BASEL IV Credit risk changes for commercial exposures excl. real estate

In this paper, we aim to cover the key credit risk changes for the commercial exposures proposed by BCBS (Basel Committee on Banking Supervision) in D424 document dated as Dec’2017 including associated business and implementation challenges.

Introduction

After the implementation Basel III, BCBS next focus was on the increase in transparency, consistency, robustness and risk sensitivity in risk measurements. In Basel IV to finalize the reform committee primarily emphasized on to its mandate of strengthening the regulation, supervision and practices of banks worldwide, with the purpose of enhancing financial stability. A banking system that is resilient will be able to support the real economy and contribute positively to sustainable economic growth over the medium term. The BCBS committee proposed implementation design, calibration and transitional arrangements basis impact assessment on banking system, macro economy and expected capital requirement increment. BCBS continue the monitoring and evaluation of the effectiveness of these reforms on an ongoing basis.

As continuation of our previous article covered the Basel IV credit risk changes for retail & real estate asset classes, here we aim to cover the credit risk changes for the remaining asset classes and associated implementation challenges.

The following sections cover details of changes in standardised approach and IRB for Basel IV.

Changes in RWA calculation approach

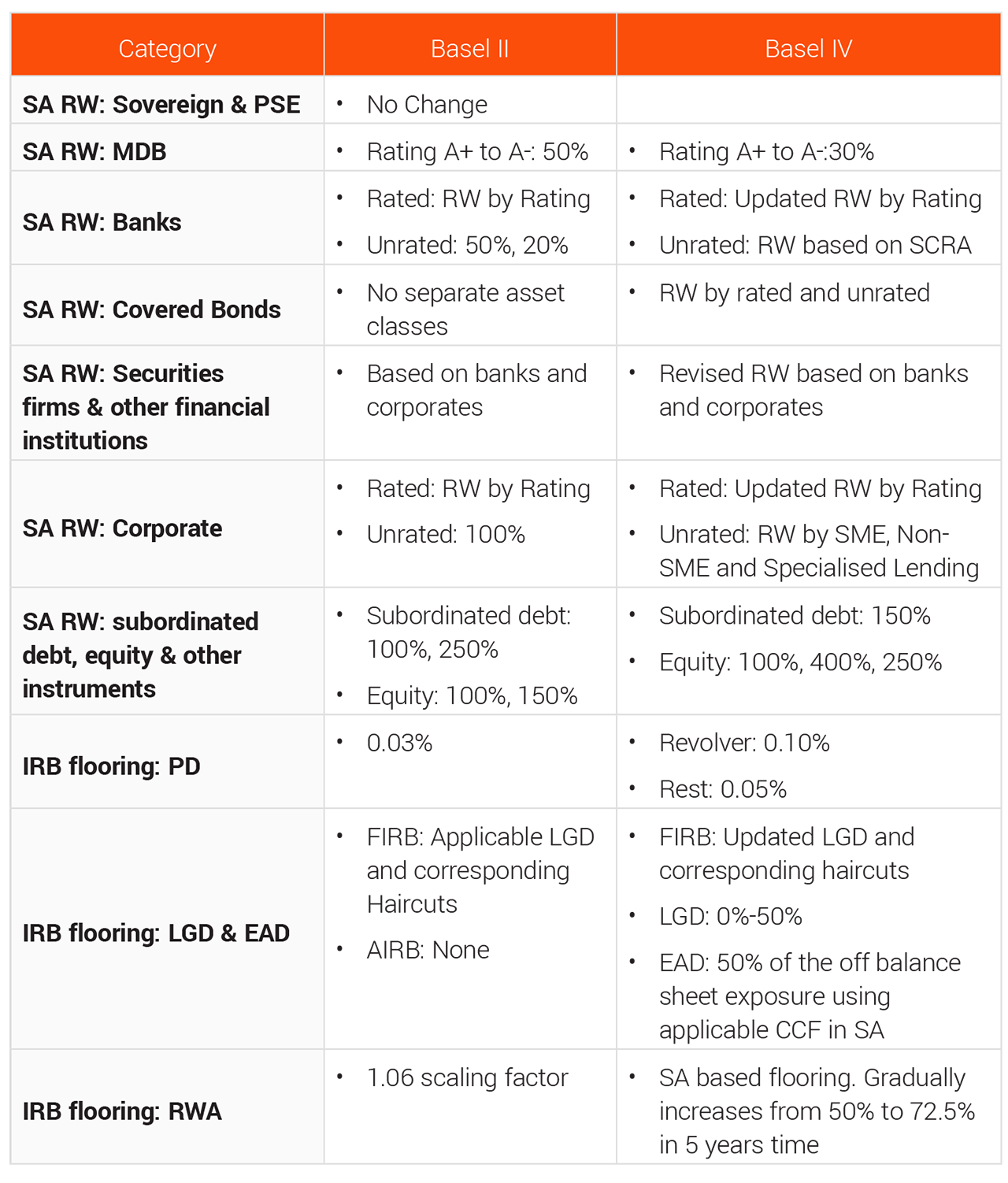

Summary overview

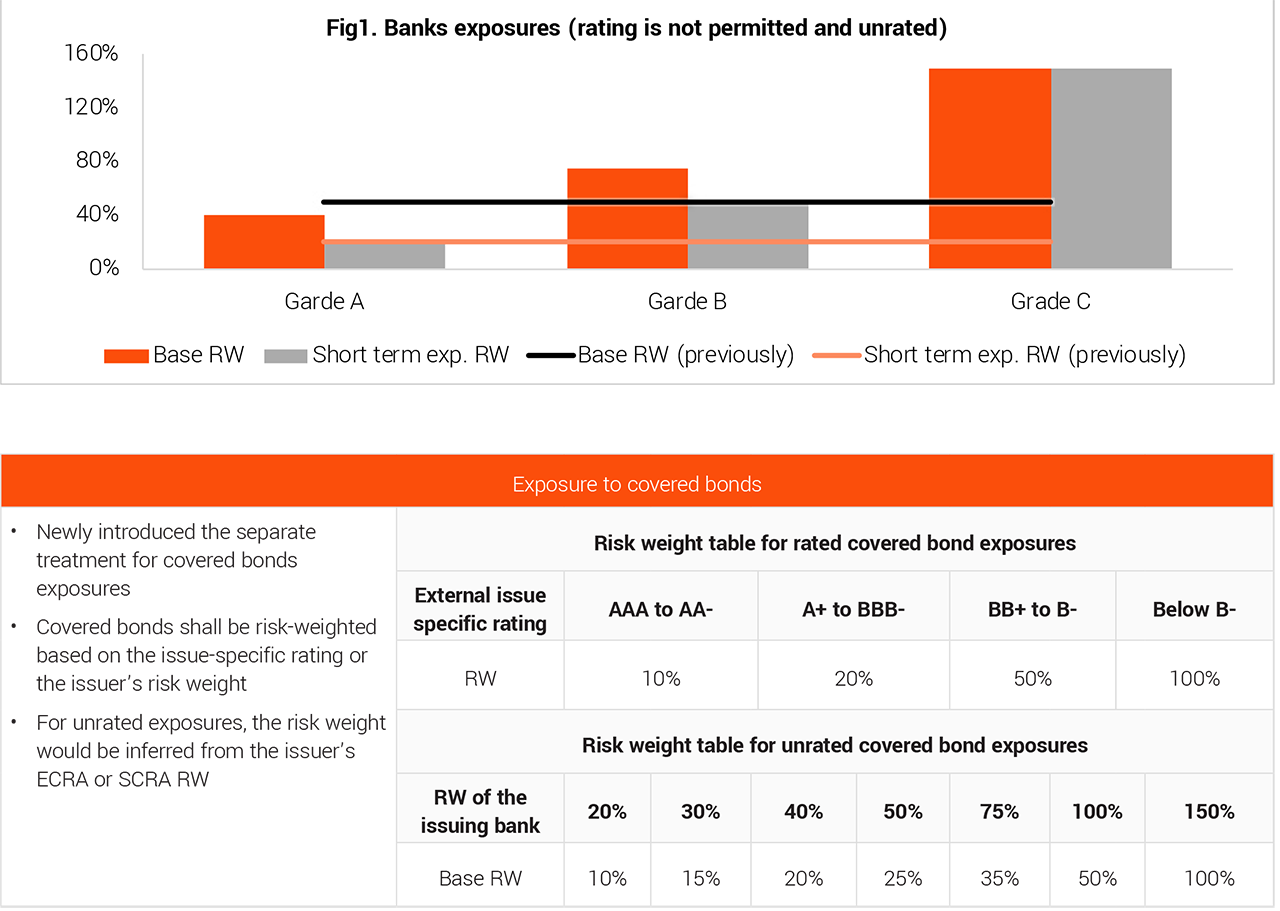

Changes in standardised approach

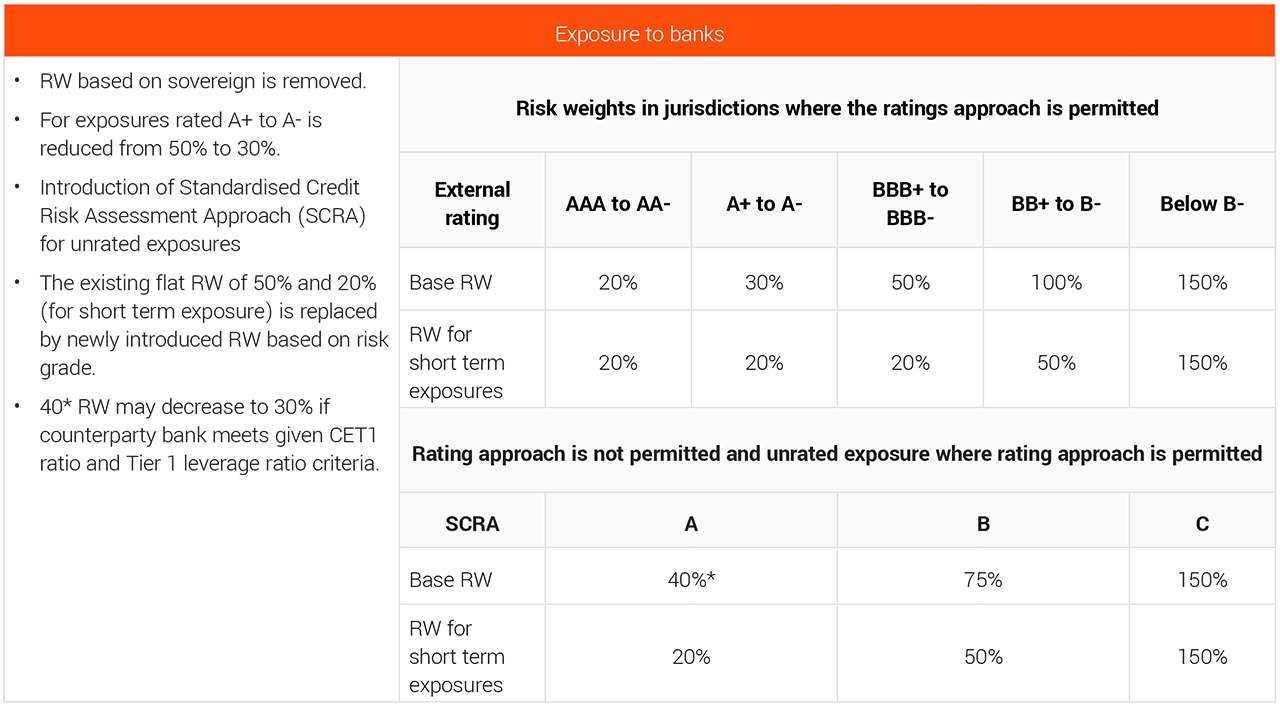

- Removal the link between Banks exposures and sovereign: RW, based on the sovereign is no more applicable, which breaks the link of the institutions with the sovereign. As a continuation, it also explicitly removed the assumption of implicit government support from the rating, unless it refers to a public bank owned by its government.

- Preferential treatment for banks exposures: Basel IV kept a window for exception to apply preferential treatment for banks belonging to the same institutional protection scheme (such as cooperative, mutual etc.) to apply a RW lower RW than the one mentioned by ECRA or SCRA to their intra-group or in-network exposures if those are members of the same effective institutional protection scheme.

- Unrated banks exposures to be treated based on riskiness: Fig1 shows that Basel IV further split the unrated exposures into riskier groups-based capacity to meet their financial commitments and recommended higher RW as per the riskiness. Exposures will fall into Grade B and especially in Grade C will face the huge impact as Grade C refers to higher credit risk exposures, where the counterparty bank has material default risks and insufficient safety margin. RW is increased by 3 times for non-short-term exposures and almost by 7.5% times for short-term exposures under Grade C.

