options, extended turnaround times seem antiquated and unacceptable. Especially compared to the instant gratification proffered by such consumer-experience leaders as Amazon and Netflix. People, even those involved in a commercial lending situation, want quick, simple and easy. So, where can we accelerate the script?

The opportunity to improve is at hand

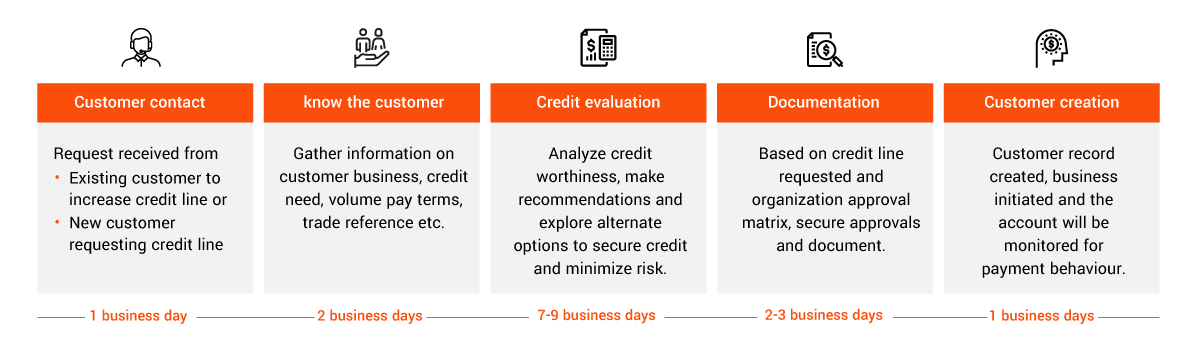

The following chart breaks down five areas in the customer credit evaluation journey to benchmark our review of the process and identify areas of opportunity.

1. Customer contact: Can onboarding be condensed to an hour? Why should it take a full day? How can automation or self-service reduce the timeline?

2. Know the customer: If customer contact can be condensed, can this shift left and begin sooner? Where can automation accelerate the collection of data?

3. Credit evaluation: This is where the bulk of time is consumed. Can AI and machine learning (ML) technologies sift the data faster and offer recommendations? Can human involvement be reduced to exception management? How can technology reduce risk and expand options? Is it possible to condense this to less than three days?

4. Documentation: How many people are involved in the decision chain? How much time is spent reviewing, questioning, commenting, waiting a queue? Is paper still the preferred method of documentation? What if this could be squeezed down to a couple of hours?

5. Customer creation: What would this look like if bots provided the notifications, secured signoffs and monitored activities? Could valuable personnel be repurposed to more important areas of the business?

As you can see, there is much to be questioned in the status quo. But the greater question is, “What will it take to cross over from a traditional to a digitally intelligent credit review process?”

Doing the same thing over again never works

While banks and financial institutions have gradually improved operations and customer experience management using AI and ML over the last few years, especially in the areas of lending and collecting, commercial credit evaluation still lags. Even though these technologies could help generate more accurate forecasts based on real-time data, many commercial credit managers cling to concerns over lack of transparency and interpretability of AI and ML models. More so, with in-house legacy systems and spreadsheet solutions having carried the load for so long, many question the reliability of such modern technologies in comparison.

For organizations to trust AI and ML to produce legitimate, reliable judgments and outcomes in a modern business setting, it is important to understand:

- Corporate cultures and risk practices are changing. A new generation of decision-makers is coming online, bringing an ingrained bias toward streamlined customer experiences and a deep familiarity with the associated technologies to the business.

- An incremental approach is the most practical way to transform commercial lending. By examining existing systems and processes and identifying areas to inject new technologies for spot improvements over the long-haul, organizations can grow comfortable with the change and even create a groundswell of enthusiasm for rapid modernization.

- Accept and acknowledge that AI and ML have already proven their place in performing complex commercial and financial operations. Companies that have adopted these technologies offer proof that AI and ML are reliable. There is nothing to be gained by waiting another day.

