How utilities providers can manage increasing customer debt amid price rise

Wholesale energy prices for both electricity and gas almost doubled in 2021. As a result, OFGEM revised tariff prices in April 2022.

How utilities providers can manage increasing customer debt amid price rise

The current scenario

Just when UK utility companies had begun recovering from the after effects of the pandemic, they find themselves facing a new set of challenges. Wholesale energy prices for both electricity and gas almost doubled in 20211. As a result, OFGEM revised tariff prices in April 2022. This price rise, coupled with higher inflation, is making it increasingly difficult for customers to make their utility payments. As a result, existing debt will balloon, and new customers may find themselves in default. This will raise additional issues for utilities companies, as debt collection has often been a source of poor customer experience and stress.

1. Energy Crisis: Which suppliers have gone bust and why? (choose.co.uk)

Between managing ballooning customer debts and meeting regulatory requirements, utility companies can expect to face troubled waters through at least the end of 2023. Based on economic trends and its expertise in the utilities industry, EXL predicts that debt will increase between 15-30%, depending upon the portfolio mix and current debt exposure. This will make it even harder for smaller organizations to sustain themselves. Nearly 28 companies have already gone out of business in UK in 2021, displacing about 4.2 million customers1. The main factor behind these collapses is the rising wholesale cost of energy. This trend is expected to continue for the upcoming fiscal year. Even large companies will need extra provisioning in their 2022-23 balance sheets.

Some organizations have already started exploring finding new data sources to better identify these at-risk customers, such as using data from third-party vendors such as credit bureaus to better identify impacted customers.

How consumer debt will evolve

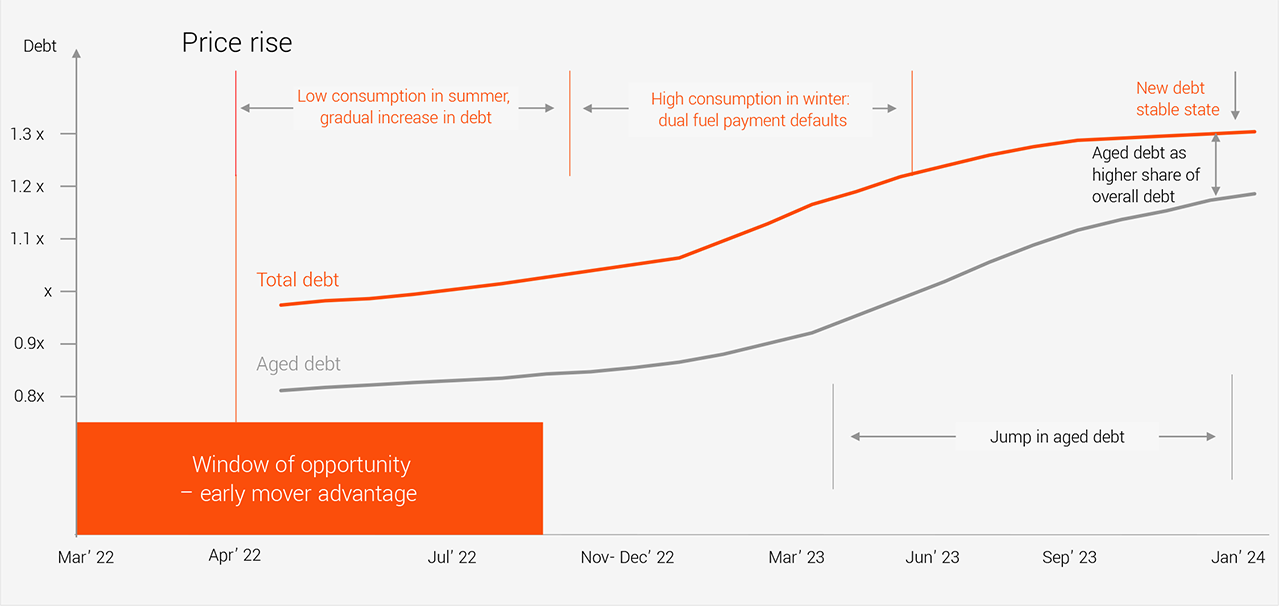

The impact of rising wholesale energy prices on debt won’t be felt immediately, but gradually build up. The true impact will begin slowly over the first six-to-nine months before increasing at a higher rate through the second quarter of 2023 due to the subsequent defaults on gas payments as customers prioritize essential expenses such as groceries over their utility bills.

