The future of retail

The point-of-sale (POS) financing market is growing rapidly as consumers expect the flexibility to pay for purchases over time. Traditional issuers are still developing their POS lending strategies to keep pace with the scale and speed of disruption that new technology players are bringing to the market. To help organizations fast-track their ability to provide affordable payment options at the point-of-sale, both in-store and online, and deliver an exceptional consumer experience, EXL and Skeps have partnered to create a packaged, scalable financing solution. The end-to-end, cloud-based solution helps banks and other organizations accelerate technology development and bring point-of-sale financing products to market faster.

Creating a successful risk management framework for point-of-sale financing

At EXL, we have combined our data and analytics expertise with our domain knowledge to develop a five-pronged strategy for lenders to consider when designing a risk framework for point-of-sale financing. Lenders can now integrate the right technologies that are purpose-built to scale POS financing while simultaneously providing accurate, thorough, and fast credit decisions.

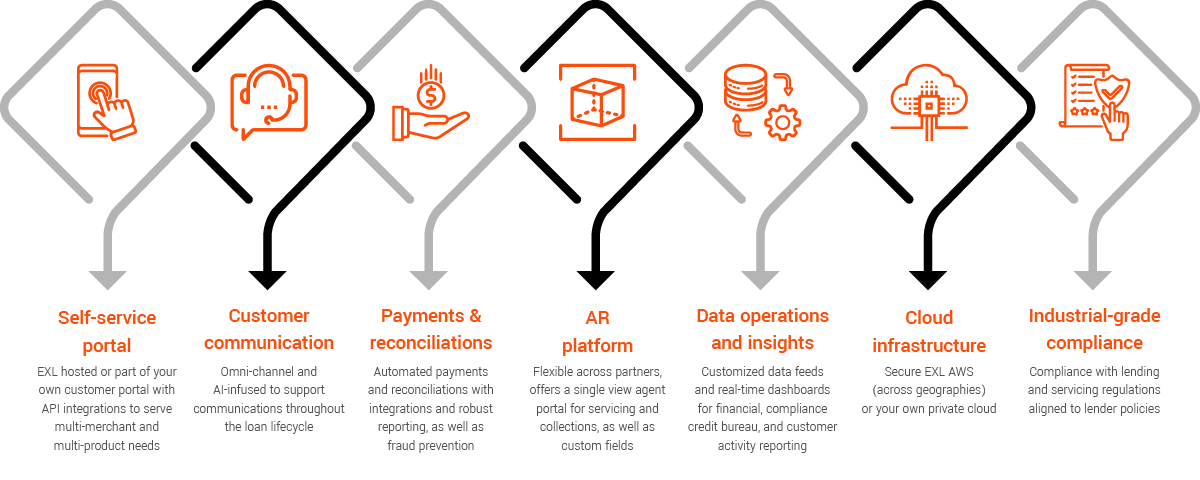

Servicing suite

EXL offers a full service, white-labeled servicing solution that is designed to address your unique needs.

Our value to you

Cloud-based end-to-end solution

We enable speed to market with a comprehensive, end-to-end solution that allows clients the flexibility to leverage the entire solution, or specific components to supplement existing systems.

Deep analytics expertise

Our extensive capabilities in advanced analytics and AI, along with our domain expertise in the banking and retail industries, allow us to drive greater business insights and strategies that solve critical challenges for our clients.

State-of-the-art technology

By integrating Skeps’ cutting-edge technology and EXL’s digital solutions for customer service, we help lenders launch white-label POS financing solutions in just a few months, enabling organizations to reach customers where they shop, integrate financing into the pre-purchase phase of the customer journey, and enable an always-on digital customer experience.

Proven customer servicing capabilities

Backed by 20+ years supporting customer service operations for Fortune 500 clients, customer experience is part of our DNA. Our technology allows you to create a superb customer journey from login and checkout to servicing and collections.

"We are seeing a significant demand from end-consumers for flexible payment options at the point of sale. Despite slow growth projections for US unsecured consumer lending overall, point-of-sale financing is projected to significantly increase over the next few years. As a lot of traditional banks are looking for solutions to keep pace with new technology players, we are proud to have launched this end-to-end solution in partnership with Skeps to enable our clients to capture a larger share of this growing market."

Vivek Jetley,

President and Head of Analytics, EXL

"We’ve combined state of the art loan origination capabilities from Skeps with EXL’s deep experience in using cutting edge, innovative data sources, best-of-breed analytics, and scaling world-class operations to deliver a complete POS Financing solution. This helps our clients fast-track their launch of new point-of-sale financing solutions to meet consumer needs while we take care of operations behind the scenes."

Vikas Sharma,

SVP, Analytics, EXL

"At Skeps, we have designed a best-in-class solution to connect merchants and lenders to enable the next generation of POS financing. In collaboration with EXL, we are able to design an end-to-end capability supporting entire customer lifecycle from originations to servicing to collections. This enables us to support multi-million dollars in growth for our clients while guaranteeing a stellar and consistent customer experience."

Tushar Srivastava,

CEO, Skeps