Effective. Ethical. Noble.

Delivering new products at speed. Providing personalized customer experiences at scale. Enabling better, faster decisions across the business. Succeeding in the insurance market today requires meeting these and other objectives, and meeting these objectives requires data-driven transformation that embeds analytics and AI at every level of the organization.

These trends have led to insurers embarking on a journey to turn their volumes of data into value-creating insights. However, this is no easy task. Companies must manage ever-increasing amounts of information as advances such as connected cars generate more than a terabyte of data every hour. It requires treading the fine line between using consumer data to build customized products, while respecting privacy laws, and without violating the trust of customers wary about sharing their data in the first place.

Most of all, it takes building a data transformation journey with the right destination in mind. All too often, insurers view data in terms of the short-term value it can create. Rather than seeing data’s potential for fundamentally changing how a business operates and creates value, companies focus on identifying small improvements in costs or process efficiency.

This isn’t to deride making marginal improvements. It’s simply emphasizing data programs that generate transformational results put three guiding principles at the heart of their objectives: Using data for effective, ethical, and noble purposes.

Image analytics for more accurate prices

EXL is helping a UK personal lines insurer use data from aerial images to better quantify the risk of floods, fires, and other natural catastrophes. This previously untapped data source allows the insurer to provide its customers more accurate pricing for property insurance.

Effective: Transformed operations and customer journeys

Centering a data transformation program around effectiveness means going from asking how data can optimize current processes to how it can power new business models, revenue streams, and new opportunities to create value. An effective data journey breaks data out of its silos and weaves it into every aspect of the organization. Additionally, it re-examines every consumer touchpoint through the lens of how and what data is collected, processed, and distributed.

Breaking data silos for a complete customer view

Cross-functional, accessible data lets insurers develop a 360-degree view of their customers. By better understanding these individuals – their preferred contact methods, demographic data, household relationships, life events, and other information – insurers ensure every interaction can use this information to increase acquisition and retention rates.

This is only possible if every part of the organization can access the necessary data for powering this level of customization. Product designers will need to see information on who’s purchasing different policies to shape new market offerings, marketers need insight into how their messages resonate with different groups, and claim handlers need ready access to data to resolve customer issues at speed.

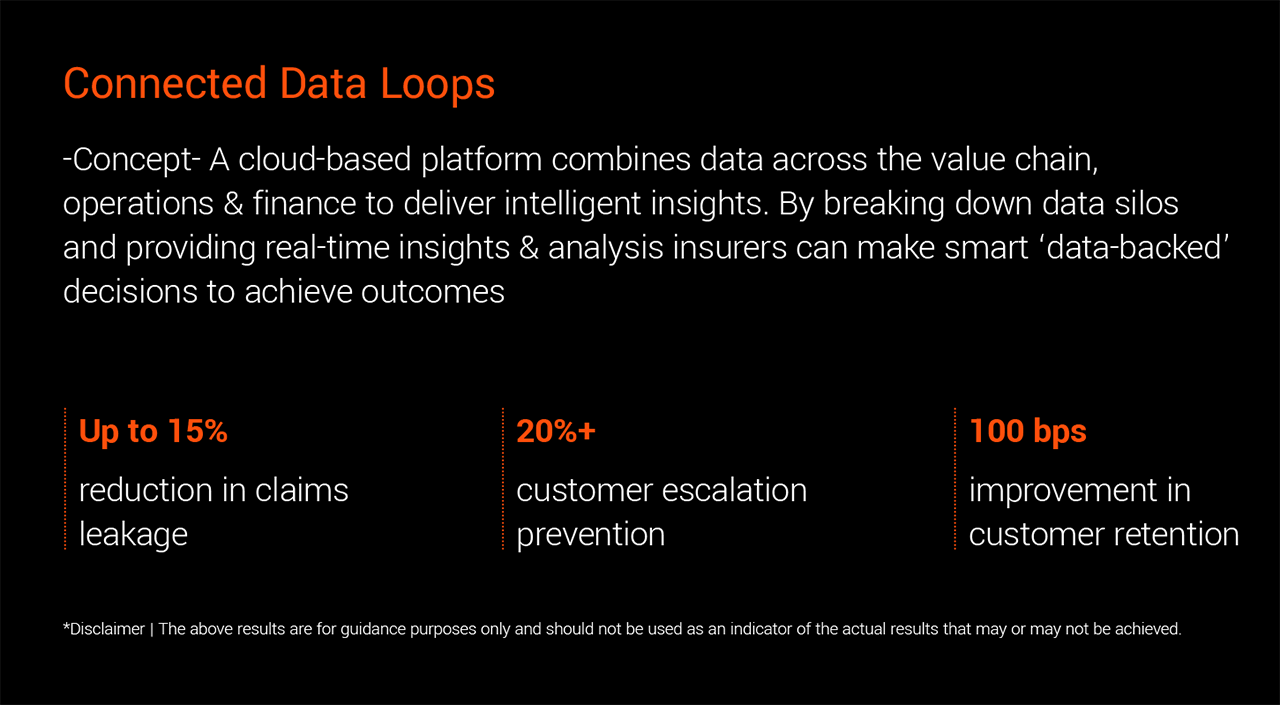

Leveraging cloud platforms and third-party data

Two of the largest enablers of this 360-view are cloud-based platforms and third-party data. The right cloud solution provides built-in advanced analytics, scalable data storage, and breaks down data silos. Third-party data can take what an insurer already knows about a customer and augment it with information from social media, credit bureaus, and publicly available sources to create a deeper understanding of consumer preferences and motivations. Used together, these tools let insurers make data-driven decisions and power the differentiated customer journeys required to succeed in the market today.

