Achieve superior business growth and profitability.

We leverage our deep expertise in data and analytics, coupled with industry-focused finance and accounting capabilities, to deliver intelligent operations and actionable insights that power better decisions. We work with you to streamline your finance function, drive efficiencies and improve customer experience so you can focus on being effective and forward-looking business partners.

What we do

Deep expertise in higher-end technical domains and analytical finance

Commitment to business outcomes

Proven credentials

Client-centric delivery philosophy

Testimonials

Our success is our clients’ success

“Future-ready” finance

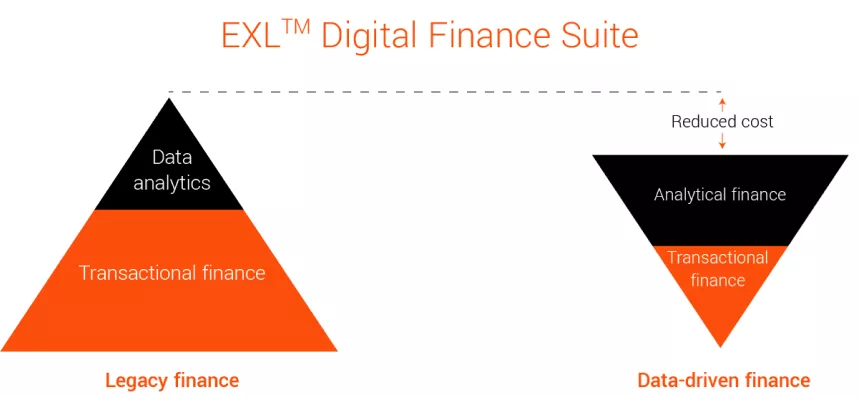

EXL helps CFOs reduce cost and drive growth by transforming finance into a ‘digitally enabled data driven’ function.

Brilliant at basics

<p>We create a strong foundation for finance transformation by focusing on and getting the basics right.</p> <p>Our depth and breadth of talent includes more than 10,000 finance professionals and more than 1,400 finance analytics practitioners.</p> <p>Our world-class secure infrastructure, operations and industry expertise, proven methodologies and deep analytics core brings strong operations rigor, real-time performance management and insights, Golden processes and best in class controls.</p> <p>We help create, embed and sustain a culture of Continuous Improvement through proprietary industry leading programs such as A.I.M (All Ideas Matter) and Digital EXLerator™, our proprietary framework for process transformation.</p>

Practical digital

<p>We help our clients harness the power of data and AI in their finance operations.</p> <p>We do this by re-architecting legacy process flows and strategically deploying AI solutions, analytical tools and hyper-automation to create new clean data, intelligent workflows and improve the effectiveness of existing platforms and technologies.</p> <p>Our cloud ecosystem allows us to swiftly deploy these redesigned "intelligent" workflows delivering the trifecta impact of outcomes, customer experience and efficiency at speed and at scale.</p>

Insights factory

<p>We enable our clients to democratize and accelerate decision through deeper, contextual and actionable insights.</p> <p>Our solutions combine EXL proprietary and client data, including new data gleaned from operations to enable near real-time alerts, signals and triggers that drive faster insights and action.</p> <p>We combine our world-class Analytics Centers of Excellence, cloud ecosystem and proprietary analytical solutions to deliver Insights As a Service, delivering a sustainable, scalable and lower cost solution for our clients.</p>