EXL: Your catalyst for change

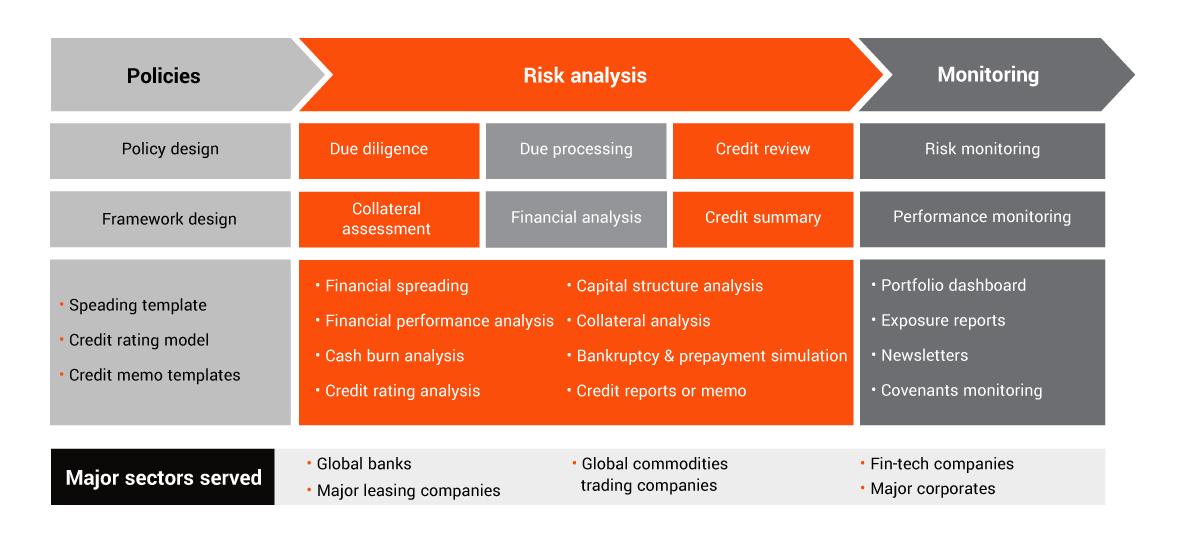

Far from being a recent business phenomenon, AI and ML have been maturing in practice for a long time. EXL has been there from the start. Our partnership with global leaders in a wide array of industries, including banks and financial institutions across the value chain of credit risk underwriting, has positioned us as a go-to source for rapid results.

We possess more than a decade of hands-on experience implementing AI and ML solutions for major brands, and we can bring this unmatched depth of experience and expertise to the table, to help you jumpstart your progress into a more modern way of doing business.

Our established framework has proven successful over time. With it, our consultants can help you lay the foundation for ongoing improvement, ensuring that every detail of your program leads to the outcomes you expect and your will customers appreciate.

Chief among our strengths is our unique, next-generation natural language processing and AI-powered solution suite known as EXL XTRAKTO.AI™. It is literally your short ramp to effecting results.

EXL XTRAKTO.AI™ “heavy digital” and “thin human” components will help you reduce cost, improve speed and increase accuracy collecting, processing and analyzing the data you need to make better decisions fast. As a cloud-based solution with managed services available, it plugs right into your existing workflows. Its reusable ML engineering components support processing of large volumes of data at high speeds, including multiple types of structured, semi-structured and unstructured information, from myriad sources in multiple formats.

As EXL XTRAKTO.AI™ deep learning technologies continue processing information from customer documents, images, audio and video over time, the tool learns as it goes, getting smarter every day to improve its performance. EXL customers have reported strong results, including:

- 40-60% lower cost

- 60-70% improvement in turnaround time

- Up to 5% improvement in accuracy

Talk to EXL today

In the year 2022, there is no excuse to continue conducting credit reviews using costly, time-consuming, labor-intensive processes. The technologies exist today to achieve breakthrough results now. And EXL has the knowledge, experience and solutions you need to get there at a pace that serves your purposes.

Why wait another day? Contact us to schedule an initial consultation or to arrange a demonstration of our EXL XTRAKTO.AI™ solution today. Make your move to a more streamlined credit review process with EXL.