EXL improves collections performance for a large multinational bank with EXL Paymentor

Introduction

EXL identified the operational scope to improve the effectiveness of B2C collections for a large multinational bank. The bank was looking for an agile partner to improve the economics of debt collections and chose EXL PaymentorSM, an AI-powered debt collections and receivables management solution that covers all aspects of debt collections.

Challenge

The bank was facing a high number of delinquencies, with approximately 100K customers overdue every month. The bank’s debt collections processes were costly, ineffective, and operated on an inflexible infrastructure that did not allow changes to be easily made. The collections team was mainly using traditional techniques with the following key problems:

- One-size-fits-all approach to communication: There was limited content personalization due to suboptimal use of analytics, leading to low customer engagement

- Heavy reliance on manual voice calling due to an immature digital channel:

- Most customers were contacted over the phone, leading to a high cost to collect

- Customers could not respond to any SMS sent by collectors as part of the collections process

- There was no digital self-serve capability. Customers were required to talk about their financial situation to a collections agent, which many found a negative experience

- There was no ability to measure customer engagement

- Inability to scale: Limitations in scaling up operations during periods when delinquent balances spiked

- No reporting on collections operations

Solution

The client leveraged EXL PaymentorSM to digitally reach 100% of its delinquent customers without negative impacts on the customer experience. It continuously engaged customers through AI-powered personalized messaging, automatic follow-ups, and asking the reasons for non-payment while offering payment relief within defined guardrails.

EXL PaymentorSM deployed the following modules:

- Intelligence module

- Machine learning algorithms determined customer personas using multiple behavioral data points such as ability to pay, willingness to pay, payment discipline, outstanding amount, and tenure

- Behavioral data scientists designed 30-40 communication templates with a variety of tones, such as polite, empathetic, assertive, and negotiating, to be used based on different customer personas

- Self-learning algorithms performed experiments to determine the optimal channel, frequency, time, and content for communications to improve cure rates

- For example, determining whether a “likely to cure” persona should receive communications every three or four days or four days in the morning or evening

- Digital execution module

- Customers were contacted digitally using emails, two-way SMS and WhatsApp

- All outbound communications, such as email opens, text, and WhatsApp responses, were tracked. The data was used as an input for the intelligence module.

- For example, if a customer opened an email but did not pay, this data was used to update the communications with the customer

- Two-way capability was enabled on SMS and WhatsApp to allow customers to inform the bank that they were experiencing hardship and express interest in forbearance plans

Prior to implementing EXL PaymentorSM, analytics models alone weren’t enough to drive improvements as there was no historical data to learn the optimal frequency, content and channel for customer contacts. Thus, the self-learning algorithms continuously experimented to determine the optimal contact strategy using customer response data.

Outcomes

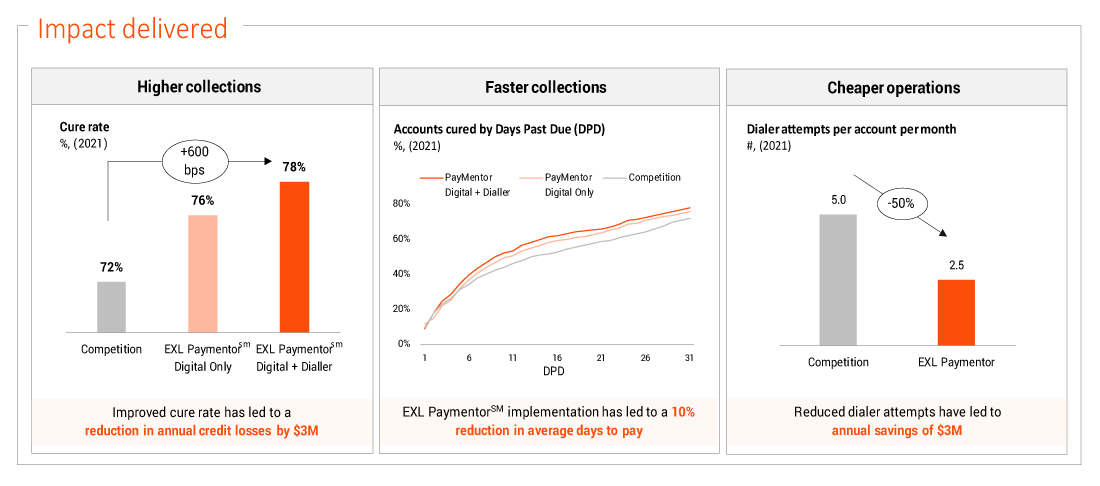

Within a couple of months of operations, EXL PaymentorSM was able to optimize the client’s communication strategy leading to the following impacts:

- Higher collection: EXL PaymentorSM recorded a 600 bps higher payment rate, leading to annual credit loss savings of $3M

- Faster collection: EXL PaymentorSM collected money 10-20% faster

- Cheaper collection: Prior to EXL PaymentorSM, a customer on average was dialed five times per month. EXL PaymentorSM reduced the dialing to 2.5 per customer per month, leading to annual savings of $3M

- Better customer experience: Customers were able to engage and express their ability to pay digitally. Email open rates of 55% was achieved, an improvement over the previous average open rate of 25%. An SMS response rate of 15% customers was recorded, an improvement over the previous average of 4%.

As a cloud-based solution, EXL PaymentorSM was implemented within two months, from start to finish. With digital collections outreach diminishing the need for manual voice calling, the solution made collections processes highly scalable and able to easily handle peak loads of ~10X above the agreed frequency.