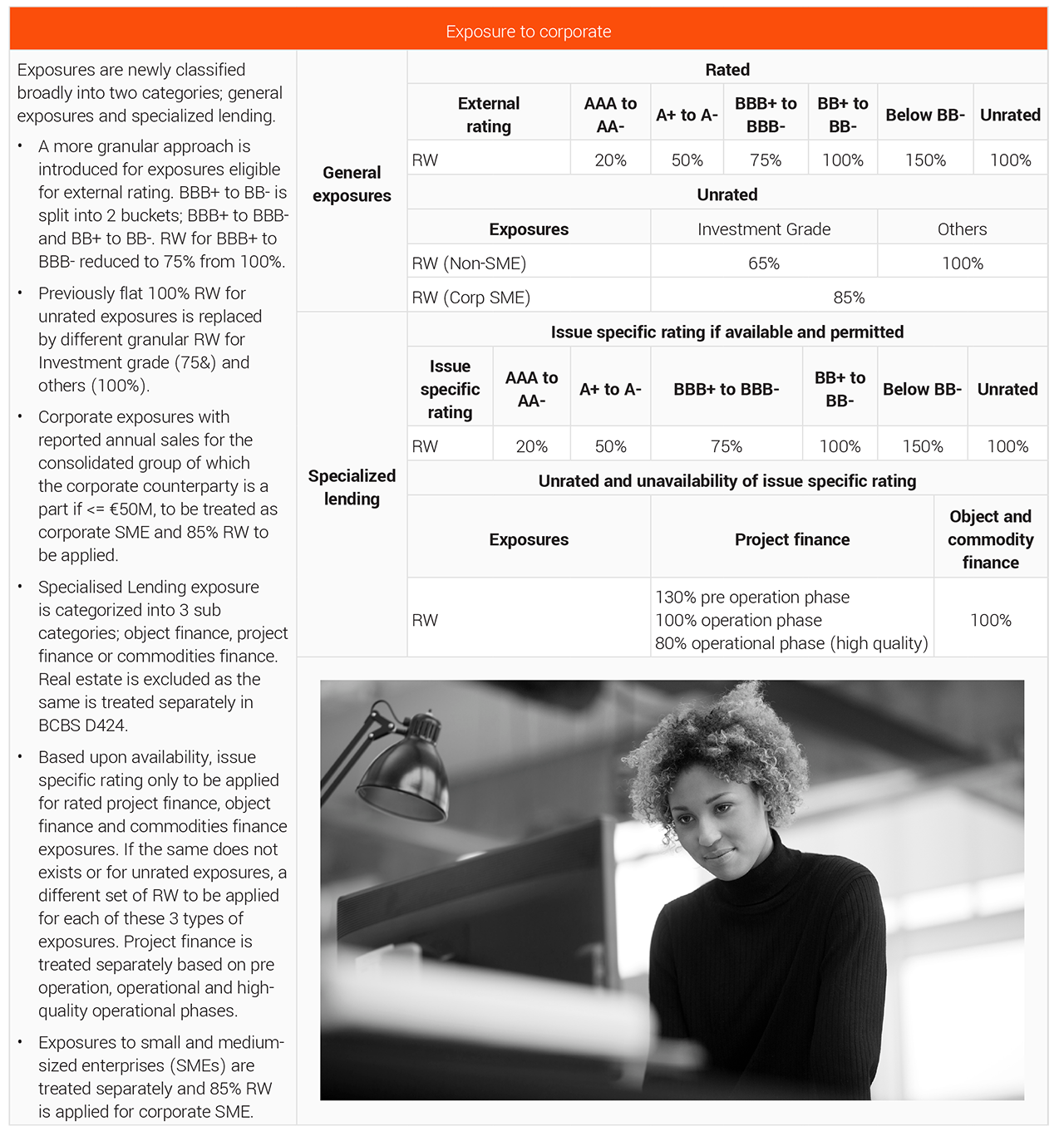

- Introduction of specialized lending for corporate SA: To be consistent with the IRB approach and keep in mind the diversity of the corporate exposures, Basel IV categorized and treated separately project finance, object finance and commodity finance as a specialized lending under SA.