Enabling tailored customer journeys

Insurers can build off this foundation of augmented, accessible data to deliver hyper-personalized interactions. This could include using machine learning to automatically recommend the right policies with the right coverage, or use previous interactions with a customer to determine whether follow-up information on a claim should be provided through an email or phone call.

The right data strategy also lets organizations offer innovative products that calculate risk in real time. For instance, integrated data could allow a commercial insurer to automatically incorporate any construction defects reported in a customer’s claim into their renewal rate. Drivers that share their vehicle’s telematics data can enable insurers to offer usage-based policies where customers only pay for the miles they drive.

In short, the effective use of data transforms the entire way an insurer operates and interacts with their customers.

Measuring and managing privacy risk

EXL partnered with a leading insurance broker to help quantify and reduce privacy risks across 40+ countries, ensuring compliance with regional privacy laws such as the General Data Protection Regulation in the UK/EU and other applicable guidelines for the US, South America, and other areas.

Ethical: Building trust & combatting bias

The effective use of data relies on an exchange between insurers and their customers: The customers agree to share their data, knowing they will receive better products and services from the insurer. Achieving this relationship relies on building up trust with consumers that their data will be used ethically – trust that is in short supply these days, with only 30% of consumers stating they highly trust companies today.

Putting customers in control of their data

Some of this lack of trust stems from customers not understanding or feeling in control of the data they share. It’s true that telematics can help a driver prove they weren’t liable in a car accident, or that smart home devices that detect everything from floods to break-ins can lower premiums for home insurance customers. Still, if these customers feel like a company isn’t being transparent about the data being collected or how it’s used, they won’t participate in these programs.

Insurers must examine how they communicate with customers about these programs to ensure they’re clearly explaining how they’re harvesting and using data, the steps being taken to keep the consumer’s private information private while complying with any applicable data regulations, and the benefits provided by sharing this data. Finally, they need to know what steps a company will take in case of a data breach or privacy incident, and how such an event would be remedied.

Combatting bias in AI

Internally, insurers must also examine that their programs for using data are free from bias. All too often, the fact that algorithms rely on data to produce their findings obscures how bias can affect the results. This view overlooks how bias can be built into an algorithm indirectly through its design or training. Consider if a machine learning algorithm used to predict credit risk was only trained using sample data sets made up exclusively of high-net-worth individuals. Using this algorithm to judge individuals in other income groups would generate biased, inaccurate results.

Carrying out algorithm audits looking at how analytics programs may be excluding or treating different groups unequally can help insurers address any bias and demonstrate their commitment to the ethical, responsible use of data. By periodically examining what data an algorithm is taking in, how it’s being analyzed, and checking the results for any discrepancies, insurers can make sure their data and analytics programs aren’t generating biased findings.

Noble: Making the world a safer place

Insurance can seem inherently reactive by its nature. Customers take out a policy protecting them against a risk, and receive compensation if loss occurs. Data can make this process more efficient by helping insurers better judge risk and pass the savings on to the consumer. However, it can also go beyond that to proactively protect customers and reduce the chance of an adverse event occurring in the first place.

Encouraging safety, decreasing risk

This is already happening through some of the previously mentioned usage-based insurance programs. Many of these products do more than just tracking any miles a customer drives. For example, some monitor for risky driving habits such as speeding, but also offer lower premiums for good driving habits. The same data is also used to provide safety alerts to drivers indulging in unsafe driving, leading to overall safer roads for everyone.

Moving from reactive to proactive approaches

A similar approach can also be taken to proactively inform individuals of increased risks in other ways. Real-time data modeling for severe weather can let insurers reach out to customers who may be at risk of hailstorms or other events, giving them an early warning that advising them to move cars into garages or other safe structures to protect their property. Some health insurers have also begun using data to proactively track and reward healthy behaviors. Incorporating data from wearables and fitness apps enables them to see when customers are engaging in healthy activities and provide discounts in real time.

Enabling true transformation with data

Insurance has always been about data. It’s what has been behind every actuarial table, every policy, and every premium. What insurers now have is an opportunity to go beyond using data to create transactional customer relationships based around pricing and claims to build something more. The effective use of data lets insurance companies create products personalized to individual customers and make better decisions across the entirety of their organization. The ethical use of data ensures customer trust and prevents bias from negatively affecting results. The noble use of data takes insurers out of the role of cushioning the blow when the unthinkable happens and positions them as helping prevent negative outcomes from occurring in the first place.

None of these goals are easy to achieve – but all of them are worthwhile. While the right technology and platforms can help companies make better use of their data, they won’t be enough without the right principles guiding an insurer’s data journey. Insurance companies that move fast to ensure their data and analytics programs are built around the effective, ethical, and noble use of data will be well positioned to succeed in the market.

Written by:

Vikas Bhalla

President and Head of Insurance, EXL

Contributor:

Rajat Monga

Vice President Insurance, EXL