Analytics-driven subrogation ecosystem to drive expense from your organization

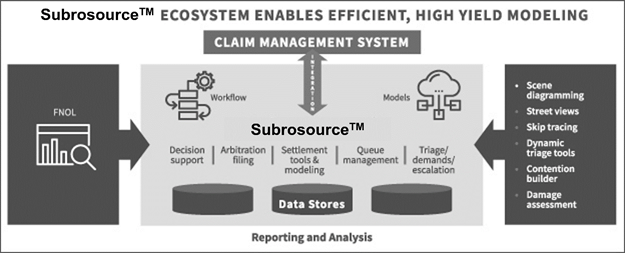

EXL’s Subrosource™ platform encompasses technology, advanced analytics, and patented methodologies to improve both net- and top-line recoveries. Our solution embeds analytics throughout the process to proactively identify opportunities, provide decision support, automated insurance arbitration, and industry leading vendor management. The net result is an industry-leading yield per file. EXL is the largest provider of subrogation solutions in the United States, and the only company to provide solutions that cover the entire recovery eco-system from FNOL through litigation.

Embedded in our multi-line platform is a full recovery suite including salvage, liability deductible recovery, Contention Builder, in-bound demand review, and vendor management. Leveraging Subrosource™ seamless handling transitions, EXL can employ a modular approach to handle select parts of the end-to-end process. For example, EXL could handle only arbitration & vendor management, while you focus on core negotiations.

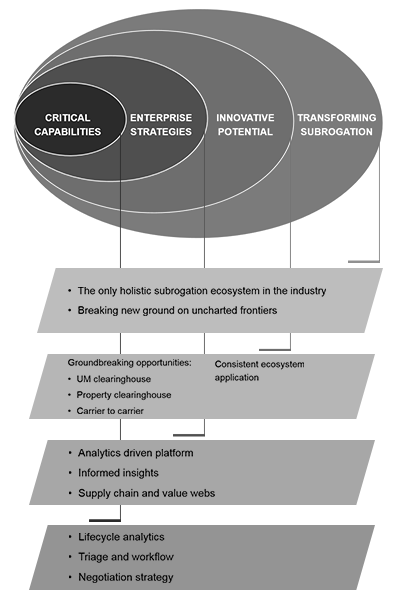

EXL’s industry leading recovery ecosystem

How is EXL Subrosource™ different?

Why Subrosource™

- Largest non-carrier subrogation analytics-driven platform with 1,200 users

- $1.5B processed annually, several multi-nation carriers, two of the top five US PL carriers

- Connected to 300+ vendors, attorneys and carriers

- 30,000+ arbitrations filed annually

- Deployed globally, with multi-language and multi-currency capability

- Minimal or no IT effort involved. Easy to integrate with multiple claim systems, or can be used as a standalone

What we do

EXL’s Subrosource™ is an industry leading subrogation recovery platform with embedded lifecycle analytics. Subrosource™ creates value in the identification of opportunities, assignment of recovery strategies and automated execution of recovery steps. The platform enables an efficient service ecosystem for recovery processing and automated demand generation. Subrosource™ caters to both subrogation for auto insurance and subrogation for property insurance.

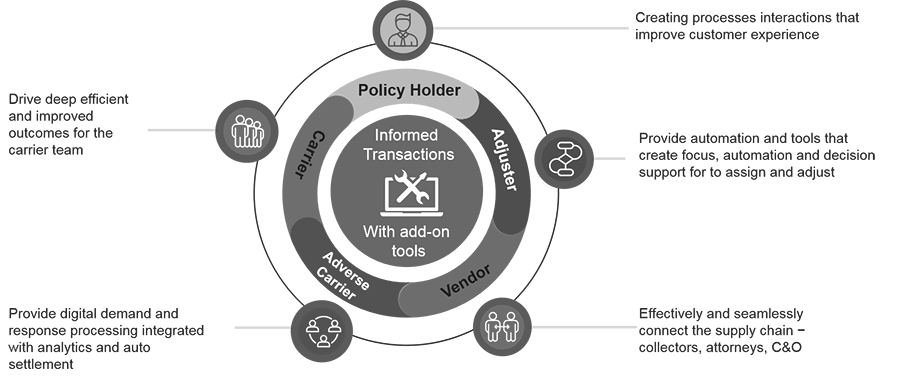

EXL can solve for the entire subrogation claim lifecycle. We can bundle and unbundle our solution depending upon a carrier’s needs. EXL has a subrogation ecosystem with improved customer experience for the policy holder, automation, and tools for adjusters for improved decision making, effectively and seamlessly connecting the supply chain for vendors while at the same time driving deep, efficient and improved outcomes for the carrier team.

Subrosource™

Subrosource™ utilizes embedded analytics throughout the lifecycle of a claim. Beginning at FNOL, files are scored for OPID and triaged to recommended recovery paths. Adjusters, whether you handle the subrogation or outsource to us, will utilize proven methodologies to optimize negotiation strategies.

- 10% recovery improvement

- 30% productivity gains

- 25% cycle time improvement

Arbitration

Beyond the platform, EXL is a leader in arbitration services. Our Contention Builder provides an immediate lift, improving efficiencies, as well as winning percentages with the use of embedded analytics, predictive modeling and advanced analytics.

- Over 50,000 applicant and respondent arbitrations filed annually

- Delivered over $250M over last 3 years

Vendor Management

UM clearinghouse leverages analytics to identify these high volume, low yield recoveries that take valuable time away from your staff. Our process gives you the ability to leverage our network of resources to focus on these files, freeing up your staff to collect on higher yield opportunities.

- Rotational Placement

- Top recoveries in the industry expenses

- We manage the process for your team

Property Clearinghouse

Property Clearinghouse provides an immediate lift on property claims and automated claims processing by providing support and claims analytics so adjusters can focus on customer service and resolution. Our team works in tandem to secure and preserve evidence within three days of loss. Our process is supported by EXL’s Property Triage technology to move files efficiently through the recovery process.

- Preserve evidence

- Manage C&O

- Improve recoveries by as much as 30%

- Very low management overhead