- RW based on riskiness: RW for corporate unrated exposures or where the rating is not permitted are treated in further granular level. It can be seen from the Fig2 that though for most of the sub exposure classes, RW is remain 100% but it has been increased for project finance if it is in pre operational phase due to additional risk but the same is decreased to 80% for high quality project in operational phases. Similar RW for investment grade will be treated with lower RW 65%.

Credit risk mitigant

The final Basel III framework brings majorly following list of changes to the Credit Risk Mitigant (CRM) provisions:

- Recalibrated haircuts:

- Supervisory haircuts under the comprehensive approach are recalibrated and separate treatment is introduced for jurisdiction that allows the use of external rating and which do not allow the use of external ratings for regulatory purposes.

- For rated exposures, more granular level haircut is introduced by residual maturity except for sovereign. For debt securities to other issuers mainly haircut has been reduced with residual maturity in-between 1 to 3 years is decreased but increased with residual maturity more than 10 years. Haircuts for Main index equities and gold is increased to 20% from 15% and increased from 25% to 30% for other equities and convertible bonds listed on a recognised exchange.

- Own estimates of haircut in comprehensive approach have been removed in order to take account of the risk mitigating effect of the collateral received.

- Full recognition of credit derivatives is applicable where restructuring is not covered by the credit derivative, but partial recognition of the credit derivative will be allowed if the other given requirements are met.

- Removal of the use of nth to default: nth to default can’t provide any regulatory capital relief anymore as nth to default credit derivatives are not eligible as CRM technique.

- The risk weights of the assets aggregated up to a maximum of 1250% and multiplied by the nominal amount of the applicable protection for 1st to default credit derivatives.

- Treatment is similar for 2nd to default however the asset with the lowest RW amount can be excluded from the calculation while aggregating the RW.

- n-1 assets with the lowest RW amounts can be excluded from the calculation for nth to default.

Inferences

- Reduction of overreliance on external rating: Basel IV re-emphasised the importance of due diligence requirements to reduce the over-reliance of external rating for SA during not only at the time of origination but during the tenure of the loan in regular basis (at-least annually) to have a sufficient understanding on the risk profile and characteristics of the counterparties. Except the sovereign and non-central government public sector entities (PSEs) exposures, for other rated exposures, due diligence is mandatory in purpose of the risk management and verification for the appropriateness applicability of the applicable RW.

- Hard to be immune to changes – Case Example – Sovereigns: While Basel IV has kept the treatment unchanged for sovereign exposures from the Basel II framework (9th June 2006). However, there are overarching changes that will apply to Sovereigns including:

- Updated CCFs and CRM criteria will be applicable to central governments and central banks exposures.

- Removal of 1.06 scaling and application of SA based flooring are applicable to all required exposures.

