Utilizes automation and data enrichment

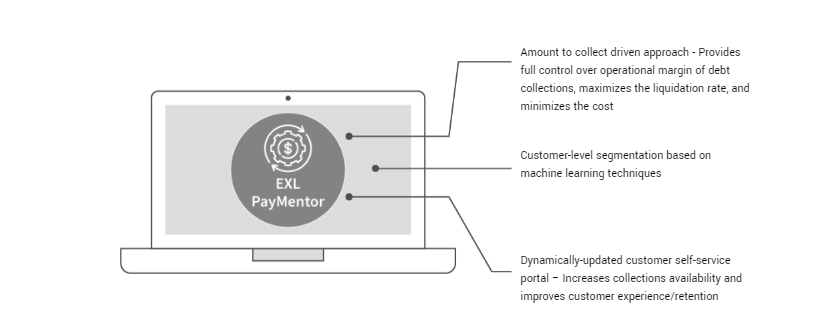

EXL Paymentor℠ is an AI-powered collections and receivables management solution that covers collection operations, collection analytics, and all aspects of full-cycle collections. Paymentor℠ improves debt collections by increasing the liquidation rate - making it cheaper, faster, and improving customer experience/retention.

EXL Paymentor℠ FAQsSolution highlights