Leverage aerial imagery & AI for property assessment

Challenge

One of the largest residential property insurance providers in the U.S., with net written premiums valued at over a $1B, was challenged by its manual operating procedures and lack of digital interventions affecting its property and casualty (P&C) value chain. Sending underwriters to physical properties to gather policy and claims information was expensive. As well, variable knowledge, experience and bias among underwriters created inconsistencies in risk assessment and premium decisions. Challenges included:

- Inefficient manual measurements on-site

- Inadequate attributes for decisionmaking (e.g., inaccessible rooftops)

- Cost of sending agents on-site to verify claims

- Inefficient underwriter and adjuster utilization

- Higher loss ratios

The time had come to implement a digital approach to remotely assess roof conditions and get an accurate view of other property attributes, such as swimming pools and fire and flood risks.

Solution

EXL implemented a state-of-the-art property risk analytics solution for the carrier that leverages powerful AI algorithms and information extracted from high-resolution aerial imagery. This helped the client produce accurate risk models for various claims and combine individual peril scores into an overall risk score without sending humans to the location.

The solution provided the following metrics and KPIs based on numerous property and surrounding attributes:

Underwriting:

1. Fire risk scores: Tree distance, tree overhang, chimneys, distance to fire station, roof material

2. Weather risks scores: Tarp sheet area, patching on roof, debris, roof condition, roof material, tree overhang, vegetation density, distance to tree

3. Flood risk scores: Distance from waterbody, sea level height, slope of parcel, presence of basement

4. Value: Footprint area, number of stories, living area, number of buildings in parcel, etc.

5. Liability: Swimming pool, trampoline, fences, parking lots, etc.

Claims

1. Severity score

2. Triaging and reserve setting

3. Support assessment of replacement value

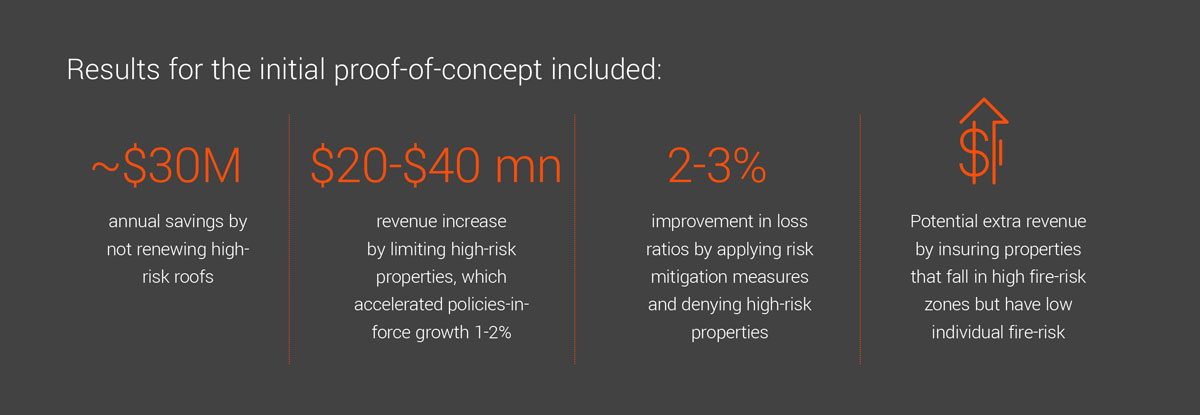

Outcomes

Using EXL’s image analytics solution, the company was able to cost-effectively provide underwriters with useful decision input, such as:

- Swimming pool and secondary structure detection

- Roof footprint and composition

- Continuous roof condition score

To learn more about EXL’s procure-to-pay expertise, please visit EXLservice.com.

To learn what EXL Property Insights™ can do for you, please visit AWS Marketplace - EXL Property Insights™