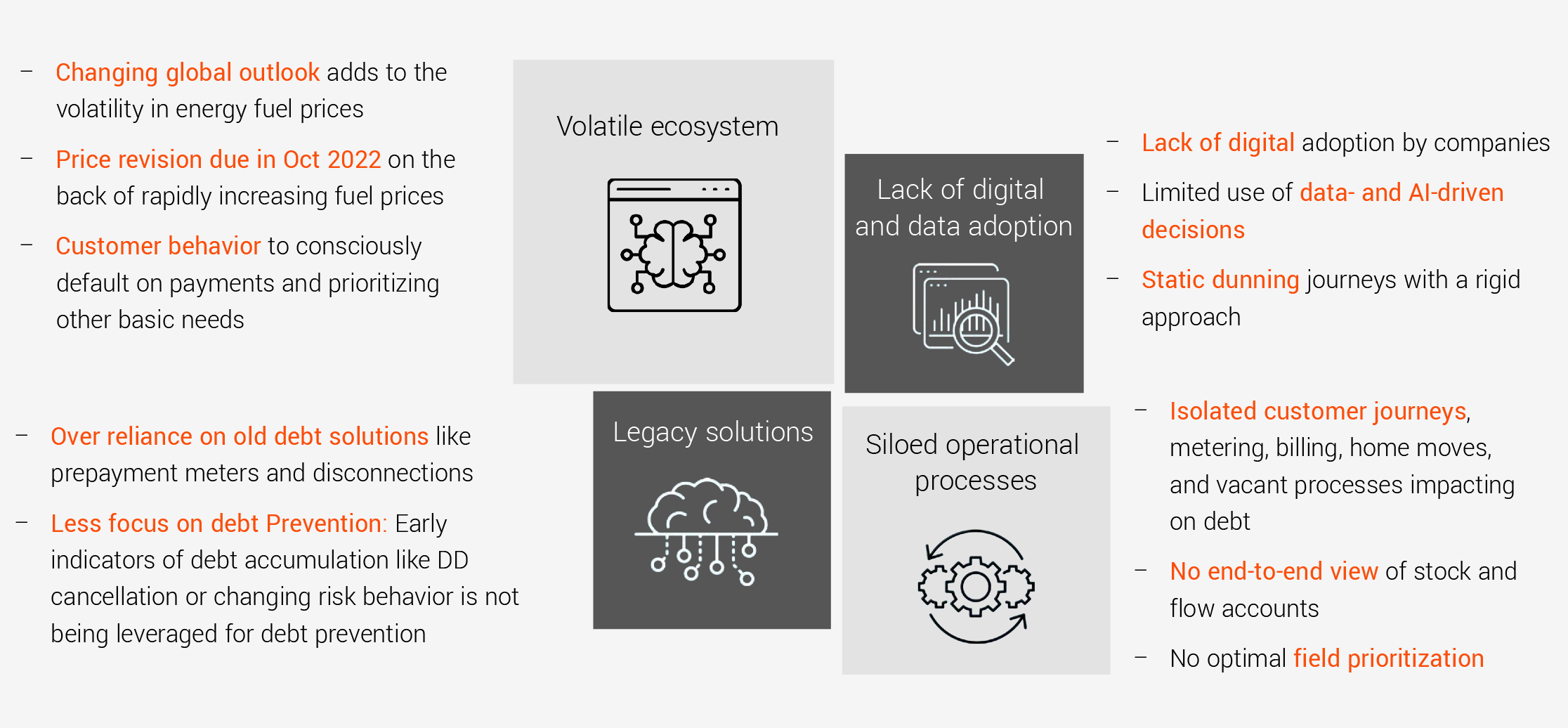

Challenges facing by utility suppliers

Utilities suppliers face an uphill task in keeping these debt increases in check due to four exacerbating factors.

What utility suppliers need to do?

Due to the volatility and difficulty in preparing for unseen events, suppliers must take an agile approach to gain an early-mover advantage. Data will be critical in identifying fringe customers likely to cross over from into debt.