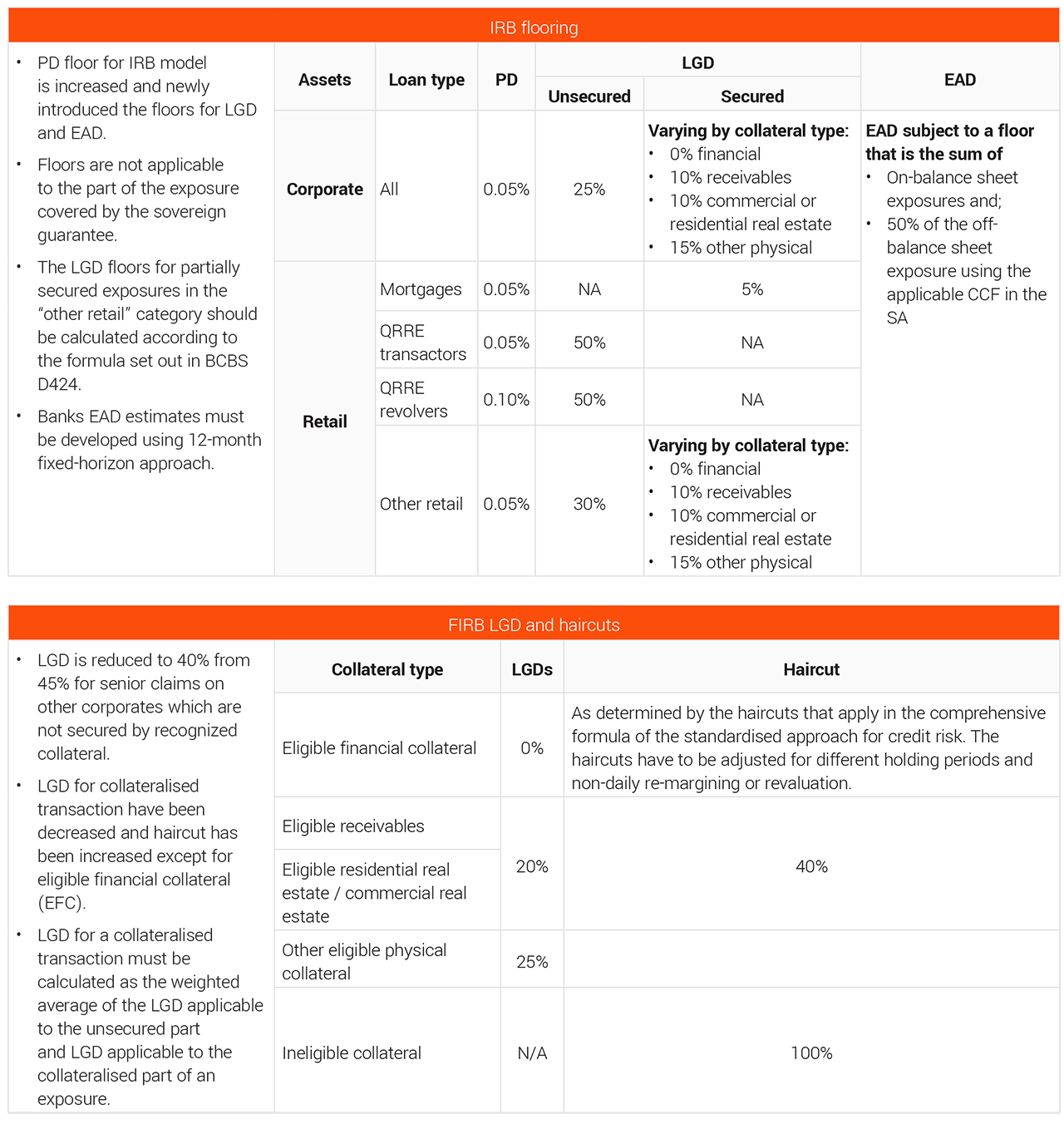

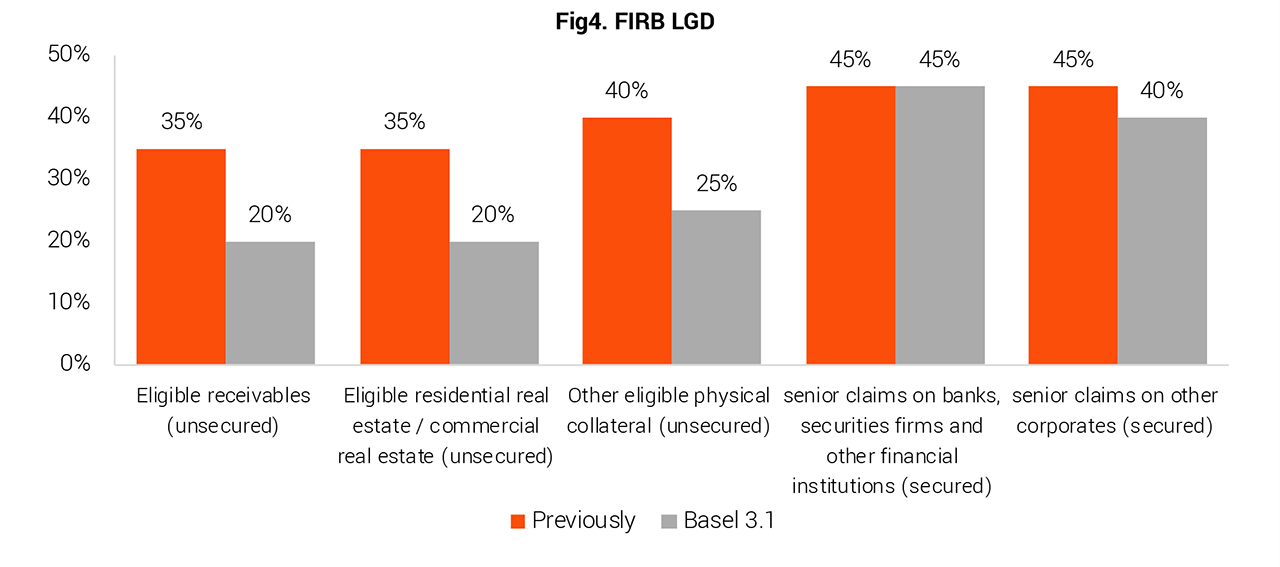

Changes in internal rating based approach

AIRB approach is not permitted anymore for the following exposures:

