The premium audit process

What is an Insurance premium audit?

- An insurance premium audit is a provision of your policy contract.

- The purpose of the premium audit is to develop actual exposures (usually payroll or sales) that are properly classified in accordance with manual rules and regulations. This information will be used to determine your final premium.

- Most states require premium audits to be conducted to confirm the final premium and to ensure accurate statistical data for rate-making purposes.

When is a premium audit Performed?

- It is usually performed shortly after policy expiration, but can also occur early in the policy period to verify the accuracy of estimated exposures.

- It is also performed after policy cancellation, to determine your final earned premium for the shortened policy period.

- Audits will typically occur on an annual basis, but can be done every second or third year as determined by your carrier, and can go back as far as 3 years.

How will my premium audit be conducted?

Your insurance carrier will determine the best method to conduct your premium audit based upon the size and complexity of your business operations. The most typical methods are:

- A physical visit to your business premises to review actual records and operations.

- A telephone audit, after receiving certain information requested from you in advance of the audit. The information provided will be verified over the phone.

- A voluntary report in a specified format that you will complete.

Who will conduct my premium audit?

EXL has been selected by your insurance carrier to perform premium audits on a contractual basis. EXL is an industry leading, nationwide audit services vendor that conducts premium audits for numerous insurance carriers, Managing General Agents, Third Party Administrators, and state insurance funds across the United States.

How do I prepare for my audit?

The objective is to make the premium audit process a positive experience. Having the appropriate records available for the audit will allow the auditor to complete the process smoothly. For physical audits, you will be contacted by letter or phone to schedule a date for the audit appointment and you will be requested to provide certain records.

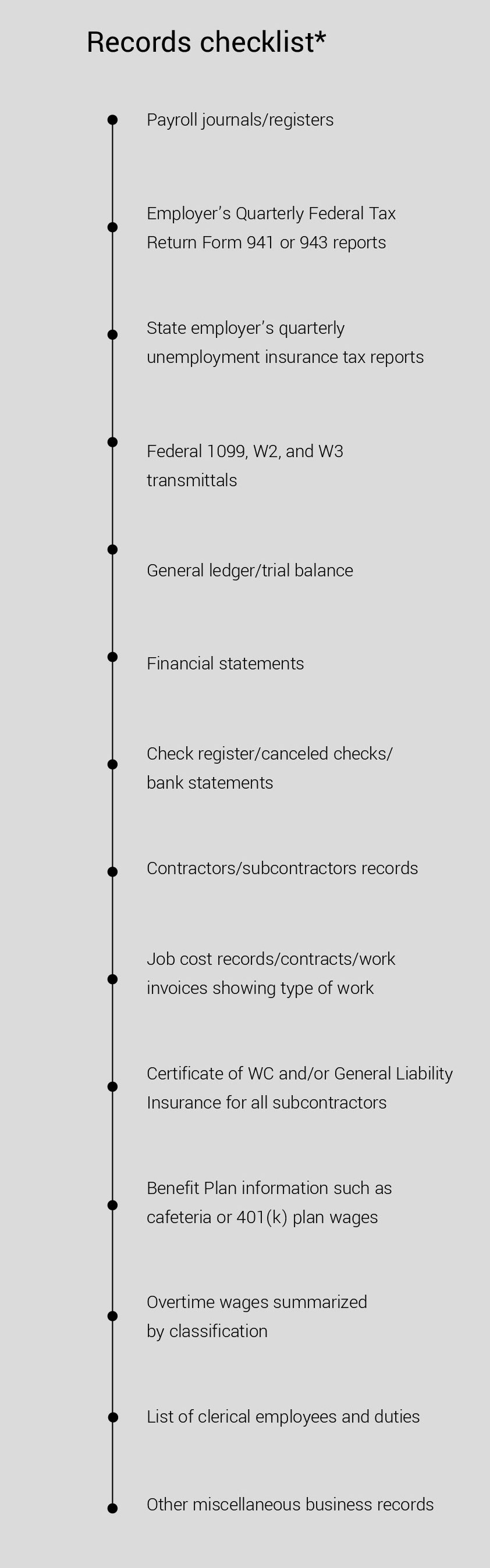

Our Records Checklist* indicates the most typical records requested for an audit. These records will help in determining the appropriate classification(s) and correct reportable exposures. If a phone or voluntary premium audit has been requested, you may be asked to complete a voluntary form and return it by a specified date.

Organize your payroll records

Accurate records that are complete and well organized make the audit process much easier. Your advance preparation will help the auditor quickly find what he or she needs and will require less of your time for questions and/or clarifications during the actual audit. Payroll records used for an audit should be organized to clearly show payroll by:

- Policy period

- Classification code (List each type of job separately, i.e. clerical, sales, etc.)

- Separating overtime from gross pay

Note: If you maintain accurate and detailed records, you may be able to take advantage of available credits.

Request certificates of Insurance from your subcontractors

If you have subcontractors working for you, you should always ask them to provide a current Certificate of Insurance. This is critical information to provide the auditor at the time of your audit and could help to avoid possible additional premium charges.

Your gross payroll

Gross payroll is the amount of payroll prior to any deductions. It includes items such as a 401(k) or cafeteria-style plan which may reduce the employee’s taxable income. Payroll for worker’s compensation or general liability purposes may not be the same as payroll reported for tax purposes. Examples of items commonly included in the payroll basis for the audit are:

- Wages and salaries

- Bonuses and Stock Bonus plans

- Vacation, Holiday, and Sick pay

- Commissions

- Profit sharing

- Payment for piece work

- Salary Reduction plans, Savings plans, Retirement or Cafeteria plans

- Substitutes for money which may include goods, board and lodging, meals, and the reasonable cash value of any non-cash item used as payment of wages.

The following are examples of the most common payroll exclusions (not inclusive.)

- Tips

- Severance pay

- Premium Overtime

- Exercised stock options

Be available for questions

The owner of the business should be available to speak with the auditor to answer questions and review the results of the premium audit. If the owner is not available at the time of the audit, the auditor will need to meet with someone who has a thorough knowledge of the business operations. The auditor is also available to answer any questions you may have about the audit process.

Your audit results

All information obtained will be kept in strict confidence and reported only to the Insurance Carrier servicing your policy. You will receive an audit statement from your insurance carrier shortly after the premium audit is completed. If you disagree with the audit findings, please contact your agent directly for assistance. The agent will discuss the situation with the carrier and the carrier can determine if the case needs be reopened for a formal dispute. In the case of a formal dispute, you would need to provide specific documentation as to the reason for any dispute along with associated back up documentation.