Some organizations have already started exploring finding new data sources to better identify these at-risk customers, such as using data from third-party vendors such as credit bureaus to better identify impacted customers.

To overcome above challenges, EXL proposes a three-step approach.

1. Debt prevention and portfolio assessment

Utilities providers must move away from traditional solutions and collaborate with customers affected by price shocks. Datadriven decision making will be essential for identifying and segmenting customers based on payment types, bill frequency, fuel types, and other factors. This will help organizations provide customized solutions complemented by proactive communication that hedge upcoming risks while being empathetic to customer needs.

Managing the portfolio:

- Normalize DD amount: Customers will find it hard to manage expenses and sudden spikes in energy prices. Allowing DD customers to normalize their amount over a full year, agnostic of seasonality, would allow them to absorb this sudden increase.

- Early DD increase: Organizations should consider proactively reaching out to high-risk DD customers and encouraging them to increase their monthly DD payments during the low-consumption summer months of summer in 2022. This will build up a credit buffer, creating a cushion during the high-consumption winter season.

- DD cancellations: Utilities providers should have empathetic conversations with customers canceling their DD to understand the pain points and allow for custom solutions like partial payments with delayed payment terms upon reinstatement of DD. This will also reduce the provisioning requirements.

- Changing billing frequency to monthly: Identifying cash cheque customers at higher risk or customers with sudden risk score changes using additional third-party indicators and behavioral factors can help manage customers in debt. Changing the billing frequency from quarterly to monthly can also help mitigate risks by detecting defaulting customers early.

Streamlining upstream processes:

Utilities providers must also streamline upstream processes in order to prevent customers from accumulating debt. Issues in billing, metering, address, Home move processes are the biggest contributors of the debt at later stages. Our analysis shows these issues contribute to nearly 50-70% of old and stuck debt.

2. Adopting digital and data for effective early debt collections:

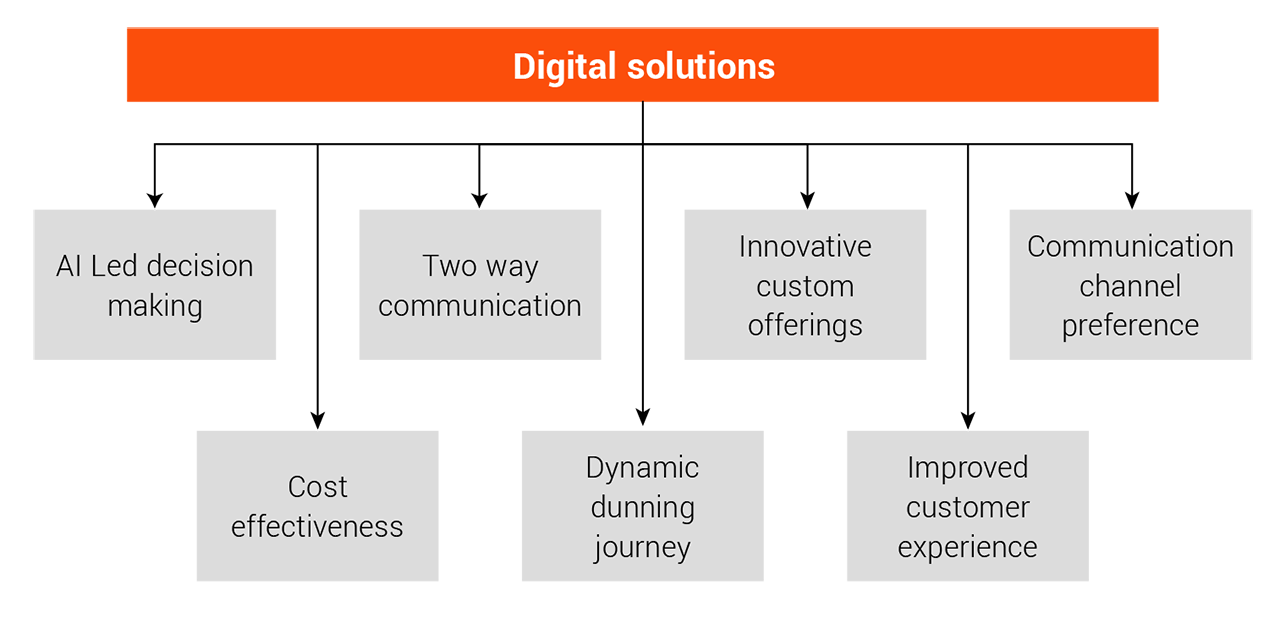

Digital solutions can be a key differentiator for early collections. Organizations leveraging AI and a data-driven approach through low-cost digital methods can provide better communications over a customer’s preferred channels. This would also allow faster adaptation to changing market scenarios and allow new offerings to be rolled out quickly.