- General corporates exposures belonging to a group with total consolidated annual revenues > €500M.

- Banks exposures, other securities firms and financial institutions.

AIRB and FIRB both are not permitted for equities.

Business/ Implementation challenges

Basel IV, the final reform introduces multiple changes and which paves way for multiple challenges for the banks. Key notables:

Limitation of IRB usage will restrict banks flexibility to manage their capital requirements

- There is a strong intent by BCBS to keep IRB flexibility in check through SA floors. The SA floors will hurt the banks two-fold: 1. The floors limit the benefits drawn through IRB approach and 2. Calculating floor will entail one time implementation cost and ongoing operational cost. This may trigger a reevaluation of IRB usage as there may be limited incentive to maintain two sets of RWA calculations

New data requirements introduced by BCBS pose significant implementation cost and risk

- The updated RWA calculations and reporting changes may require additional criteria leading to new data requirements. This may entail additional effort (cost) for data sourcing, maintaining and ongoing governance. Some key additions from data perspective are:

- Real estate: Finished property, Legal enforceability, claims over the property, Ability of the borrower to repay, Prudent value of the property, required documentation to calculate LTV required to apply RW accordingly.

- Corporate: issue specific rating for specialised lending

- Banks: capital adequacy ratio and detailed audited financial statements for the counterparties to allocate Grade wise RW for unrated exposures

Profitability pressures due to increased capital requirements

- Introduction of SA floors may lead to increased RWA and hence additional capital requirements. The cost of additional capital will need to be attributed across asset classes, putting pressure on profitability, product pricing and asset mix for the bank.

Managing implementation risks alongside other inflight regulatory programs

- Currently many major UK banks are involved in implementing CRDIV and at the same time banks need to process the Basel IV implementation activity as the implementation date is nearby. To drive the Basel IV implementation along with other critical regulatory needs side by side, lead to the requirements of apt planning, additional resources and act in tight timeline. Hence increase the implementation risk.

- Though the effective implementation date is 1 January 2025 but many national supervisors are yet to come up with the final policy to implement the Basel IV. Like, Bank of England intends to publish the related consultation paper in Q4 2022 for UK. As banks need to be compliant with national guidelines, they might find it as in- sufficient time to implement the final policy by 1 January 2025.

Contacts

Soumya Hait

Basel Regulatory SME

soumya.hait@exlservice.com

Raman Thakral

Director, UK&EU Banking

raman.thakral@exlservice.com

Kunal Chawla

Director, Decision Analytics

kunal.chawla@exlservice.com

Alok Rustagi

Head, UK Banking

alok.rustagi@exlservice.com

Sources:

1. BCBS D424

Basel III: Finalising post-crisis reforms (bis.org)

3. EBA Basel III full implementation impact study

EBA updates its Basel III impact study following the EU Commission’s call for advice | European Banking Authority (europa.eu)

6. Bank of England: Implementation of Basel standards date

Implementation of Basel standards | Bank of England

Abbreviations:

- AIRB - Advance Internal Rating Based

- BCBS - Basel Committee on Banking Supervision

- CCF - Credit Conversion Factor

- CRM - Credit Risk Mitigant

- EBA - European Banking Authority

- EFC - Eligible Financial Collateral

- EU - European Union

- FIRB - Foundation Internal Rating Based

- LGD - Loss Given Default

- LTV - Loan To Value

- MDB - Multilateral Development Banks

- PD - Probability of Default

- PSE - Non-central Government Public Sector Entities

- QRRE - Qualifying Revolving Retail Exposure

- RWA - Risk Weighted Asset

- SA - Standardised Approach

- SCRA - Standardised Credit Risk Assesment

- SME - Small Medium Enterprise