EXL’s AI solutions, such as EXL PaymentorSM and EXL EXELIA.AITM, allow organizations to make the dunning journey dynamic and establish two-way communication with customers.

- Making the journey dynamic: Customer communications must be dynamic, ongoing engagements that take place over channels including emails and text messages. This will allow for more personalized customer journeys. For instance, if a customer has opened reminder mails but has not responded, the provider could analyze whether an early field visit would be warranted based on attributes such as amount due, due date, and other factors. EXL PaymentorSM enables dynamic customer journeys with configurable messaging to identify the best next steps.

- Enable two-way communication: Early adoption of digital platforms will give organizations a competitive advantage. Customer can leverage these platforms to inform their providers about moving in or out of a residence, financial distress, vulnerability, and set up their DD amount within allowed thresholds, allowing for better engagement at low cost.

- Create personalized payment plans: Providers should offer payment plans which can be customized using selfserve digital platforms. This will enable customers to get through the financial hardships and improve customer loyalty.

Taking this three-step approach focused on debt prevention, early collections, and late collections will not only prove beneficial as prices rise but in the long run as well.

3. Late collections: Field optimization and operational excellence

Field collections will become a focus area due to an increase in customers. While this is not a particularly customizable area, there is huge a potential to optimize the process. Given the expected increased load on field visits, providers should move to tighten late collection practices now.

Optimizing this process requires prioritizing customer accounts considering bad debt charge (BDC) and collectability. EXL’s MIA (Management Information Assistant) debt framework outlays end-to-end field journey to identify of stuck or repeat accounts for first visit and warrants process. This helps prioritize and resolve any outstanding account issues, improving collectability and field efficacy.

- Field prioritization: Customer should be segmented based on key attributes such as propensity to pay and age of debt. Separate strategies need to be defined for new or old customers and customers with high monthly consumption rates, as they would drive higher provisioning.

- Optimize visit bandwidth: This can be accomplished by removing account looping until the root cause is fixed. Collectability is an important criterion for field visits. The accounts which have been field visited two-to-three times should be eliminated from the loop unless the issue has been fixed.

- A ring-fenced team should be setup to operationally sort the accounts

- Comprehensive customer-level data can aid the ring-fenced team and identify the root cause quickly

- These steps will free up field bandwidth, enabling a better focus on collections

- Clear information requests: Using historical trends and complete customer information, pinpointed instructions can be sent during field visits. This will allow the agents to address any present issues and reduce repeat visits. For example, information on meters, and addresses can be provided, or even photographs of demolished properties can be sent to remove any ambiguity.

Partner with customers in advocating for reduced energy consumption

While these steps can help reduce the amount of customers accumulating debt, they also create an opportunity for a whole new customer-supplier partnership model. When sending customers their energy bill, providers can include customized recommendations outlining specific steps to encourage reduced energy consumption.

Customer advocacy will help build trust and awareness among consumers to encourage a long-term relationship and increased engagement.

Conclusion

Debt management would become more challenging from the third quarter of 2022 onwards. The balance between customer experience, regulatory obligations, and rising debt levels will be a careful path to tread. The challenges around global outlook, legacy systems, technology paralysis, and inefficient operational processes can make it even difficult.

Organizations will have to break out of their traditional ways of doing things and move swiftly to adapt. Time lost to making these necessary decisions will hamper utility providers’ abilities to recover debt and directly impact the bottom line.

Taking this three-step approach focused on debt prevention, early collections, and late collections will not only prove beneficial as prices rise but in the long run as well.

We would like to thank Andrew Upton, Head of Collections, British Gas for his contribution and insights. If you would like to discuss any of the issues raised in the report and how we can help your organisation please contact

Susan Pollock

Email id: Susan.Pollock@exlservice.com